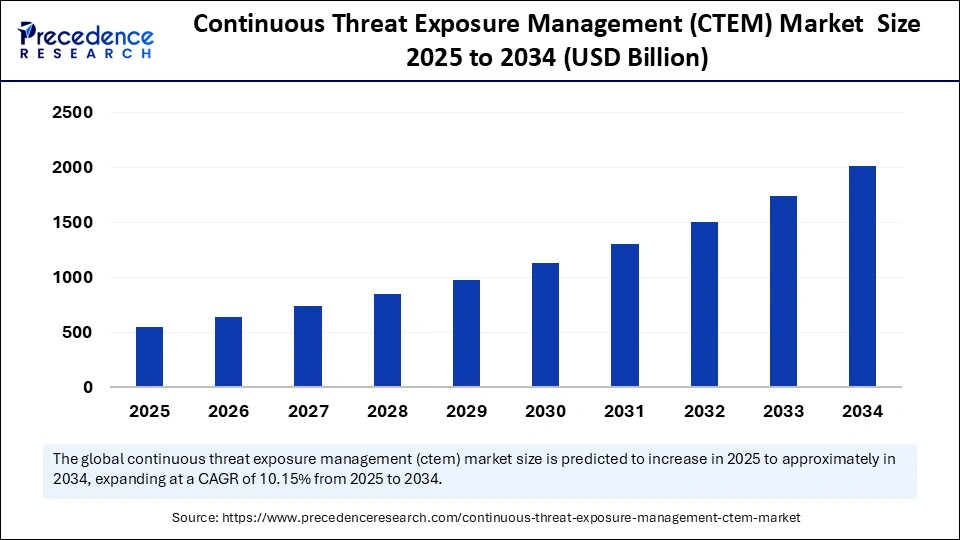

The global Continuous Threat Exposure Management (CTEM) market is projected to grow at a robust CAGR of 10.15%, reaching its peak revenue by 2034.

Continuous Threat Exposure Management Market Key P0ints

-

The Continuous Threat Exposure Management (CTEM) market is anticipated to grow at a CAGR of 10.15% from 2025 to 2034.

-

In 2024, North America held the largest share of the CTEM market.

-

Asia Pacific is projected to witness the fastest growth rate over the forecast period.

-

By component, the solutions segment accounted for the highest market share in 2024.

-

The services segment, by component, is expected to expand at the fastest CAGR in the coming years.

-

Based on organization size, large enterprises led the market in 2024.

-

Small and medium-sized enterprises (SMEs) are forecasted to grow at the highest CAGR during the upcoming period.

-

Among industry verticals, the BFSI sector held the largest market share in 2024.

-

The retail industry is expected to experience the fastest growth between 2025 and 2034.

-

By deployment mode, the cloud segment dominated the market in 2024.

-

The on-premises segment is anticipated to grow at the fastest CAGR throughout the forecast timeframe

Market Overview

The Continuous Threat Exposure Management (CTEM) market is rapidly gaining traction as organizations across the globe adopt more proactive, dynamic approaches to cybersecurity. CTEM represents a strategic, ongoing cybersecurity methodology that continuously assesses, tests, prioritizes, and addresses an organization’s threat landscape. Unlike traditional reactive security tools that may identify threats only after a breach occurs, CTEM enables continuous visibility into potential vulnerabilities, simulates attack paths, and provides actionable insights into security posture improvements in real time.

As cyber threats grow more advanced and persistent—driven by state-sponsored actors, ransomware groups, and zero-day vulnerabilities—the limitations of periodic penetration testing and static risk assessments have become increasingly evident. This has led to widespread demand for CTEM solutions that offer real-time analytics, automated threat modeling, and integrated remediation capabilities. In 2024, North America dominated the CTEM market, primarily due to its mature cybersecurity infrastructure and early adoption of next-generation security technologies. Looking ahead, the market is expected to expand at a CAGR of 10.15% from 2025 to 2034, with Asia Pacific poised to register the fastest growth owing to rising digitalization and heightened cyber risk awareness.

Continuous Threat Exposure Management Market Growth Factors

The growth of the CTEM market is driven by several interconnected factors. First, the evolving threat landscape, marked by an increase in sophisticated cyberattacks, has compelled organizations to shift from reactive to proactive security postures. The growing frequency of ransomware incidents, data breaches, and supply chain attacks is making it essential for enterprises to continuously monitor and evaluate their security controls.

Second, regulatory compliance requirements across industries are becoming more stringent, requiring ongoing threat assessments and security validation. Regulatory bodies worldwide are emphasizing the need for continuous risk monitoring, which aligns perfectly with the core functionality of CTEM platforms.

Third, the increasing adoption of cloud infrastructure, IoT devices, and remote work environments is expanding the attack surface for organizations. Traditional perimeter-based defenses are insufficient, making continuous threat exposure analysis critical for maintaining secure operations across hybrid and distributed IT ecosystems.

Furthermore, as more organizations adopt zero trust security frameworks, CTEM is playing a pivotal role in validating access controls, identifying misconfigurations, and ensuring continuous compliance with the principles of least privilege and micro-segmentation.

Impact of AI on the Continuous Threat Exposure Management (CTEM) Market

Artificial Intelligence (AI) is reshaping the capabilities and scalability of Continuous Threat Exposure Management solutions. AI algorithms can ingest and analyze massive volumes of security telemetry in real time, allowing CTEM platforms to deliver faster and more accurate threat prioritization. By leveraging machine learning (ML), these platforms can differentiate between real threats and false positives, reducing alert fatigue and enabling security teams to focus on the most critical vulnerabilities.

AI is also enhancing attack path modeling and risk simulation, helping organizations predict how a potential adversary might exploit a chain of vulnerabilities to reach high-value assets. This predictive modeling helps enterprises understand potential breach impacts and plan remediation efforts based on real-world exploitability.

In addition, AI-driven automation in CTEM platforms enables continuous validation of security controls, automates routine testing (such as breach and attack simulation), and recommends remediation steps without manual intervention. Natural Language Processing (NLP) further facilitates the interpretation of threat intelligence reports and vulnerability descriptions, making insights more accessible to security teams.

As CTEM systems integrate AI capabilities, their ability to scale across complex environments, self-learn from evolving threats, and provide actionable insights in near real-time is revolutionizing how enterprises manage cyber risks.

Market Drivers

Key drivers of the CTEM market include:

Surging cybersecurity risks across all sectors, leading to increased investment in tools that can continuously evaluate and fortify security postures.

The shift toward hybrid and multi-cloud environments, which increases complexity and requires more dynamic threat exposure analysis to maintain visibility and control.

Growing reliance on third-party vendors and supply chains, necessitating continuous monitoring of external security exposures.

Digital transformation across industries, especially in finance, healthcare, and retail, which demands robust cybersecurity validation and attack surface management.

Increased budget allocation for cybersecurity in response to executive and board-level prioritization of cyber risk mitigation.

Opportunities

The CTEM market presents significant opportunities for expansion and innovation. One of the most promising opportunities lies in cloud-native CTEM solutions, which offer scalable deployment across diverse cloud environments, enabling consistent and comprehensive threat exposure management.

There is also increasing demand for managed CTEM services, particularly among small and medium enterprises (SMEs) that lack the internal resources to build and manage sophisticated cybersecurity programs. This opens avenues for security service providers to offer CTEM as part of their managed security portfolios.

Another emerging opportunity is the integration of CTEM platforms with security orchestration, automation, and response (SOAR), vulnerability management systems, and security information and event management (SIEM) tools. This integration streamlines workflows, reduces response time, and enhances end-to-end visibility.

Additionally, as critical infrastructure sectors (energy, transportation, utilities) modernize their digital systems, they present a new and urgent market for CTEM adoption due to heightened risks and regulatory requirements.

Challenges

Despite its growing adoption, the CTEM market faces notable challenges. Integration with legacy systems remains a major hurdle, especially in large enterprises with fragmented or outdated security architectures. Ensuring compatibility across multiple platforms while maintaining performance and accuracy is complex.

Another challenge is the shortage of skilled cybersecurity professionals who can effectively interpret CTEM insights and implement remediation strategies. While automation can alleviate some of this burden, human oversight remains critical for incident prioritization and strategic response.

Cost and complexity of implementation may also be prohibitive for smaller organizations, especially those with limited budgets and technical capacity. CTEM platforms need to evolve toward more user-friendly and cost-effective models to ensure broader adoption.

Lastly, the need for continuous updates and context-aware threat intelligence is critical. Without access to high-quality, real-time data, the effectiveness of CTEM can be compromised, highlighting the importance of strong partnerships between vendors, intelligence providers, and end-users.

Regional Outlook

North America remains the largest and most mature CTEM market, driven by early technology adoption, a strong cybersecurity vendor ecosystem, and strict regulatory frameworks. Large enterprises and government agencies in the U.S. and Canada have been early adopters, leading to a robust demand for both cloud-based and on-premises CTEM solutions.

Asia Pacific is projected to be the fastest-growing region through 2034, fueled by rapid digital transformation, increasing cyberattack frequency, and a growing emphasis on national cybersecurity strategies. Countries like India, China, Japan, and Australia are investing heavily in cybersecurity infrastructure, making CTEM adoption a critical step toward resilience.

Europe is also a key market, with GDPR and other data privacy laws pushing organizations toward continuous compliance and risk exposure management. Nations like Germany, the UK, and France are prioritizing proactive security strategies across both public and private sectors.

Latin America and the Middle East & Africa represent emerging markets with growing potential. As digital economies in Brazil, UAE, and South Africa expand, the need for modern cybersecurity frameworks like CTEM is becoming increasingly evident. Government initiatives and international partnerships are expected to play a major role in CTEM adoption in these regions.

Continuous Threat Exposure Management Market Companies

- AT&T

- Core Security

- Rapid7

- Digital Defence

- IBM

- RSA Security

- Micro Focus

- Qualys

- McAfee

- Symantec Corporation

Recent Developments

- In June 2025, AttackIQ introduced AttackIQ Ready3, a next-generation platform designed to enhance threat exposure management. Ready3 offers advanced discovery features that continuously map both internal and external attack surfaces. By integrating asset discovery with vulnerability context, it reveals actual attack paths and evaluates existing compensating controls. This enables security teams to pinpoint which vulnerabilities remain exposed due to ineffective current defenses.

- In May 2025, Check Point Software Technologies Ltd. completed the acquisition of Veriti Cybersecurity, the industry’s first fully automated, multi-vendor platform for pre-emptive threat exposure and mitigation. This pioneering solution automates the identification and remediation of potential threats across multiple security vendors, offering organizations a proactive approach to cybersecurity.

Segments Covered in the Report

By Component

- Solutions

- Services

By Organization Size

- Large Organizations

- SMEs

By Industry Verticals

- BFSI

- Aerospace and Defence

- Energy Utility

- Healthcare

- Public Sector

- IT Telecom

- Retail

- Others

By Deployment Mode

- Cloud

- On-premises

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Read Also: GPU as a Service Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6256

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344