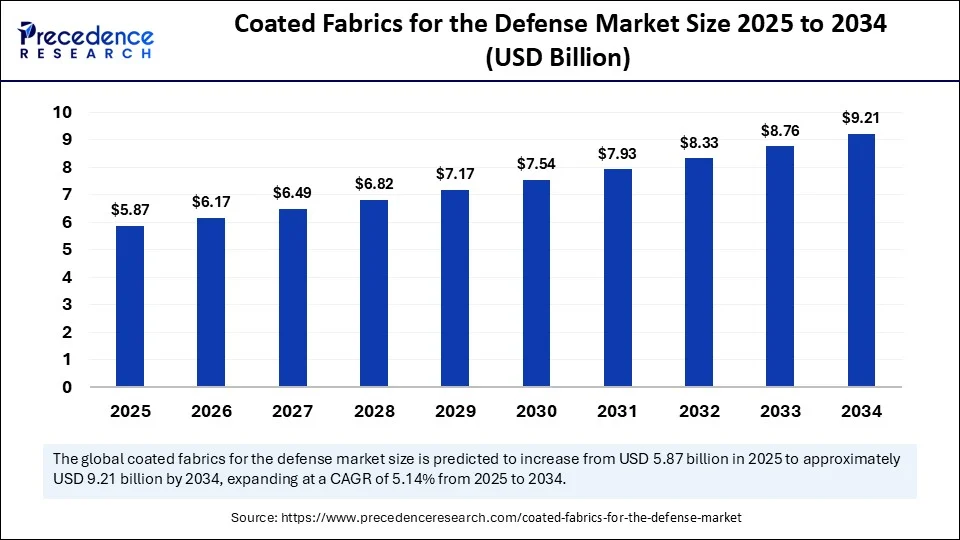

The global coated fabrics for the defense market size is expected to attain around USD 9.21 billion by 2034 increasing from USD 5.58 billion in 2024, with a CAGR of 5.14%.

Growth is propelled by escalating global defense budgets, intensified geopolitical tensions, and the continuous demand for lightweight, durable, and multifunctional materials that can withstand chemical, biological, radiological, nuclear (CBRN), and extreme climatic threats. Coated fabrics—engineered by applying specialized polymer or ceramic layers to high‑strength substrates—offer an unmatched blend of tensile strength, fire resistance, low weight, and environmental durability.

These properties make them indispensable in tents and rapid‑deployment shelters, protective clothing, inflatable structures, vehicle covers, and ballistic or blast‑mitigation systems. North America currently dominates revenue thanks to its advanced defense R&D ecosystem, while Asia‑Pacific is registering the fastest expansion as regional powers modernize their armed forces and invest in resilient soldier‑systems programs.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6338

Coated Fabrics for the Defense Market Key Insights

-

The global coated fabrics for defense market was valued at USD 5.58 billion in 2024.

-

It is forecasted to reach approximately USD 9.21 billion by 2034, growing at a CAGR of 5.14% from 2025 to 2034.

-

North America led the market in 2024, holding the largest share.

-

The Asia Pacific region is projected to witness the fastest growth rate throughout the forecast period.

-

By application, the tents and shelters segment accounted for the largest market share in 2024.

-

The body armor and protective clothing segment is anticipated to register the highest CAGR in the coming years.

-

Based on material, the Kevlar segment dominated the market in 2024.

-

The Nomex segment is expected to experience the fastest growth over the forecast period.

-

In terms of end use, the military segment captured the largest market share in 2024.

-

The law enforcement segment is projected to grow at the fastest CAGR during the forecast timeframe.

-

By coating type, polyurethane coatings held the largest market share in 2024.

-

Fire-retardant coatings are forecasted to expand at the highest CAGR in the coming years.

-

Regarding form, the sheets segment generated the major share of the market in 2024.

-

The rolls segment is expected to record the fastest growth during the forecast period.

Coated Fabrics for the Defense Market Growth Factors

Several structural currents underpin robust market expansion. Rising global defense spending is driving a surge in procurement of advanced personal‑protective equipment and deployable infrastructure, both of which rely heavily on coated technical textiles. The move toward expeditionary forces and rapid‑deployment doctrines incentivizes materials that combine high strength with low weight, enabling lighter packs, faster setup times, and reduced fuel consumption.

Continuous material‑science innovation—such as nanocomposite coatings, self‑healing polymers, and ultra‑thin ceramic barriers—is pushing performance envelopes, allowing fabrics to meet stringent NATO STANAG and MIL‑SPEC standards while offering superior flexibility and comfort. Lastly, more stringent environmental and occupational‑health regulations are encouraging armed forces to specify eco‑friendlier coatings that eliminate halogenated flame retardants or phthalate‑plasticized PVC, prompting suppliers to invest in new chemistries and recycling pathways.

Role of AI in the Coated Fabrics for the Defense Market

Artificial intelligence is rapidly becoming a catalyst for material discovery, production efficiency, and product functionality. In R&D labs, machine‑learning algorithms analyze vast molecular datasets to predict coating formulations that deliver optimal abrasion resistance, IR signature management, and CBRN barrier performance without lengthy trial‑and‑error experiments. AI‑driven process‑control systems monitor temperature, viscosity, and coating thickness in real time, automatically adjusting line speeds and curing profiles to minimize defects and reduce scrap.

On the finished‑product side, smart textiles embedded with AI‑enabled sensors can detect chemical agents, monitor soldier vital signs, and communicate structural strain—transforming tents, garments, and vehicle covers into data‑rich platforms for situational awareness and predictive maintenance. As connected‑battlefield concepts mature, coatings that seamlessly integrate conductive circuits and energy‑harvesting layers will open new revenue streams for defense textile suppliers.

Market Drivers

Day‑to‑day momentum comes from several tangible forces. First, armed forces are increasingly operating in diverse and harsh climates—from arctic ice to desert heat—requiring fabrics that remain flexible and protective across wide temperature swings. Second, the growing emphasis on soldier survivability has shifted procurement toward advanced body armor and flame‑resistant uniforms, both of which depend on high‑performance coated substrates.

Third, rapid deployment doctrines necessitate inflatable command centers, field hospitals, and unmanned aerial‑vehicle shelters fabricated from air‑tight, UV‑stable fabrics that can be transported compactly and erected quickly. Finally, procurement agencies are mandating longer service lives and lower total cost of ownership, favoring coated fabrics that resist mold, UV degradation, and hydrolysis while remaining repairable in the field.

Opportunities

Substantial white space remains for innovators. Lightweight ballistic composites that blend aramid fibers with low‑friction ceramic nanocoatings could replace heavier metal armor in tactical vehicles and personal gear. The integration of embedded antennas and photovoltaic layers within coated fabrics opens possibilities for self‑powered communication tents and reconnaissance drones.

Eco‑friendly coatings derived from bio‑based polyurethane or silicone hybrids offer competitive performance while meeting tightening environmental regulations—a key procurement criterion for many Western militaries. In emerging economies, localizing production of proven protective and shelter fabrics can shorten lead times and create dual‑use opportunities in disaster relief and commercial aviation.

Challenges

Despite strong tailwinds, manufacturers face several hurdles. High‑grade aramid, UHMWPE, and specialty coating chemistries are capital‑intensive and susceptible to price volatility, putting pressure on margins. Strict military certification protocols demand exhaustive testing for flammability, toxicity, and ballistic performance, lengthening time‑to‑market.

Environmental concerns over legacy coatings—particularly PVC and halogenated flame retardants—are prompting costly reformulation and re‑tooling. Supply‑chain disruptions and geopolitical export controls can constrain the availability of critical raw materials such as para‑aramid fiber and fluorinated intermediates. Finally, the need to reconcile extreme performance with comfort and breathability in soldier‑worn systems remains an ongoing engineering challenge.

Coated Fabrics for the Defense Market Regional Outlook

North America holds the largest market share, buoyed by consistent defense‑spending growth, a robust supplier base, and active modernization programs involving next‑generation tactical shelters and ballistic gear. Europe follows closely, with high demand for CBRN‑rated fabrics and sustainability‑driven material mandates.

Asia‑Pacific is projected to record the fastest CAGR, fueled by expanding military budgets in China, India, South Korea, and Australia, and by domestic textile industries capable of scaling advanced coatings.

Latin America is gradually increasing adoption, driven by border‑security initiatives and peacekeeping missions that require versatile shelter systems.

Middle East & Africa exhibit steady demand for heat‑ and sand‑resistant fabrics, with Gulf states investing in infrastructure and force‑protection upgrades.

Coated Fabrics for the Defense Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 9.21 Billion |

| Market Size in 2025 | USD 5.87 Billion |

| Market Size in 2024 | USD 5.58 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.14% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Material, End-Use, Coating, Form and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Coated Fabrics for the Defense Market Segmental Insights

-

By Application — Tents and shelters constituted the largest segment in 2024, reflecting the indispensable need for durable, rapidly deployable accommodation and command structures. Body armor and protective clothing is the fastest‑growing application, propelled by escalating security threats and the push for lighter yet more effective ballistic materials.

-

By Material — Kevlar led revenue in 2024 owing to its superior strength‑to‑weight ratio and proven ballistic performance, while Nomex is forecast to grow most rapidly as demand rises for enhanced flame‑ and heat‑resistant gear.

-

By End Use — The military segment captured the biggest share, underpinned by consistent procurement cycles and large standing armies. Law enforcement is the highest‑growth end user as domestic security agencies upgrade riot gear, vehicle armor, and tactical shelters.

-

By Coating — Polyurethane coatings accounted for the largest market slice thanks to their balance of flexibility, abrasion resistance, and cost. Fire‑retardant coatings are expected to post the fastest CAGR as battlefield scenarios increasingly involve incendiary threats.

-

By Form — Sheets dominated in 2024 due to widespread use in vehicle covers and large shelter panels, while rolls are projected to expand quickest, driven by automated cut‑and‑sew manufacturing and modular field‑repair kits.

Coated Fabrics for the Defense Market Companies

- Miliken

- Verseidag

- Glen Raven

- Taiyo Kogyo

- Texelis

- Ferrari

- Gore

- Serge Ferrari

- Huafang Industrial

- Mehler Huntelaar

- Astrup

- Hyosung

- Seaman Corporation

- Fabrene

Also Read: Cyclic Olefin Polymer Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344