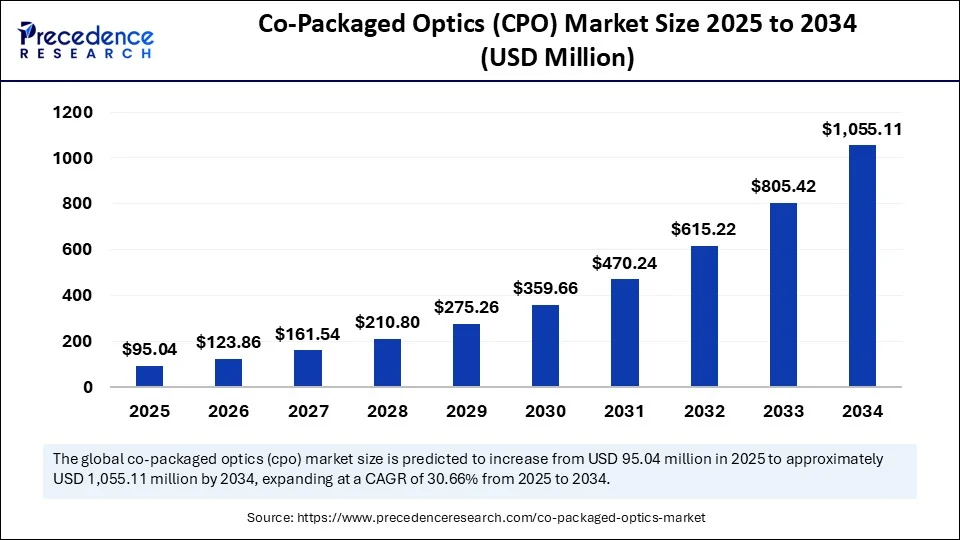

The global co-packaged optics (CPO) market, valued at USD 72.97 million in 2024, is forecasted to rocket to approximately USD 1,055.11 million by 2034, expanding at a robust compound annual growth rate (CAGR) of 30.66% from 2025 to 2034.

This explosive growth is propelled by surging demand for ultra-high bandwidth, energy-efficient data transmission solutions in hyperscale data centers, driven by the rapid expansion of AI applications, cloud services, and 5G networks.

Co-Packaged Optics Market Key Insights

-

The market valuation reached USD 95.04 million in 2025, forecasted to surpass USD 1 billion by 2034.

-

North America currently dominates the market, led by substantial investments from Google, Amazon, and Microsoft.

-

Asia-Pacific is the fastest-growing region due to rapid digital transformation and government-backed innovation initiatives.

-

Optical engines/transceivers were the leading component segment in 2024.

-

True packaged optics integration leads the technology landscape, minimizing power consumption and latency.

-

Data centers hold the largest end-user share, with AI-driven high-performance computing (HPC) representing the fastest-growing application segment.

-

Direct OEM sales dominate distribution, with contract manufacturing partnerships growing rapidly.

-

Key market players include Broadcom, Intel, NVIDIA, Cisco, TSMC, and Ayar Labs.

How is AI Transforming the Co-Packaged Optics Market?

Artificial Intelligence is playing a revolutionary role in both the demand and development of co-packaged optics technology. The surge in AI workloads requires ultra-high bandwidth and low-latency data throughput within hyperscale data centers—criteria that traditional pluggable optical receivers no longer meet efficiently. AI integration allows for faster data movement, significantly reduced power consumption, and scalable architectures supporting massive AI training clusters.

Additionally, AI-driven machine learning tools are enhancing the market by optimizing optical component design, predicting performance issues like signal loss, and improving thermal and power management within co-packaged optics systems. In manufacturing, AI-powered quality control assures precision assembly of critical components, boosting reliability. Thus, AI acts as both a catalyst and an enabler in advancing co-packaged optics innovation and deployment.

What Factors Are Driving Market Growth?

The rapid escalation of cloud computing, 5G rollout, and AI-driven data processing workloads are the primary engines behind the market’s expansion. Co-packaged optics technology’s core advantage—integrating optical and electronic components in the same package—greatly reduces electrical interconnect distances, lowers power consumption, and enables ultra-high bandwidth density.

Moreover, hyperscale data centers face growing bandwidth bottlenecks and energy consumption challenges, creating a pressing need for scalable, energy-efficient solutions like co-packaged optics. Innovations in silicon photonics and advanced packaging further accelerate adoption by enhancing performance, cost efficiency, and integration capabilities.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/6705

What Emerging Opportunities and Trends Are Shaping the Future?

Could quantum computing and smart city infrastructure boost future demand for co-packaged optics? Emerging applications in quantum technologies, scientific research, and intelligent urban systems present promising growth avenues for the market. The industry is also witnessing a pronounced shift towards sustainability, with data centers prioritizing energy-efficient technologies to mitigate environmental impact.

How will silicon photonics integration transform the optics landscape? By embedding optical components directly into silicon chips, silicon photonics is set to revolutionize data transmission speeds, scalability, and power efficiency. This trend is attracting significant investment from leaders like Intel, Broadcom, and Cisco, paving the way for next-generation networking solutions.

Co-Packaged Optics Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,055.11 Million |

| Market Size in 2025 | USD 95.04 Million |

| Market Size in 2024 | USD 72.97 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 30.66% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Component, Integration / Packaging Type, Reach / Interconnect Length, End-Use Application, and Region | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Co-Packaged Optics Market Regional and Segmentation Landscape

North America leads the global co-packaged optics market, driven by advanced technological infrastructure, strong cloud service ecosystems, and substantial R&D investments from major tech companies. The Asia-Pacific region is the fastest-growing hub, benefitting from rapid industrialization, progressive governmental policies, and booming 5G deployment in countries such as China, Japan, and South Korea.

By component, optical engines/transceivers dominate due to their crucial role in high-speed data transfer. Photonic integrated circuits (PICs) are anticipated to register the fastest growth given their ability to integrate multiple optical functions on a single chip, enhancing scalability and energy efficiency. Integration-wise, true packaged optics hold the largest market share by offering the shortest electrical links and best power/performance trade-offs.

Data centers are the largest end-use segment, fueled by increased cloud computing and big data analytics, followed by HPC applications that are rapidly adopting co-packaged optics to enable AI training and complex simulations. Direct OEM sales remain the dominant distribution channel, although contract manufacturing partnerships are expanding swiftly to meet scaling production demands.

Co-Packaged Optics Market Companies

-

Broadcom Inc.

-

Intel Corporation

-

NVIDIA Corporation

-

Cisco Systems, Inc.

-

Taiwan Semiconductor Manufacturing Company (TSMC)

-

Ayar Labs

-

Lumentum Holdings Inc.

-

NeoPhotonics Corporation

-

Corning Incorporated

-

Coherent Inc.

These firms are pioneering advances in silicon photonics integration, advanced packaging techniques, and optical component design to meet next-generation data center and networking requirements.

Challenges and Cost Pressures

Despite strong growth, significant challenges remain. The high cost and technical complexity of integrating optical components with silicon chips increases initial capital expenditure, raising barriers for smaller players. Additionally, lack of standardized interfaces and vendor interoperability slows adoption and integration. Scalability issues present risks in large-scale deployment, as consistent performance and cost control are critical.

Trade policy changes, especially in the U.S., have introduced new tariffs on semiconductor and photonic components, impacting sourcing costs and supply chain strategies. These pressures are prompting manufacturers to explore nearshore production and alternate supply routes to mitigate risks and maintain competitive positioning.

Case Study: Scaling AI Data Centers with CPO Integration

Leading hyperscale data center operators, such as those operated by Google and Microsoft, have adopted co-packaged optics to overcome bandwidth and power bottlenecks in AI training clusters. By embedding optical engines close to switching ASICs, these data centers have achieved significant reductions in energy consumption, improved latency, and increased port densities.

This technological shift has enabled more efficient scaling of AI workloads without proportional increases in operational expenditure, validating CPO as a foundational technology for next-generation data infrastructure.

Read Also: Pharmaceutical Blister Packaging Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344