Rapid Cloud Adoption Drives Demand for Advanced Security Solutions

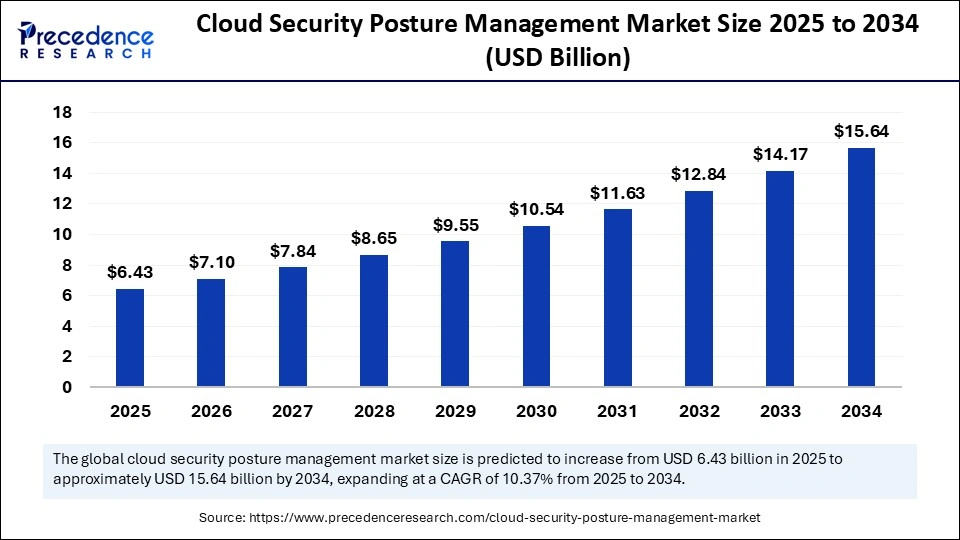

The global cloud security posture management (CSPM) market is poised for significant growth, with market size forecasted to reach USD 15.64 billion by 2034 from USD 6.43 billion in 2025, reflecting a robust CAGR of 10.37% from 2025 to 2034.

This expansion is primarily driven by the heightened adoption of cloud platforms across industries, which creates complex security challenges and increases the risk of data breaches, spurring demand for advanced CSPM solutions to safeguard cloud environments.

Cloud Security Posture Management Market Key Insights

-

The CSPM market was valued at USD 6.43 billion in 2025, expected to grow to USD 7.10 billion in 2026, and reach USD 15.64 billion by 2034.

-

North America dominates the market with nearly 40% share in 2024, followed by fast-growing Asia Pacific, expected to register a CAGR of 25%.

-

Leading CSPM providers include Wiz, Palo Alto Networks, Orca Security, CrowdStrike, Datadog, Microsoft, Lacework, SentinelOne, Amazon Web Services, Google Cloud, Alibaba, and Oracle.

-

The solution segment holds around 70% market share as of 2024, reflecting preference for integrated, automated security tools.

-

Banking, Financial Services, and Insurance (BFSI) sector dominates end-user industries with nearly 30% share in 2024.

What is Cloud Security Posture Management and Why Is It Critical?

Cloud Security Posture Management refers to a comprehensive set of technologies and practices that continuously monitor, manage, and remediate security risks within cloud infrastructures.

CSPM tools detect misconfigurations, compliance violations, and vulnerabilities across public, private, and hybrid cloud environments, allowing organizations to maintain secure cloud operations and meet evolving regulatory requirements. The increasing complexity of multi-cloud and hybrid environments drives the necessity for automated, real-time security solutions that CSPM provides.

The Role of Artificial Intelligence in CSPM

Artificial intelligence is revolutionizing CSPM by transforming static security tools into dynamic, intelligent systems. AI enables real-time threat detection, intelligent prioritization of risk alerts, predictive analysis, and guided remediation workflows that enhance security teams’ efficiency and effectiveness.

The rise of generative AI further simplifies user interactions with these platforms, allowing security professionals to communicate with CSPM tools using natural language, which reduces the need for specialized skills and accelerates response times.

Cloud Security Posture Management Market Growth Factors

-

Explosive adoption of cloud services, including public, private, hybrid, and multi-cloud strategies, increases demand for CSPM solutions.

-

Rising incidents of cloud data breaches and cyberattacks necessitate proactive security management.

-

Regulatory compliance requirements across industries such as BFSI, healthcare, and government reinforce the need for continuous monitoring and risk mitigation.

-

The growing preference for integrated security platforms, such as cloud-native application protection platforms (CNAPPs), which bundle CSPM with other security functionalities.

-

Advancements in AI and machine learning enhance CSPM capabilities and open new avenues for automation and predictive security.

Cloud Security Posture Management Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.43 Billion |

| Market Size in 2026 | USD 7.10 Billion |

| Market Size by 2034 | USD 15.64 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.37% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Model, Organization Size, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Are the Emerging Opportunities and Trends in the CSPM Market?

How is the rise of CNAPPs impacting the CSPM landscape?

The convergence of CSPM with cloud workload protection and infrastructure entitlement management in CNAPPs offers comprehensive cloud security frameworks. This integration simplifies security oversight while increasing protection breadth, making CNAPPs a promising growth segment within the CSPM market.

What role do managed security services play in expanding CSPM adoption?

The complexity of modern cloud environments drives organizations to adopt managed security services that deliver CSPM as a service. This approach helps address the cybersecurity skills gap and provides continuous, expert security monitoring without requiring extensive in-house resources.

How is AI shaping the future development of CSPM tools?

AI incorporation is leading to more intuitive, adaptive CSPM platforms capable of natural language interaction, predictive analytics, and automated remediation, significantly boosting operational efficiency and threat response time.

Regional and Segment Analysis

North America leads the market, supported by advanced cloud infrastructure and a mature regulatory environment that drives extensive CSPM adoption. Asia Pacific is the fastest-growing region, spurred by aggressive digital transformation initiatives and newly implemented stringent data protection laws in countries like India and China.

Segmentation Highlights

-

Solutions dominate the market with nearly 70% share due to demand for automated multi-cloud security tools.

-

Public cloud deployment is the largest segment (60%), given its scalability and widespread use, while hybrid cloud deployment grows rapidly (25% CAGR).

-

Large enterprises capture about 65% of the market due to complex cloud infrastructures and higher security needs; SMEs are rapidly adopting CSPM driven by affordable toolsets.

-

BFSI holds the largest end-user share (30%) due to regulatory pressure and sensitive data handling; government & defense sectors are also growing briskly (35% CAGR) with critical data security requirements.

Top Companies in the Cloud Security Posture Management Market

Tier I – Major Players

These companies are dominant in the market, each holding a significant share individually, and together accounting for approximately 45–50% of the total market revenue.

- Microsoft Corporation: It offers Microsoft Defender for Cloud, a comprehensive CSPM solution that provides continuous assessment and security posture management across hybrid and multi-cloud environments.

- Palo Alto Networks, Inc.: The company provides Prisma Cloud, a cloud-native security platform offering CSPM capabilities, including real-time visibility, compliance monitoring, and threat detection across multi-cloud environments.

- Check Point Software Technologies Ltd.: The company provides comprehensive cloud security posture management through its CloudGuard platform, enabling organizations to manage misconfigurations, enforce compliance, and automate threat detection across multi-cloud environments.

- Trend Micro Incorporated: It offers Cloud One – Conformity, a CSPM solution that offers continuous monitoring and remediation of cloud misconfigurations, helping organizations maintain compliance and security across their cloud environments.

- Fortinet Inc.: Its FortiCNP, a CSPM solution, provides visibility and control over cloud security posture, enabling organizations to detect and remediate misconfigurations and vulnerabilities in real-time.

Tier II – Mid-Level Contributors

These companies have a strong presence in the CSPM market, offering specialized solutions and catering to specific customer needs, collectively contributing around 30–35% of the market.

- Lacework Inc.

- Aqua Security Software Ltd.

- Qualys Inc.

- McAfee Corp.

- IBM Corporation

Tier III – Niche and Emerging Players

These are smaller, emerging, or regionally-focused companies with limited but growing presence, together contributing about 15–20% of the market.

- Wiz

- CrowdStrike

- Zscaler

- Cloudflare

Challenges and Cost Pressures

Despite benefits, CSPM vendors face challenges in keeping up with evolving cloud threats and hacking techniques that exploit vulnerabilities. Continuous solution updates demand significant investment. Some tools focus narrowly on misconfiguration detection, requiring integration with additional tools for comprehensive protection, adding to costs and complexity.

Case Study: Wiz (Agentless CSPM/CNAPP)

-

Company Name: Digital-Only Bank (Tier-1 Fintech)

-

Headquarter (Vendor): New York, New York, USA

-

Offering: Wiz (agentless CSPM, graph-based risk, CIEM, IaC guardrails)

-

Detailed Case Study:

Deployed agentless scanning across AWS & GCP in under a week. Wiz Security Graph revealed high-impact attack paths (public bucket → over-privileged role → sensitive datastore). Added IaC policies to Terraform pipelines; introduced approval gates for risky changes. -

Outcome:

-

2,300+ critical/High issues remediated in 60 days

-

Time to full environment visibility: <24 hours

-

Achieved ISO 27001 & SOC 2 Type II re-certification with fewer audit findings

-

-

Protectional:

Attack-path elimination, identity right-sizing, secret exposure detection, database posture checks, and continuous compliance with automated tickets. -

Impact on the Market:

Demonstrates the shift to agentless, graph-prioritized CSPM with strong CIEM and developer pipeline controls. -

Financial After Implementation:

~12% reduction in cyber-insurance premiums (~$600k); ~20% reduction in security engineering toil (~$1.1M productivity gain); avoided potential regulatory exposure from data leakage events.

Read Also: Robotic Arm Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344