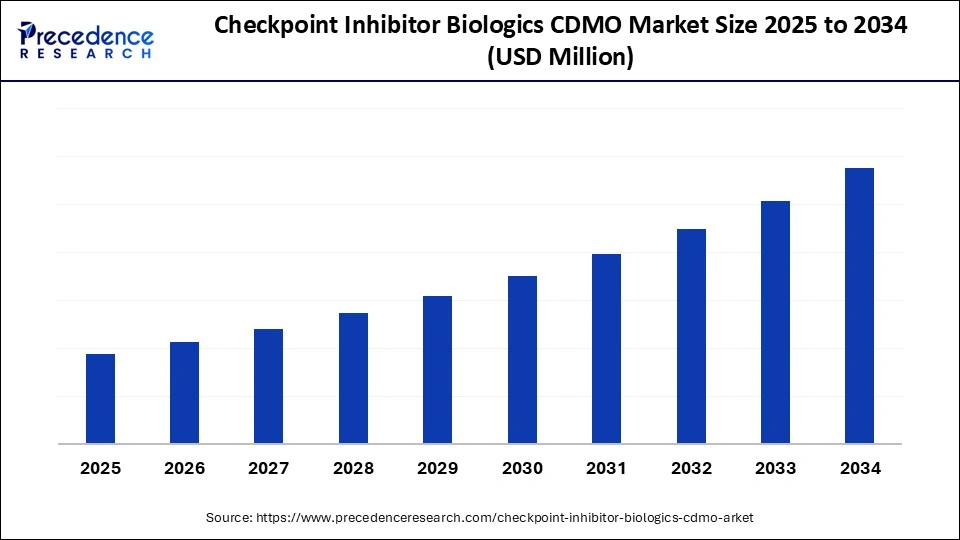

The global checkpoint inhibitor biologics CDMO market is projected to see remarkable growth from 2025 to 2034, driven by rising oncology pipelines, technological advances, and increasing personalized cancer therapies demand. With North America leading and Asia Pacific as the fastest-growing region, the market is expected to witness a dynamic shift in biologics manufacturing processes, incorporating AI and modular bioprocessing.

Introduction: Market Expansion and Key Drivers

The checkpoint inhibitor biologics CDMO market is on a robust growth trajectory, fueled by expanding cancer immunotherapy regimens, especially in PD-1, PD-L1, and CTLA-4 inhibitors. Outsourcing biologics development is becoming crucial for pharmaceutical companies aiming to accelerate time-to-market and reduce costs. The market is driven by high regulatory standards, complexity in manufacturing, and the rising need for personalized niche oncology therapies, all of which underpin a CAGR indicative of strong double-digit growth.

Checkpoint Inhibitor Biologics CDMO Market Key Insights

-

The checkpoint inhibitor biologics CDMO market is dominated by North America, holding approximately a 45% share.

-

Asia Pacific is the region with the fastest growth rate due to expanding biotech ecosystems and investments in GMP facilities.

-

Monoclonal antibodies represent about 70% of manufacturing activities in this sector, underscoring their importance in immunotherapy.

-

Commercial manufacturing services capture 40% of the CDMO market share, reflecting a shift toward large-scale production and stringent GMP compliance.

-

Fill-finish services are the fastest-growing segment, expected to grow at a CAGR between 20-25% driven by demand for advanced aseptic drug product handling.

-

Pharmaceutical companies constitute roughly 50% of the end-user base, leveraging CDMO expertise for production flexibility and regulatory compliance.

-

Technological innovations like single-use bioprocessing platforms and AI-driven process controls are transforming manufacturing capabilities.

Checkpoint Inhibitor Biologics CDMO Market Segment Breakdown

Based on the available data, the market segments include:

| Segment | Market Share/Importance |

|---|---|

| Commercial Manufacturing | 40% share, dominant for late-stage approvals |

| Fill-Finish Services | Fastest growing, CAGR 20-25% |

| Mammalian Cell Culture | Leading technology platform (~60% share) |

| Monoclonal Antibodies | Constitute ~70% of biologics CDMO market |

| Regional Share | North America (45%), Asia Pacific (fastest growing) |

Role of Artificial Intelligence in the Market

Artificial intelligence is playing an increasingly pivotal role in the checkpoint inhibitor biologics CDMO market by streamlining development and optimizing production. In early process development, AI-powered predictive models help identify optimal cell lines and process conditions, enhancing yield and ensuring critical protein structure preservation. During scale-up, AI-driven digital twins simulate bioreactor conditions, enabling manufacturers to optimize processes while reducing experimental cycles and accelerating time-to-market.

Additionally, machine learning algorithms monitor real-time production data to detect deviations early, enabling automated corrections that maintain consistent product quality. AI also supports predictive maintenance of manufacturing equipment, reducing downtime and operational inefficiencies.

Checkpoint Inhibitor Biologics CDMO Market Growth Factors

The primary growth driver remains the significant expansion of oncology pipelines requiring complex biologic manufacturing. There is increasing outsourcing to CDMOs due to high regulatory bars, specialized GMP requirements, and the need for flexible manufacturing solutions that can accommodate small batches and multi-tonne scale production.

Additionally, technological shifts towards modular bioprocessing, advanced analytics, and downstream innovations like membrane chromatography reduce costs while enhancing batch consistency. The rising demand for personalized and combination therapies further incentivizes companies to partner with capable CDMOs.

Opportunities and Trends: What Are the Emerging Growth Frontiers?

How are CDMOs expanding beyond manufacturing?

CDMOs are moving into adjacent services such as regulatory support, analytics-on-demand, and supply-chain orchestration, increasing client value beyond production.

Can regional diversification mitigate risks?

Geographic diversification reduces geopolitical and supply chain risks, while emerging regions like Asia Pacific and India are gaining prominence as lower-cost hubs.

What role do new biologic modalities play?

The rise of bispecific antibodies and combination therapies demands new manufacturing expertise and tailored workflows, presenting growth opportunities for innovative CDMOs.

Will AI and digital technologies redefine CDMO dominance?

Absolutely, integrating AI-driven quality monitoring and digital twin simulations is becoming essential to maintain competitiveness and regulatory compliance.

Checkpoint Inhibitor Biologics CDMO Market Regional Analysis

North America: The region holds the largest market share of approximately 45%, driven predominantly by the United States. This dominance is supported by a highly developed biotechnology ecosystem, state-of-the-art GMP (Good Manufacturing Practice) compliant manufacturing infrastructure, and an advanced regulatory framework that fosters innovation and expedited approvals. The U.S. is the central hub for oncology drug development and commercialization due to significant capital investments, established pharmaceutical companies, and biopharma startups focused on checkpoint inhibitor biologics.

Asia Pacific: This region is identified as the fastest-growing market for checkpoint inhibitor biologics CDMO services. Growth drivers include rapidly increasing investments in GMP-certified biologics manufacturing facilities, competitive lower manufacturing and labor costs, and expanding biotech innovation hubs in countries such as China, Japan, and South Korea. The region is also leveraging local innovation tailored to regional cancer profiles and treatment needs, making it a vital growth frontier.

India: Highlighted as a burgeoning player within Asia Pacific, India’s biotechnology sector is rapidly expanding with governmental support, skilled personnel, and cost advantages. India is improving its manufacturing capabilities, focusing on biosimilars and innovator checkpoint inhibitors, thus emerging as a cost-effective and growing hub for biologics CDMO services.

Checkpoint Inhibitor Biologics CDMO Market Segment Analysis

By Service Type:

Commercial Manufacturing: This segment dominates with around a 40% share, primarily due to the large-scale production demands for commercially approved biologics. CDMOs are leveraging advanced manufacturing platforms to meet stringent regulatory compliance and ensure product quality for global markets.

Fill-Finish Services: Recognized as the fastest-growing segment, fill-finish operations are gaining traction driven by the increasing complexity in aseptic drug product handling. The segment benefits from rising demand for injectable, stable checkpoint inhibitor formulations requiring specialized sterile filling, final product inspection, and packaging services.

By Technology Platform:

Mammalian Cell Culture: Constitutes nearly 60% of the market share as the preferred technology platform for checkpoint inhibitor biologics manufacturing. The high preference stems from its capability to produce complex glycosylated monoclonal antibodies and other biologics with appropriate critical quality attributes necessary for efficacy and safety.

By Drug Class:

Monoclonal Antibodies: Represent about 70% of manufacturing activities in the checkpoint inhibitor biologics CDMO market, underscoring their status as the mainstream therapeutic modality in cancer immunotherapy.

Emerging Modalities: Bispecific antibodies and combination biologics are increasingly incorporated into manufacturing pipelines, reflecting innovation trends and adding complexity that calls for advanced CDMO capabilities.

Top Checkpoint Inhibitor Biologics CDMO Market Companies

- Lonza Group: Lonza is a global leader in biopharmaceutical manufacturing and CDMO services, offering fully integrated solutions from cell line development to commercial biologics and cell/gene therapy production. The company’s global facilities in Switzerland, the U.S., and Asia make it a preferred partner for biologics manufacturing, biosimilars, and mRNA vaccine components.

- WuXi AppTec: WuXi AppTec provides comprehensive R&D, manufacturing, and testing services across small molecules, biologics, and advanced therapies. With its “follow the molecule” business model, the company supports clients throughout the entire drug development cycle, accelerating timelines for global pharmaceutical firms.

- Samsung Biologics: Samsung Biologics is one of the largest biologics CDMOs in the world, offering large-scale monoclonal antibody and recombinant protein manufacturing. Its state-of-the-art Bio Campus in Incheon provides unmatched production capacity, speed, and digitalized quality systems for global biotech and pharma clients.

- WuXi Biologics: WuXi Biologics delivers end-to-end biologics development and manufacturing through its proprietary WuXiBody™ platform, enhancing antibody design and expression. The company’s global expansion includes facilities in the U.S., Ireland, and Singapore, supporting clinical to commercial-scale biologics production.

- Boehringer Ingelheim: Boehringer Ingelheim’s BioXcellence™ division offers world-class biologics CDMO services, including mammalian and microbial cell culture systems. With over 35 years of experience, the company supports biopharma partners from early development through to large-scale commercial manufacturing.

Other Companies in the Checkpoint Inhibitor Biologics CDMO Space

Challenges and Cost Pressures

Capacity constraints, especially in aseptic fill-finish and downstream operations, limit supply flexibility. Long lead times and high capital investments for GMP facilities, plus stringent regulatory requirements, present hurdles. Margin compression from competitive pricing and tendering pressures further constrain profitability, alongside talent shortages in specialized biomanufacturing skills. These factors collectively challenge the ability to meet growing market demand without impacting quality.

Case Study Snapshot

A leading CDMO partnered with a pharmaceutical sponsor to implement AI-driven digital twin simulations for a PD-1 inhibitor manufacturing scale-up. This resulted in a 30% reduction in time-to-market and improved batch consistency, demonstrating the value of technology-enabled process optimization in complex biologics production.

Read Also: Cell Encapsulation Technology Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344