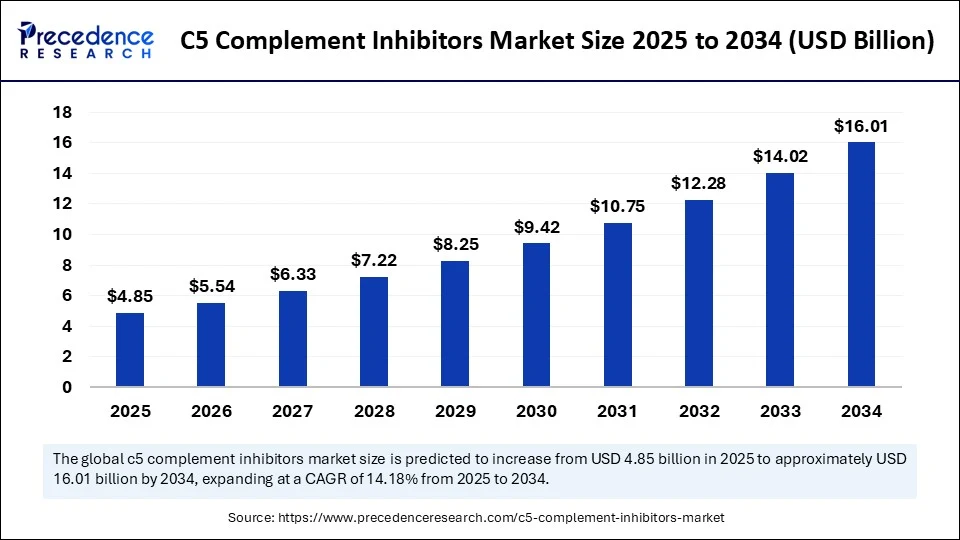

The global C5 complement inhibitors market is projected to grow robustly at a compound annual growth rate (CAGR) of 14.18% between 2025 and 2034, increasing from USD 4.85 billion in 2025 to an estimated USD 16.01 billion by 2034. This growth is propelled by rising prevalence of rare and fatal complement-mediated diseases such as paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS), intensive research and development efforts in developed countries, and rapid advancements in biotechnology and artificial intelligence (AI) enabling innovative therapeutics and improved patient outcomes.

C5 Complement Inhibitors Market Key Insights

-

The C5 complement inhibitors market was valued at USD 4.25 billion in 2024 and is forecasted to reach USD 16.01 billion by 2034.

-

North America dominates the market driven by advanced healthcare infrastructure and reimbursement policies, while Asia Pacific is the fastest-growing region supported by increasing diagnosis rates and healthcare investments.

-

Key players advancing the market include Alexion Pharmaceuticals, AstraZeneca, Apellis Pharmaceuticals, Hemapharmaceuticals, CANbridge Pharmaceuticals, and Beijing Defengrei Biotechnology.

-

Monoclonal antibodies currently dominate drug types, with RNA-based therapeutics emerging as the fastest growing segment.

-

Intravenous (IV) administration is preferred for reliability; however, subcutaneous routes are gaining traction for better patient convenience and cost savings.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6672

Revenue Breakdown Table (USD Billion)

| Year | Market Size (USD Billion) |

|---|---|

| 2024 | 4.25 |

| 2025 | 4.85 |

| 2034 | 16.01 |

What Role Does AI Play in the C5 Complement Inhibitors Market?

Artificial intelligence (AI) is revolutionizing the C5 complement inhibitors market by accelerating drug discovery and development processes. By analyzing vast datasets from clinical trials, genomics, and patient health records, AI algorithms help identify patterns and optimize drug candidates with higher efficacy and safety profiles. This enables pharmaceutical companies to make data-driven decisions, reduce time-to-market, and lower development costs.

Furthermore, AI-driven collaborations between researchers and pharmaceutical firms enhance personalized medicine approaches by predicting patient responses to inhibitors, optimizing dosage forms, and improving accessibility and affordability of treatments. These advances are shaping the next generation of C5 complement inhibitors and expanding therapeutic options for rare diseases.

What Factors Are Driving Market Growth?

The growth of the C5 complement inhibitors market is primarily driven by:

-

Increasing incidence of complement-mediated rare diseases demanding targeted therapies.

-

Continuous innovations in monoclonal antibodies and RNA-based therapeutics offering improved efficacy and safety.

-

Shift toward less invasive and cost-effective subcutaneous drug delivery methods.

-

Expanding biotech research focused on RNA interference (RNAi), gene therapy, and non-viral delivery systems such as lipid nanoparticles for enhanced tissue targeting.

-

Favorable regulatory environments and reimbursement frameworks in developed regions, particularly North America.

What Emerging Opportunities and Trends Are Shaping This Market?

Could RNA-based therapeutics and subcutaneous drug delivery redefine C5 complement treatment standards?

The increasing adoption of RNA-based therapeutics is revolutionizing treatment modalities, with rapid development cycles and broad applicability to rare diseases gaining attention. Similarly, the shift from intravenous to subcutaneous administration is improving patient compliance and reducing healthcare costs.

Are next-generation inhibitors poised to address current challenges such as infection risks and persistent anemia?

Next-gen inhibitors under development aim to extend half-lives, reduce resistance, and improve delivery, potentially mitigating side effects like infection risk (e.g., meningococcal infections) and sustained anemia caused by incomplete complement blockade.

C5 Complement Inhibitors Market Regional and Segmentation Analysis

North America leads the global market owing to superior healthcare infrastructure, reimbursement policies, and large-scale clinical trials focusing on complement inhibitor therapies. The U.S., in particular, faces a higher burden of complement-mediated diseases enabling faster adoption.

Asia Pacific shows the fastest growth propelled by rising disease awareness, supportive regulatory bodies like China’s National Medical Products Administration, and active involvement of regional leaders like AstraZeneca and CANbridge Pharmaceuticals. This region represents a prime opportunity for market expansion due to its population size and improving healthcare capabilities.

Monoclonal antibodies dominate the drug type segment due to their high selectivity for the C5 protein, minimizing side effects. However, RNA-based therapeutics are anticipated to grow rapidly due to their flexibility and proven success in other domains such as mRNA vaccines.

Intravenous administration remains common for reliable and direct drug delivery, especially critical in severe conditions like PNH. Yet, subcutaneous administration is catching up as it allows self-injection, reduces clinic visits, and lowers treatment costs.

Hospitals are the preferred end users given the need for close patient monitoring in severe disease cases, but the home care segment is accelerating as chronic patients seek convenience. Hospital pharmacies lead distribution due to the complexity in handling these biologics, while the online pharmacy segment is poised for rapid growth driven by e-commerce expansion and better inventory management.

Latest Breakthroughs and Leading Companies

Leading companies like Alexion Pharmaceuticals (part of AstraZeneca), Apellis Pharmaceuticals, Hemapharmaceuticals, CANbridge Pharmaceuticals, and Beijing Defengrei Biotechnology are pioneering C5 complement inhibitor development. Recent approvals and innovations include drugs like ravulizumab, eculizumab, and newer molecules such as AVACOPAN, EMPAVELU, and ENJAYMO. These advances showcase a shifting paradigm from older therapies to RNA-based and small molecule approaches.

Challenges and Cost Pressures

Challenges include risks of infections such as meningococcal disease due to immune system modulation and the persistence of anemia due to incomplete suppression of complement activation. The high cost of biologic drugs and requirement for specialized administration settings add financial and logistical burdens for healthcare providers and patients alike.

Case Study Highlight

In patients with paroxysmal nocturnal hemoglobinuria (PNH), the introduction of eculizumab drastically reduced intravascular hemolysis and improved quality of life. However, ongoing anemia led to the exploration of newer inhibitors with longer half-lives and innovative delivery methods, demonstrating the evolving treatment landscape and continuous need for R&D investment.

Read Also: Vaccine CDMO Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344