This growth is primarily driven by increasing automation in manufacturing processes, stringent regulatory labeling requirements in food, beverage, and pharmaceutical industries, and the growing e-commerce sector’s packaging needs.

Key end-use sectors fueling market expansion include pharmaceuticals, food and beverages, cosmetics, chemicals, and logistics. With Industry 4.0 adoption accelerating globally, automatic labeling machines are becoming indispensable for enhancing operational efficiency and product traceability.

Automatic Labeling Machine Market Key Insights

-

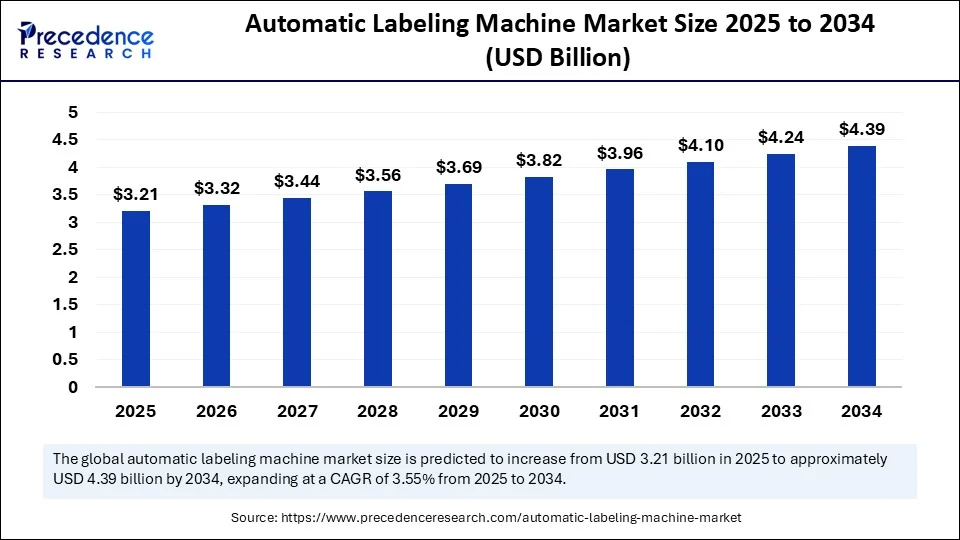

The global automatic labeling machine market was valued at USD 3.10 billion in 2024 and is projected to reach USD 4.39 billion by 2034, growing at a CAGR of 3.55% during the forecast period (2025–2034).

-

Asia Pacific led the market in 2024, accounting for the largest share of 41%, while the Middle East and Africa region is poised to witness the fastest CAGR over the next decade.

-

Based on type, pressure-sensitive labelers dominated with a 38% share in 2024, whereas RFID labeling machines are expected to register robust growth throughout the forecast period.

-

In terms of technology, fully automatic machines held the largest share at 55% in 2024. Meanwhile, print & apply systems are anticipated to grow significantly in the coming years.

-

By orientation, side labelers captured a 33% share in 2024, while top and bottom labelers are expected to exhibit the highest growth rate through 2034.

-

Among applications, bottles and jars dominated the market with a 40% share in 2024. However, the pouches and flexible packaging segment is projected to expand at a notable CAGR.

-

Regarding end-users, the food & beverage sector held a substantial 37% market share in 2024. In contrast, the e-commerce and logistics segment is likely to experience strong growth moving forward.

-

By speed capacity, machines operating at 101–300 labels per minute accounted for the largest share of 45% in 2024, while those with above 300 labels per minute are forecast to witness the fastest CAGR during the outlook period.

Impact of Artificial Intelligence and Advanced Technologies

Artificial intelligence (AI), machine vision systems, and industrial IoT (IIoT) are profoundly reshaping the automatic labeling machine market. AI-enabled labeling machines are now capable of real-time fault detection, dynamic label positioning, and adaptive speed control based on product variations. Machine vision technologies ensure label accuracy and quality by identifying misalignments, damaged labels, or print errors during high-speed operations.

IoT-integrated systems enable predictive maintenance by monitoring performance parameters, minimizing downtime, and optimizing energy usage. Cloud connectivity further supports remote diagnostics, production tracking, and compliance reporting, thus enhancing scalability and overall equipment efficiency (OEE).

Automatic Labeling Machine Market Regional Insights

Asia Pacific – Dominant Region

Asia Pacific held the largest revenue share in 2024, accounting for over 41% of the global market. The region’s dominance is driven by robust manufacturing bases in China, Japan, South Korea, and India, especially in pharmaceuticals, food processing, and consumer goods. Government incentives and foreign direct investment (FDI) in automation, combined with rising labor costs, are compelling manufacturers to adopt advanced labeling technologies.

Latin America – Fastest-Growing Region

Countries like Brazil and Mexico are witnessing growing demand for packaged food, beverages, and pharmaceuticals, along with rapid industrial digitization. The increasing presence of multinational CPG companies and regulatory improvements in labeling standards are major growth accelerators.

Automatic Labeling Machine Market Overview

Automatic labeling machines are specialized systems used for applying labels to containers, packaging, or products during manufacturing and distribution. These machines are critical for brand identification, regulatory compliance, traceability, and product information dissemination.

Widely used across sectors like pharmaceuticals, food & beverage, cosmetics, electronics, chemicals, and logistics, automatic labeling solutions are evolving from standalone units to fully integrated systems within production lines. Growing demand for flexible packaging, serialization, and customized product packaging further drives their relevance.

Growth Drivers

-

Rise in Manufacturing Automation: Manufacturers are adopting automatic labeling to reduce human error, improve speed, and meet production scalability.

-

Stringent Regulatory Compliance: Especially in pharmaceuticals and food, clear and compliant labeling is legally mandated, driving machine demand.

-

Surging E-commerce and Logistics: Increased volume of shipped packages boosts the demand for barcode and shipping label systems.

-

Sustainability Trends: Demand for eco-friendly packaging and recyclable label materials is prompting innovation in labeling technologies.

Restraints

-

High Initial Investment: Fully automatic, high-speed labeling machines involve significant capital expenditure, particularly for SMEs.

-

Integration Challenges: Compatibility with existing production lines and the complexity of customizing machines for varied product sizes can limit adoption.

Opportunities

-

Emerging Economies Expansion: Africa, Southeast Asia, and Middle East are investing in food processing and pharmaceutical sectors, presenting new opportunities.

-

Smart Labeling and RFID: Growing use of smart labels and RFID technology is opening avenues for connected supply chains and asset tracking.

-

Modular and Compact Machines: Demand for space-saving and flexible systems in small- to mid-scale facilities is rising.

Automatic Labeling Machine Market Scope

| Category | Details |

|---|---|

| Base Year | 2024 |

| Forecast Period | 2025–2034 |

| Market Size (2024) | USD 3.10 Billion |

| Market Size (2034) | USD 4.39 Billion |

| CAGR (2025–2034) | 3.55% |

| Key Regions | Asia Pacific, North America, Europe, Latin America |

| Key Segments | Type, Technology, Orientation, Application, End-User, Speed Capacity |

Segmentation Analysis

By Type

-

Self-Adhesive/Pressure-Sensitive Labeling Machines (Dominated ~45% market share in 2024): Favored for precision and speed, commonly used in consumer goods and food sectors.

-

Shrink Sleeve Labelers: Growing in beverage and cosmetic industries due to full-body branding capabilities.

-

Glue-Based Labeling Machines: Used in bulk packaging and industrial applications, although declining in favor of cleaner alternatives.

By Technology

-

Automatic (Fully & Semi-Automatic): Fully automatic systems dominate due to high throughput and minimal manual intervention.

-

Smart Labeling Systems: Equipped with AI, machine vision, and IoT for real-time label verification and quality control.

By Orientation

-

Horizontal Labeling Machines: Preferred for tubes and ampoules.

-

Vertical Labeling Machines: Common for bottles, jars, and round containers.

By Application

-

Primary Packaging: Holds the majority share; includes labeling of bottles, boxes, tubes.

-

Secondary/Tertiary Packaging: Includes outer case, logistics, and pallet labeling—growing rapidly in the e-commerce sector.

By End-User

-

Pharmaceutical Industry: High demand due to strict traceability and serialization requirements.

-

Food and Beverage: Accounts for a major share due to mass production and packaging compliance.

-

Cosmetics and Personal Care: Rising demand for aesthetic and clear labeling for brand differentiation.

-

Chemical Industry: Safety labeling and compliance drive demand.

-

Logistics & E-commerce: Rapidly expanding due to online retail growth.

By Speed Capacity

-

Up to 100 Labels per Minute

-

100–300 Labels per Minute

-

Above 300 Labels per Minute (Preferred in high-volume manufacturing environments like beverage bottling)

Automatic Labeling Machine Market Top Companies

-

ProMach, Inc.

-

Krones AG

-

Sidel Group

-

Fuji Seal International, Inc.

-

Herma GmbH

-

Weiler Labeling Systems (WLS)

-

Marchesini Group

-

Accutek Packaging Equipment Companies

-

Quadrel Labeling Systems

-

Label-Aire, Inc.

-

Videojet Technologies (Danaher Corporation)

-

Sacmi Group

-

Aesus Packaging Systems

-

Bausch+Ströbel

-

Pack Leader Machinery Inc.

Recent Developments

-

February 2024: Krones AG launched its modular labeling station “ModulJet,” designed for fast changeovers and digital label management in beverage production.

-

July 2023: ProMach acquired Etiflex, enhancing its product labeling automation capabilities for the North American market.

-

November 2023: Herma GmbH introduced a track-and-trace-enabled smart labeling machine for pharmaceutical serialization and tamper-evident packaging.

(Source: Company press releases)

Segments Covered

-

By Type: Pressure-sensitive, Shrink Sleeve, Glue-based

-

By Technology: Automatic, Semi-automatic, Smart systems

-

By Orientation: Horizontal, Vertical

-

By Application: Primary Packaging, Secondary/Tertiary Packaging

-

By End-User: Pharmaceuticals, Food & Beverage, Cosmetics, Chemicals, E-commerce/Logistics

-

By Speed Capacity: <100 LPM, 100–300 LPM, >300 LPM

-

By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Read Also: Decanter Centrifuge Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344