Automated Mining Equipment Market Outlook and AI Integration Trends (2025–2034)

The global Automated Mining Equipment Market is entering a transformative era driven by rapid advancements in artificial intelligence (AI), Internet of Things (IoT), and robotics. These technologies are revolutionizing the drilling processes across various energy-intensive sectors such as oil & gas, mining, and geothermal energy. With mounting pressures to enhance operational efficiency, reduce human intervention, and minimize environmental impact, the market is expected to see sustained growth over the next decade.

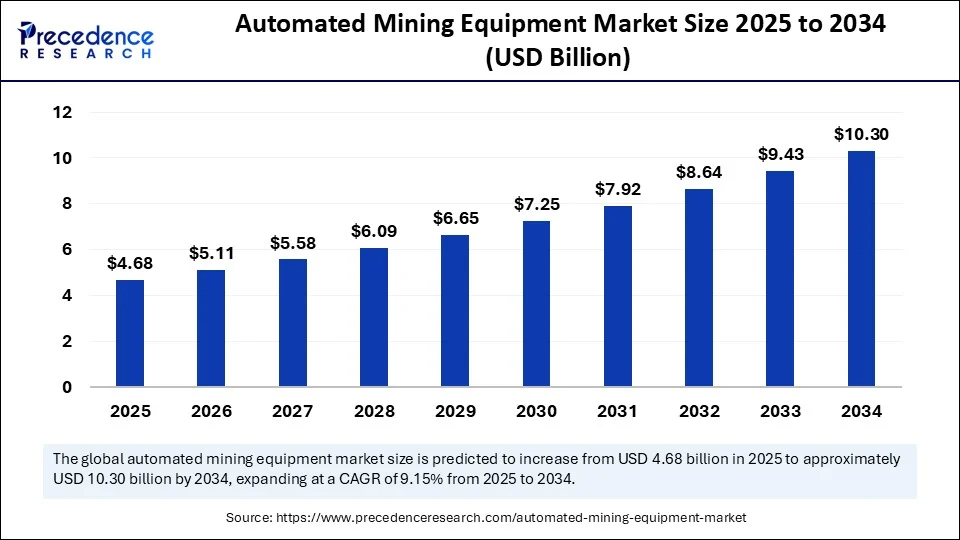

The global automated mining equipment market size was evaluated at USD 4.29 billion in 2024 and is predicted to attain around USD 10.30 billion by 2034, growing at a CAGR of 9.15%. The rising demand for resource extraction and the need for productivity optimization in hazardous environments are key contributors to this growth. The automation trend is not limited to mining alone—it is increasingly being integrated across the drilling ecosystems in oil & gas and geothermal sectors, creating a multi-industry opportunity landscape.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6423

Automated Mining Equipment Market Key Insights

-

Market Size and Growth

-

Valued at USD 4.29 billion in 2024, the global automated mining equipment market is projected to reach USD 10.30 billion by 2034, expanding at a CAGR of 9.15% from 2025 to 2034.

-

-

Regional Insights

-

Asia Pacific dominated the market in 2024.

-

Middle East & Africa (MEA) is anticipated to witness the fastest CAGR during the forecast period.

-

-

By Equipment Type

-

Autonomous haul trucks led the segment in 2024.

-

Automated drilling rigs are expected to grow at the highest CAGR between 2025 and 2034.

-

-

By Mineral Type

-

Metallic minerals (iron/copper) dominated in 2024.

-

Rare earth minerals will grow at a notable CAGR during the forecast period.

-

-

By Deployment Mode

-

The OEM-integrated segment held the largest market share in 2024.

-

Retrofit automation is projected to grow significantly through 2034.

-

-

By Level of Automation

-

The semi-automated segment generated the majority share in 2024.

-

The fully autonomous segment is expected to witness rapid growth moving forward.

-

-

By Software Solution

-

Fleet management software held the largest market share in 2024.

-

Predictive maintenance software is forecasted to expand at the fastest CAGR from 2025 to 2034.

-

-

By End-user

-

Surface mining dominated the market in 2024.

-

Underground mining is set to grow at the highest rate during the forecast period.

-

Role of AI in Automated Mining Equipment Market

AI plays a pivotal role in advancing the automated mining and drilling landscape. One of its most transformative applications is in predictive maintenance. By analyzing data from sensors embedded in drilling equipment, AI algorithms can forecast equipment failure or component degradation, enabling timely maintenance and minimizing costly downtime.

AI is also powering real-time analytics and automated decision-making. During drilling operations, AI systems analyze geological and operational data in real time to optimize drill paths, control drilling parameters, and enhance precision. This reduces human error and improves overall operational efficiency.

Automated Mining Equipment Market Segmentation

Equipment Type Insights

Which Equipment Dominated the Automated Mining Equipment Market in 2024?

In 2024, autonomous haul trucks held the leading position in the market, driven by their increasing deployment in mining operations aimed at improving efficiency and safety. These trucks are equipped with advanced technologies like AI and sensors, allowing for optimized routing, reduced fuel usage, and enhanced productivity. The industry’s growing focus on cost reduction and risk mitigation further supports their adoption across both surface and underground mining environments.

Meanwhile, automated drilling rigs are projected to grow at the fastest pace during the forecast period. Their ability to operate continuously, enhance safety, and reduce operational costs makes them a favorable investment. Innovations integrating AI and IoT provide real-time data insights, supporting smarter decision-making and increased operational efficiency.

Mineral Type Insights

Why Did the Metallic Minerals Segment Lead in 2024?

The metallic minerals segment emerged as the market leader in 2024, largely due to the critical role automated equipment plays in extracting and processing metals like iron, copper, gold, and nickel. These processes often involve hazardous conditions, increasing the demand for automation to safeguard workers and maintain efficiency.

The rare earth minerals segment is anticipated to register the highest growth rate going forward. Driven by their increasing demand in industries such as electronics, automotive, and renewable energy, the extraction of rare earths—often involving toxic and radioactive materials—necessitates the use of automated solutions to ensure worker safety and regulatory compliance.

Deployment Mode Insights

How Did OEM-Integrated Equipment Lead the Market in 2024?

The OEM-integrated segment dominated the market in 2024, supported by its ability to offer specialized, efficient, and safe automated solutions tailored to mining operations. Leading OEMs are heavily investing in technologies like AI and IoT to deliver smart solutions such as autonomous haulage, drilling, and loading systems. These integrated systems enable real-time monitoring and data-driven decision-making.

On the other hand, retrofit automation is expected to witness the fastest growth over the forecast period. As a cost-effective alternative, it allows mining companies to upgrade existing fleets with automation features without major capital investments. By extending the life of aging equipment and minimizing waste, retrofit solutions offer a sustainable path to modernization.

Level of Automation Insights

Why Was the Semi-Automated Segment the Market Leader in 2024?

In 2024, semi-automated equipment held the largest market share. This can be attributed to its balanced approach between human oversight and automation, allowing companies to reduce upfront costs while gradually integrating automated technologies into operations. Its flexibility supports a seamless transition from manual to remote-controlled processes.

The fully autonomous segment is projected to grow at the highest CAGR, driven by its strong potential to cut operational costs and enhance productivity. Increasing adoption of autonomous vehicles, remote-operated machinery, and intelligent software systems are making fully automated solutions indispensable, especially in high-risk environments.

Software Solution Insights

What Made Fleet Management Software the Market Leader in 2024?

Fleet management software led the market in 2024 due to its ability to significantly improve operational performance, optimize vehicle utilization, reduce fuel consumption, and enhance safety. These systems provide real-time visibility into fleet operations, enabling dynamic decision-making and efficiency gains.

Predictive maintenance solutions are expected to grow at the fastest pace, thanks to their ability to extend equipment lifespan and minimize downtime. Using real-time analytics, sensors, and machine learning, these tools help detect early signs of equipment failure, enabling proactive maintenance strategies and reducing overall costs.

End-User Insights

Which End-user Segment Led the Market in 2024?

The surface mining segment accounted for the highest market share in 2024, driven by the extensive use of automation in open-pit and strip mining operations. Surface miners are investing heavily in automated systems like autonomous trucks and drilling rigs to improve efficiency, safety, and cost-effectiveness while reducing environmental impact.

The underground mining segment is poised for rapid growth due to the adoption of advanced technologies like autonomous vehicles and remote-controlled machinery. These technologies are essential for operating safely in hazardous environments, and rising demand for minerals combined with stringent environmental regulations is accelerating the adoption of automation underground.

Automated Mining Equipment Market Regional Insights

Asia Pacific

Asia Pacific led the global market in 2024, fueled by accelerated industrialization, booming mining activities in China, Australia, and Indonesia, and government support for automation. Countries are heavily investing in mining and digital technologies to improve productivity and safety.

For instance, in March 2025, IndiaAI and GSI launched a hackathon targeting the identification of critical mineral zones in Karnataka and Andhra Pradesh. China’s strong manufacturing capabilities and government-driven advancements support the region’s dominance, although tensions with the U.S. over rare earth exports have presented trade challenges. Meanwhile, Australia remains a global innovation hub, rapidly adopting autonomous mining solutions and exporting mining technology globally.

Middle East and Africa

The Middle East and Africa region is the fastest-growing market, fueled by increasing mineral demand, rising mining investments, and strong government initiatives. Countries like South Africa, Saudi Arabia, and the UAE are promoting automation to improve efficiency and safety.

The upcoming African Mining Week 2025 in Cape Town will highlight efforts to strengthen regional partnerships and promote sustainable growth. South Africa’s established mining industry and modernization strategies are major contributors to the region’s advancement in mining automation.

North America

North America remains a significant market, driven by the early adoption of advanced technologies and a well-established mining industry. The U.S. and Canada benefit from the presence of major vendors and strict safety regulations that encourage the use of automated equipment.

The U.S., in particular, leads with strong R&D investments and a focus on minerals like iron, gold, copper, and coal. Ongoing technological rivalry with China continues to spur innovation and sophisticated equipment development.

Automated Mining Equipment Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.30 Billion |

| Market Size in 2025 | USD 4.68 Billion |

| Market Size in 2024 | USD 4.29 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.15% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Equipment Type, Mineral Type, Deployment Mode, Level of Automation, Software Solution, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Key Market Drivers

The shift toward remote and autonomous operations is one of the most prominent drivers of the automated mining equipment market. Operators are increasingly favoring technologies that allow equipment to be controlled from centralized command centers, significantly reducing the need for on-site human presence in hazardous or remote areas.

Cost-efficiency and productivity gains are another critical factor fueling market expansion. Automated drilling and extraction reduce downtime, improve drilling precision, and minimize material waste. Over the long term, these savings offset the high upfront capital investment typically associated with automation.

Moreover, environmental sustainability is becoming a core focus. Automated and AI-driven equipment helps monitor emissions, optimize fuel usage, and limit the environmental footprint of drilling activities. This aligns well with global sustainability mandates and ESG (Environmental, Social, and Governance) compliance standards.

Challenges Facing the Market

Despite the optimistic outlook, the market faces significant challenges. The most pressing issue is the high capital investment required to deploy automated systems, including AI infrastructure, robotics, and connectivity platforms. This can deter small and medium-sized players from entering the market.

Another concern is data security and cyber threats. As drilling operations become increasingly digitized and connected, the risk of cyberattacks grows, particularly in critical infrastructure like oil & gas. Ensuring data integrity and cybersecurity remains a major area of concern for industry stakeholders.

Major Companies

- Caterpillar Inc.

- Komatsu Ltd

- Sandvik AB

- Epiroc AB

- Hitachi Construction Machinery Co., Ltd.

- Volvo Group

- Liebherr Group

- Hexagon AB

- RPMGlobal Holdings

- ABB Ltd.

- Siemens AG

- Trimble Inc.

- Autonomous Solutions Inc. (ASI

- MineSense Technologies

- Scania AB

- Atlas Copco

- Rajant Corporation

- 3D-P (A Epiroc company)

- Wenco International Mining Systems

- Hitachi Vantara

Segment Covered in the Report

By Equipment Type

- Autonomous Haul Trucks

- Automated Drilling Rigs

- Autonomous Loaders

- Robotic Mining Equipment

- Dozers and Excavators

- Automated Blasting Systems

- Remote-Controlled Equipment

- Others (Grinders, Crushers, Graders)

By Mineral Type

- Metallic (Gold, Copper, Iron, Nickel, etc.)

- Non-Metallic (Limestone, Potash, Phosphate)

- Coal

- Rare Earth Minerals

By Deployment Mode

- On-Site (Fully Autonomous Sites)

- Retrofit Automation

- OEM-Integrated Solutions

By Level of Automation

- Semi-Automated

- Fully Autonomous

- Remote-Controlled

By Software Solution

- Fleet Management

- Navigation & Guidance

- Collision Avoidance & Safety

- Tele-remote Operations

- Predictive Maintenance

- Energy & Emissions Monitoring

By End-User

- Surface Mining

- Underground Mining

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Read Also: Field Device Management Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.co |+1 804 441 9344