Automated Material Handling Equipment Market Key Points

-

Asia Pacific led the automated material handling equipment market in 2024, accounting for over 39% of the total revenue share.

-

North America is anticipated to grow at a notable CAGR of 11.5% between 2025 and 2034.

-

Based on product, the robots segment captured the largest revenue share of 23% in 2024.

-

The warehouse management system segment, by product, is expected to grow at a significant CAGR throughout the forecast period.

-

By system, the unit load material handling segment held the largest market share in 2024.

-

The bulk load material handling segment, by system, is projected to expand at a notable CAGR from 2025 to 2034.

-

By vertical, the e-commerce segment emerged as the dominant contributor to market share in 2024.

Automated Material Handling Equipment Market Overview and Growth Outlook

Automated material handling equipment refers to systems and machinery used for transporting, storing, controlling, and protecting materials throughout the processes of manufacturing, warehousing, distribution, and consumption. These systems include conveyor belts, automated guided vehicles (AGVs), robots, sortation systems, and warehouse management software.

The market’s growth outlook is highly promising due to a combination of technological advancements and increasing demand from industries seeking efficiency, speed, and safety in operations. As global supply chains become more complex and consumer expectations for faster deliveries continue to rise, businesses are accelerating investments in automation to remain competitive.

Moreover, the integration of smart sensors and real-time data analytics within these systems is making automated material handling not only more efficient but also more intelligent, enabling predictive maintenance, inventory optimization, and enhanced throughput across warehouses and distribution centers.

Role of AI in the Automated Material Handling Equipment Market

Artificial Intelligence is playing an increasingly transformative role in the automated material handling equipment industry. AI technologies are being deployed to optimize routing for AGVs, enhance robotic vision systems for dynamic environments, and improve demand forecasting within warehouse management systems. Through machine learning algorithms, AI enables real-time decision-making and process automation, minimizing downtime and reducing errors in inventory management. Smart robots equipped with AI can adapt to changes in layout, product type, or order flow without requiring reprogramming.

AI also supports predictive analytics for equipment health monitoring, thereby reducing unplanned maintenance and extending machinery lifespans. Furthermore, AI-integrated systems improve worker safety by enabling collision avoidance features and automating repetitive or hazardous tasks, thus ensuring a more resilient and responsive material handling infrastructure.

Automated Material Handling Equipment Market Growth Factors

The rise in e-commerce and omnichannel retailing is one of the most significant factors fueling the demand for automated material handling equipment. As businesses strive to meet rapid delivery expectations and manage high order volumes, automation provides a scalable and efficient solution. Additionally, the growing trend of Industry 4.0 and smart factories is accelerating the adoption of robotics and digital systems in manufacturing and logistics.

Labor shortages and increasing wages in key industrial regions are further pushing companies to automate their operations. Governments and private enterprises are also investing heavily in infrastructure modernization, creating more opportunities for automation in warehouses, airports, ports, and distribution centers. Alongside these, improvements in battery technology, wireless communication, and cloud computing are making these systems more flexible and cost-effective than ever before.

Automated Material Handling Equipment Market Scope

| Report Coverage | Details |

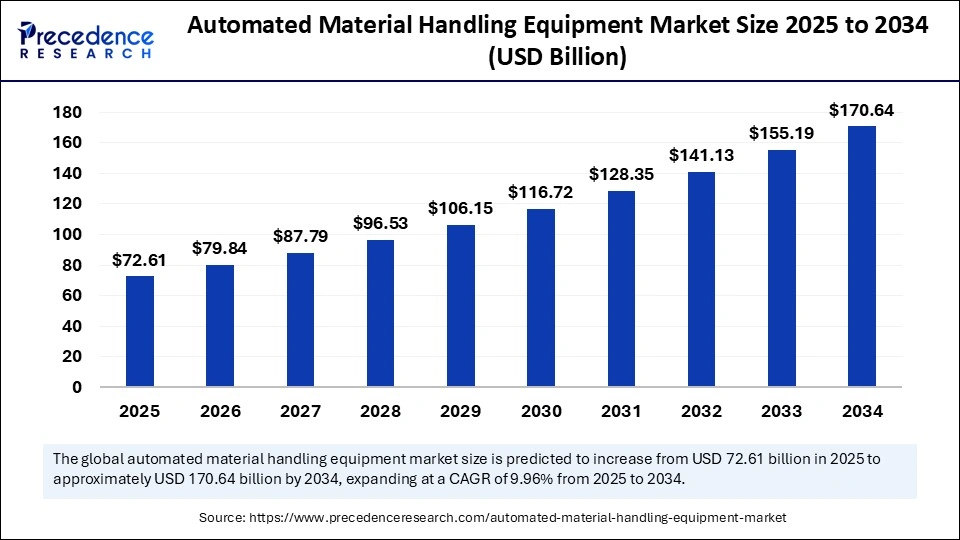

| Market Size by 2034 | USD 170.64 Billion |

| Market Size in 2025 | USD 72.61 Billion |

| Market Size in 2024 | USD 66.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.96% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, System, Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Opportunities

There is vast opportunity in the integration of AI and machine learning with material handling systems to build smarter, autonomous, and self-optimizing equipment. The growing acceptance of warehouse automation in small and medium enterprises (SMEs), supported by declining hardware costs and subscription-based software models, presents a significant market expansion path.

The ongoing digital transformation in the logistics sector, particularly in developing countries, offers untapped potential for equipment manufacturers and technology providers. Additionally, the sustainability trend is leading to the development of energy-efficient and low-emission systems, which are increasingly being adopted by companies looking to meet ESG goals. As new industries like electric vehicles, battery storage, and cold chain logistics grow, they too require specialized material handling solutions, expanding the application base even further.

Market Challenges

Despite its rapid growth, the AMHE market faces certain challenges. The high initial cost of equipment, integration complexity, and maintenance requirements can be a barrier for adoption, particularly among smaller enterprises. Additionally, a lack of skilled operators and technicians to manage and maintain these systems can limit their full utilization. Cybersecurity is another concern as increasing connectivity and cloud integration introduce vulnerabilities to warehouse management and control systems.

Moreover, companies often struggle with adapting legacy infrastructure to modern automated systems, which can delay implementation or inflate investment costs. Regulatory compliance in sectors such as pharmaceuticals and food also requires customized solutions that can complicate procurement and deployment processes.

Regional Outlook

Asia Pacific remains the most dominant region in the global automated material handling equipment market, supported by massive industrial output, rising e-commerce adoption, and strategic government initiatives to boost smart manufacturing. China, Japan, and India are key contributors to the region’s growth, investing heavily in warehouse automation and robotics. North America is witnessing strong growth, primarily due to labor shortages, technological readiness, and the presence of major e-commerce and logistics players.

Europe follows closely, benefiting from stringent safety regulations, mature industrial bases, and a growing focus on sustainable automation. Meanwhile, Latin America and the Middle East & Africa are emerging markets with increasing industrialization and infrastructure development, though growth remains somewhat limited by capital investment barriers and logistical constraints.

Competitive Landscape

- Honeywell International Inc.

- Daifuku Co., Ltd.

- Toyota Material Handling International

- KION GROUP AG

- Schaefer Systems International, Inc.

- Hyster-Yale Materials Handling, Inc.

- JBT

- Jungheinrich AG

- Hanwha Group

- KUKA AG

Future Outlook and Trends

The future of the automated material handling equipment market is closely tied to broader trends in digitization, sustainability, and intelligent automation. As the global economy becomes more data-driven, the demand for real-time visibility, traceability, and adaptive systems will continue to grow. The convergence of technologies such as 5G, edge computing, and robotics will unlock new capabilities in material handling, enabling faster, safer, and more autonomous operations. The push toward carbon neutrality will lead to innovations in energy-efficient designs and the use of recyclable materials in system components. Looking ahead, the integration of human-robot collaboration, predictive analytics, and decentralized control will reshape warehouses and factories into highly responsive, smart environments capable of adapting to dynamic market demands.

Segment Covered in the Report

By Product

- Robots

- Automated Storage and Retrieval System (AS/RS)

- Unit Load

- Mid & Mini Load

- Vertical Lift Module (VLM)

- Carousel

- Shuttle

- Conveyor Systems

- Sortation Systems

- Cranes

- Warehouse Management System (WMS)

- Collaborative Robots

- Autonomous Mobile Robots (AMR)

- Goods-to-Person Picking Robots

- Self-driving Forklifts

- Autonomous Inventory Robots

- Unmanned Aerial Vehicles

- Automated Guided Vehicle (AGV)

- Tow Vehicle

- Unit Load Carrier

- Pallet Truck

- Forklift Truck

- Hybrid Vehicles

- Others

By System

- Unit Load Material Handling

- Bulk Load Material Handling

By Vertical

- Automotive

- Semiconductor & Electronics

- E-commerce

- Healthcare

- Metals & Heavy Machinery

- Food & Beverages

- Chemicals

- 3PL

- Aviation

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Read Also: Steam Turbine Aftermarket

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6120

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344