AI Trading Platform Market Key Points

-

North America dominated the global market with the largest market share of 38% in 2024.

-

Asia Pacific is projected to grow at the fastest CAGR during the forecast period.

-

By application, the algorithmic trading segment held the largest market share of 39% in 2024.

-

The risk management segment is expected to grow at the fastest CAGR during the forecast period.

-

By interface type, the app-based segment captured the biggest market share of 55% in 2024.

-

The web-based segment is anticipated to grow at a significant CAGR in the upcoming years.

-

By deployment, the cloud segment contributed the largest market share of 51% in 2024.

-

The on-premise segment is projected to expand at a rapid pace in the coming years.

-

By end use, the institutional investors segment generated the major market share in 2024.

-

The retail investors segment is expected to expand at the fastest CAGR during the projection period.

How is AI Advancing Diagnosis and Treatment in the Veterinary Oncology Market?

AI is transforming veterinary oncology by enhancing the accuracy and speed of cancer diagnosis in animals. Machine learning algorithms can analyze medical imaging, pathology slides, and genetic data to detect tumors early and differentiate between benign and malignant growths. This enables veterinarians to make more informed decisions, resulting in faster and more precise treatment plans tailored to each animal’s condition.

AI is playing a critical role in personalizing cancer treatment for animals by predicting how different therapies will affect individual patients. It also accelerates research by analyzing large datasets to uncover new insights into cancer patterns, drug responses, and survival rates. Through predictive modeling and real-time monitoring, AI supports better treatment outcomes, reduces side effects, and contributes to the development of innovative cancer therapies for veterinary use.

Key Growth Drivers of the AI Trading Platform Market

The AI trading platform market is growing rapidly due to increasing demand for automated, data-driven trading solutions among institutional and retail investors. These platforms use artificial intelligence, machine learning, and real-time data analytics to execute trades with greater speed and accuracy, minimizing human error and emotional bias. High-frequency trading, algorithmic strategies, and predictive risk management tools are enabling investors to respond swiftly to market fluctuations, enhancing trading efficiency and profitability.

Additionally, technological advancements and infrastructure upgrades are accelerating market growth. Innovations in AI, including deep learning and natural language processing, along with the scalability of cloud computing, are making advanced trading systems more accessible and cost-effective. The rise in fintech adoption, particularly in Asia-Pacific, and the growing availability of big data are also driving the development of smarter, more adaptive platforms. These AI trading platforms increasingly offer personalized strategies, portfolio management, and regulatory compliance features, improving the overall user experience and broadening their appeal.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6167

Market Scope

| Report Coverage | Details |

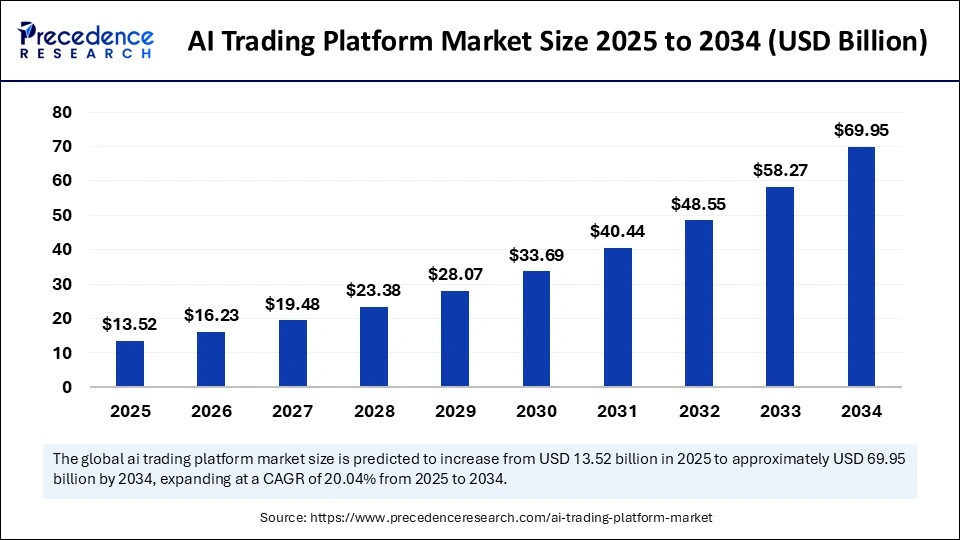

| Market Size by 2034 | USD 69.95 Billion |

| Market Size in 2025 | USD 13.52 Billion |

| Market Size in 2024 | USD 11.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Interface Type, Deployment, End Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The AI trading platform market is primarily driven by the growing demand for automation and data-driven decision-making in the financial services industry. Traders and financial institutions are increasingly adopting artificial intelligence to enhance trading speed, accuracy, and efficiency. AI algorithms can analyze massive datasets in real-time, identify patterns, and execute trades at optimal times, which significantly reduces human error and improves profitability.

The need for smarter risk management, real-time portfolio analysis, and predictive analytics is further encouraging adoption. Additionally, the rise of algorithmic and high-frequency trading, along with growing demand for low-latency systems and 24/7 market access, are pushing traditional trading platforms to integrate AI-powered features to stay competitive.

Opportunities

The AI trading platform market presents vast opportunities across both institutional and retail segments. With the democratization of financial markets, there is a rising demand for AI-driven tools among retail investors looking for advanced, user-friendly solutions. AI-enabled robo-advisors, sentiment analysis tools, and customizable trading bots are gaining popularity as they provide accessibility to professional-level trading strategies. Moreover, integration with blockchain technology and decentralized finance (DeFi) platforms offers new avenues for AI-driven trading platforms.

Emerging technologies like natural language processing (NLP) and reinforcement learning are opening doors for further innovation in market prediction and adaptive strategies. The expansion of financial markets in developing economies and increasing digital transformation in the fintech sector also provide a fertile ground for AI trading platform vendors.

Challenges

Despite the promising growth, the AI trading platform market faces several challenges. Regulatory uncertainty is a key concern, as financial authorities around the world are still evolving their frameworks to govern AI and algorithmic trading practices. The black-box nature of AI algorithms makes it difficult to ensure transparency and accountability, raising compliance and ethical concerns. Data privacy issues, cybersecurity threats, and the risk of algorithmic bias are other pressing challenges.

Moreover, the development and maintenance of AI models require high-quality data, skilled personnel, and significant computational resources, which can be a barrier for smaller firms. Market volatility and rapid changes in economic conditions can also hinder the performance of AI models that are not adaptive enough, leading to potential financial losses.

Regional Outlook

North America dominates the AI trading platform market due to its advanced financial infrastructure, high adoption of fintech innovations, and the presence of leading AI and trading technology companies. The U.S. is a global leader in algorithmic trading and continues to see strong investment in AI-enabled platforms. Europe is also a major market, supported by established financial hubs such as London, Frankfurt, and Zurich, where regulatory support for fintech and digital innovation drives growth. Asia-Pacific is experiencing rapid growth, led by countries like China, Japan, Singapore, and India, which are investing heavily in AI technologies and expanding their capital markets.

The region benefits from a large population of tech-savvy investors and government support for fintech development. Meanwhile, Latin America and the Middle East & Africa are emerging markets, where increasing smartphone penetration, digital banking initiatives, and growing investor awareness are creating new opportunities for AI-powered trading platforms.

AI Trading Platform Market Companies

- Kavout

- Numerai, Inc.

- Algotraders

- Tickeron Inc.

- MetaQuotes Ltd

- SAS Institute

- Oracle

- JP Morgan Chase

- Trade Ideas LLC

- Alpaca Securities LLC

- Wealthfront Corporation

- TradingView, Inc.

- ProRealTime SAS

Segments Covered in the Report

By Application

- Algorithmic Trading

- Robo-Advisory Services

- Market Forecasting

- Risk Management

- Others

By Interface Type

- Web Based

- App-Based

By Deployment

- Cloud

- On-premises

By End Use

- Retail Investors

- Institutional Investors

- Hedge Funds

- Brokerage Firms

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Also Read: Intelligent Battery Sensor Market

Source: https://www.precedenceresearch.com/ai-trading-platform-market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344\