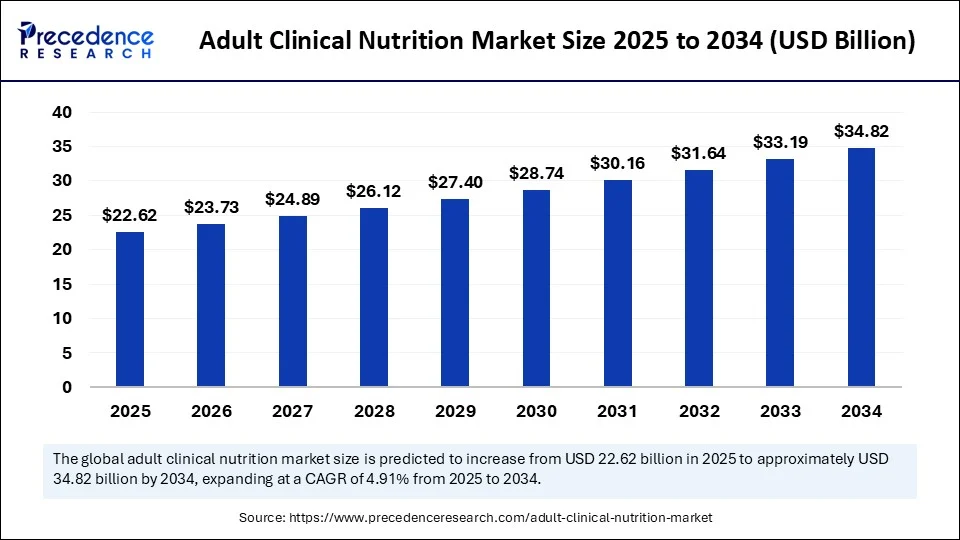

The global adult clinical nutrition market is poised for remarkable expansion, with its valuation projected to grow from USD 21.56 billion in 2024 to an estimated USD 34.82 billion by 2034, reflecting a healthy CAGR of 4.91% between 2025 and 2034. Rapid advancements in nutrition science, an aging world population, and the rising incidence of chronic disease are turbocharging the need for individualized nutrition solutions.

Why Clinical Nutrition Takes Center Stage

With healthcare systems under growing pressure to improve patient recovery and reduce treatment costs, adult clinical nutrition is taking center stage. Factors such as a rising awareness about nutrition’s role in preventing and managing chronic illnesses, plus an increasing demand for hospital and home-based nutritional therapies, are accelerating this market’s trajectory.

The U.S. market leads the charge, valued at USD 6.39 billion in 2024 and expected to reach USD 10.52 billion by 2034, growing at a brisk CAGR of 5.11% during the forecast period.

Adult Clinical Nutrition Market Quick Insights

-

The global market is expected to reach USD 34.82 billion by 2034.

-

CAGR for 2025–2034 stands at 4.91%.

-

North America leads as the dominant region, powered by robust healthcare infrastructure and R&D investment.

-

Asia Pacific is the fastest-growing market, spurred by urbanization, rising healthcare budgets, and digital health adoption.

-

Top segment: Oral nutritional supplements—particularly ready-to-drink formats—dominate.

-

The fastest-growing sub-segment: Enteral nutrition and specialized formulas tailored to specific diseases.

-

The U.S. adult clinical nutrition market is forecasted to be worth USD 10.52 billion by 2034.

-

Hospital-based and home healthcare are twin engines, with e-commerce rapidly gaining traction.

-

Geriatric and oncology patients drive demand for specialized products and tailored solutions.

Revenue Table

| Year | Global Market Value (USD Billion) | U.S. Market Value (USD Billion) | |

|---|---|---|---|

| 2024 | 21.56 | 6.39 | |

| 2025 | 22.62 | 7.03 | |

| 2034 | 34.82 | 10.52 |

The Role of AI in the Adult Clinical Nutrition Market

Artificial intelligence is radically enhancing the adult clinical nutrition sector by enabling real-time, hyper-personalized nutrition recommendations. AI algorithms sift through patient histories, lab results, and lifestyle data to generate tailored nutrition plans, improving patient adherence and treatment outcomes. Predictive analytics help forecast nutritional deficiencies before they become acute, allowing for proactive and preventative care.

AI also drives automation in manufacturing, ensuring better quality-control and faster product innovation. In clinics and hospitals, AI-powered tracking tools and apps are now used to monitor patient nutrition intake, adjust recommendations dynamically, and support remote patient management. This technology-level integration bridges the gap between population health science and personalized care, positioning AI as a linchpin for the future of clinical nutrition.

What’s Fueling the Growth of Adult Clinical Nutrition?

Aging populations and the surge in chronic illnesses such as diabetes, cancer, and cardiovascular disease have heightened the global focus on nutrition in recovery and long-term care. Medical professionals are increasingly prescribing tailored nutrition solutions for malnourished adults and those recovering from surgery or battling debilitating disease.

Additional growth drivers include:

-

Expansion of healthcare infrastructure in emerging economies.

-

Increased government initiatives for nutritional education in clinical settings.

-

Greater availability of advanced, easy-to-administer oral and enteral products.

-

A shift toward preventive healthcare and wellness solutions.

Opportunity & Trend: Are We on the Brink of a Personalized Nutrition Revolution?

Will the Rise of Biotechnology and Home Healthcare Redefine Clinical Nutrition?

The arena is ripe for disruption, as personalized medicine and advances in biotechnology converge to offer targeted nutrition solutions tailored to individual genetic profiles, metabolic rates, and disease specifics. Ready-to-use, portable nutrition packs are gaining favor among home healthcare patients. E-commerce is lowering access barriers, while public-private partnerships and technology collaborations are driving faster innovation cycles

Regional and Segmentation Analysis for the Adult Clinical Nutrition Market

Regional Breakdown

North America:

North America remains the largest adult clinical nutrition market, underpinned by its advanced healthcare infrastructure and a strong integration of medical nutrition in patient care protocols. The high prevalence of lifestyle-related chronic diseases ensures ongoing, substantial demand. Notably, heavy R&D investment drives the development of disease-specific and specialized nutritional formulas. Hospitals and long-term care facilities across the region have made nutrition therapy a standard in patient recovery.

Public and private insurance coverage for clinical nutrition products continues to expand, increasing accessibility. Technological advancements like AI-powered patient monitoring and steady collaboration between health providers and nutrition manufacturers further reinforce North America’s leading role. National nutrition education campaigns also support wider adoption of clinical nutrition interventions, especially in the U.S., where home-based nutrition programs for older adults are growing.

Asia Pacific:

Asia-Pacific is the fastest-growing market for adult clinical nutrition, with China at the forefront. The region’s rapid urbanization, rising healthcare expenditures, and increasing prevalence of both chronic and acute diseases drive robust demand. Expanding urban centers support the need for advanced nutritional products, and infrastructure development has made critical care and tailored nutrition more accessible. Government-led nutrition initiatives and greater public awareness among both healthcare professionals and patients are propelling market momentum.

Investments from private entities are fueling clinical nutrition infrastructure and research. E-commerce is making nutrition products widely available, as affordability improves. Partnerships between global and local firms are streamlining distribution and product innovation, making Asia-Pacific a primary engine for overall market growth.

Europe, Latin America, Middle East & Africa:

These regions are seeing steady adoption of adult clinical nutrition, with an increasing focus on specialized solutions for aging populations and individuals with chronic illnesses. Rising healthcare standards and greater awareness about the value of clinical nutrition are fostering gradual yet stable growth. In Europe, especially, hospitals and clinics increasingly recognize nutrition as integral to patient recovery, while Latin America and Middle East & Africa are expanding clinical nutrition access through public healthcare improvements and targeted educational campaigns.

Adult Clinical Nutrition Market Segment Highlights

By Product Type:

Oral nutritional supplements (ONS) dominate this segment, buoyed by rising health awareness and the convenience these products offer. Ready-to-drink supplements, in particular, are popular thanks to their user-friendliness and pre-measured requirements—especially beneficial for older adults or patients with mobility issues.

These are widely adopted both in hospitals and homecare settings due to their reliability and shelf stability. The enteral nutrition segment (feeding via tubes) is projected to grow fastest, as it is vital for critically ill and elderly patients who cannot meet requirements orally. Sub-segments, such as disease-specific feeds, are growing as care becomes more tailored for conditions like diabetes or renal issues. Improved formulations for better digestibility and technology-driven delivery systems are further supporting this trend.

By Formulation

Standard formulas remain the most widely used, serving a broad population with baseline nutritional needs where no specialized dietary adaptation is necessary. Their cost-effectiveness, ubiquity in hospitals and nursing homes, and balanced nutrient profile keep them at the forefront.

Specialized formulas are quickly gaining traction, designed for patients with cancer, kidney issues, diabetes, or other conditions that require adjusted nutrition profiles. These advanced solutions feature benefits like enhanced digestibility and immune-boosting ingredients, representing a shift towards truly personalized nutrition care.

By Patient Type:

The geriatric (elderly) segment leads the market, given the rapid global increase in life expectancy and higher incidence of age-related diseases and malnutrition. Older adults benefit from products formulated for easier digestion and swallowing and to maintain muscle mass.

Oncology (cancer) patients form the fastest-growing sub-segment, thanks to the crucial role of clinical nutrition in supporting strength, immune function, and tolerance to intensive therapies, as well as managing side effects like nausea or appetite loss.

By Distribution:

Hospitals and clinics are currently the principal distribution channels, as they play a central role in prescribing and initiating nutrition interventions—particularly for acute and critically ill patients. These facilities benefit from direct procurement and in-house expertise. However, homecare and e-commerce platforms are witnessing rapid expansion.

Online sales are growing quickly, making clinical nutrition products more accessible for home delivery, particularly in remote or underserved areas. Advanced packaging, subscription models, and virtual nutrition monitoring are fueling this trend. As telehealth expands and hospitals encourage at-home recovery to manage costs and capacity, demand for home-use clinical nutrition solutions is set to accelerate.

Latest Company Breakthroughs & Key Players

Top companies are investing in research for advanced, patient-specific formulations, integrating digital diagnostics, and streamlining supply chains for both hospital and home delivery. Partnerships between multinational brands and local healthcare providers are helping navigate regulations and localize product offerings.

Adult Clinical Nutrition Market Companies

-

Abbott Laboratories

-

Nestlé S.A.

-

Danone S.A.

-

Fresenius Kabi AG

-

Baxter International Inc.

-

B. Braun Melsungen AG

-

Mead Johnson Nutrition Company

-

GlaxoSmithKline plc

-

Pfizer Inc.

-

Hormel Foods Corporation

Facing the Challenges: Cost, Access, & Innovation Bottlenecks

While the market outlook is robust, hurdles persist. High product costs often limit access in lower-income regions, creating disparity in care. Stringent regulations can delay the introduction of novel formulations. Ingredient shortages and logistics hurdles can disrupt scheduling and supply. Lastly, taste fatigue, gastrointestinal discomfort, and the need for better patient adherence remain ongoing challenges for both manufacturers and care providers.

Case Study: Home-Based Nutrition in the U.S.

The U.S. has become a hotbed for home-based nutrition support programs, leveraging digital health tools for patient engagement. The use of AI-driven nutrition tracking apps and improved product packaging has enabled smoother transitions from hospital to home care, fostering better patient compliance and reducing length-of-stay in acute settings. Patient John Doe, 74, following cardiac surgery, saw reduced hospital readmissions after switching to an AI-monitored, home-based nutrition plan—demonstrating the power and potential of these innovations.

Read Also: Segmented Flow Analyzer (SFA) Market

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344