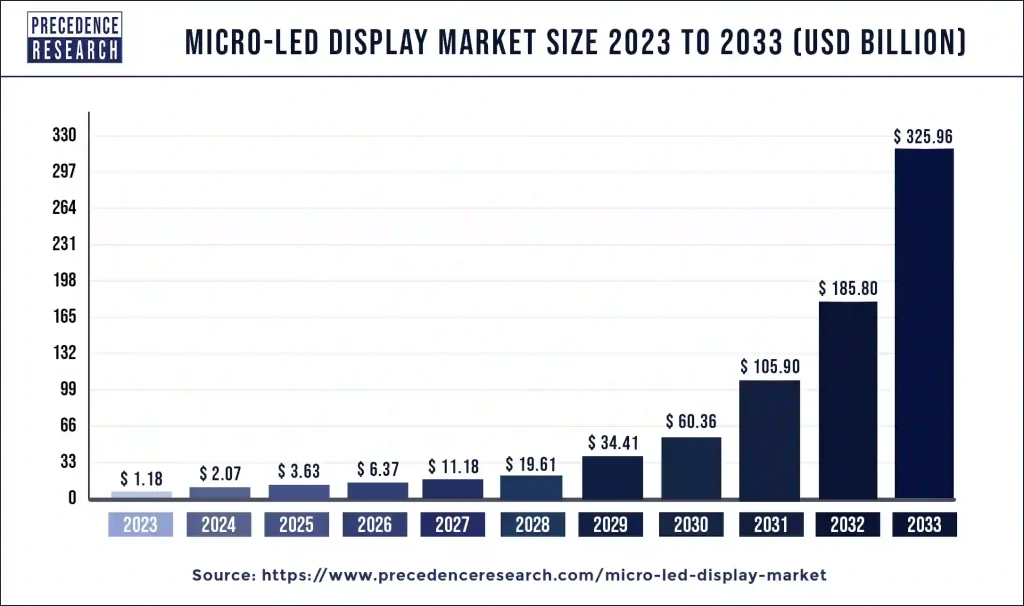

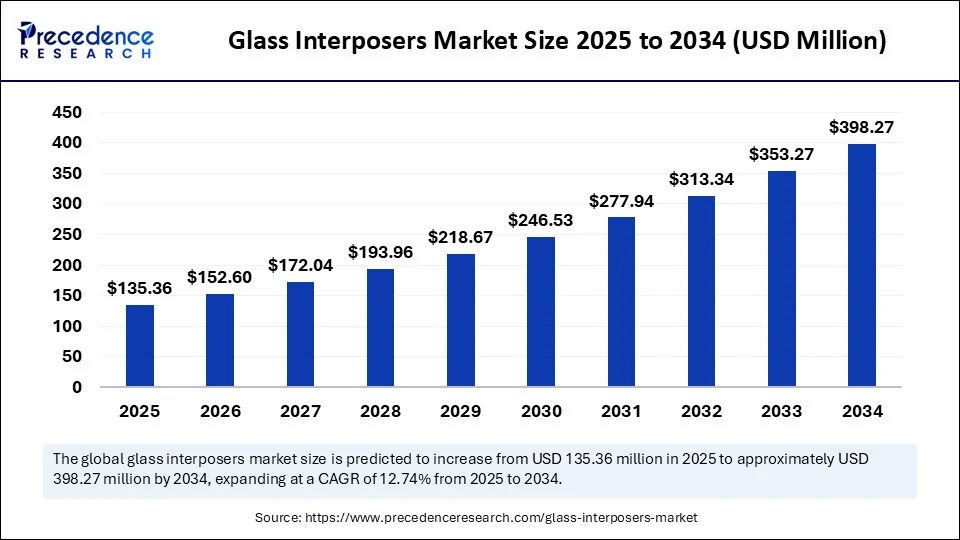

The global glass interposers market is entering an era of strong growth, projected at $135.36 million in 2025 and expected to surge to $398.27 million by 2034, charting a healthy CAGR of 12.74%.

This expansion is being fueled by cutting-edge innovations in semiconductor packaging, the global transition to high-efficiency LEDs, and the ever-growing need for high-performance microelectronics. With miniaturization trends accelerating across devices and industries, glass interposers have emerged as the backbone of next-gen chip integration.

Glass Interposers Market Quick Insights

-

Market Size: $135.36 Million in 2025 → $398.27 Million in 2034 (CAGR: 12.74%)

-

Asia Pacific leads the global market, expected to hit $249.40M by 2034

-

India is emerging as a photonics and specialty electronics innovation hub

-

Top companies: Corning Inc., Plan Optik AG, SCHOTT

-

Leading Segment: 2D Glass Interposers (cost-effective & scalable)

-

300mm wafer size dominates due to high-volume efficiency

-

Through-glass vias (TGVs) ensure signal integrity in advanced applications

-

Fan-out and glass panel-level packaging are set to redefine cost-performance balance

Glass Interposers Market Revenue Outlook

| Metric | Value |

|---|---|

| Market Size (2025) | $135.36M |

| Forecast (2034) | $398.27M |

| CAGR (2025–2034) | 12.74% |

| Asia Pacific Market (2024/2034) | $84.09M / $249.40M |

| Leading Segment | 2D Glass Interposers |

| Dominant Wafer Size | 300mm |

AI’s Role in Reshaping the Glass Interposers Market

Artificial Intelligence is revolutionizing the interposer ecosystem.

-

Design Optimization: AI-driven simulations are enabling faster, more accurate interposer layouts and predicting thermal/electrical outcomes.

-

Manufacturing Precision: Deep learning is improving TGV drilling and using machine vision for defect detection, minimizing yield losses.

-

Predictive Maintenance: AI keeps fabrication equipment at peak efficiency, reducing downtimes and optimizing throughput.

By integrating AI at every step—design, manufacturing, and inspection—the industry is scaling production with accuracy.

Glass Interposers Market Growth Drivers

-

Superior electrical & thermal stability compared to silicon

-

Demand for 2.5D/3D stacking and high-bandwidth memory

-

Miniaturization trends in consumer electronics

-

Rapid growth in 5G networks, AI accelerators, and high-speed data systems

-

Compatibility with high-density interconnects and redistribution layers

Opportunities Across Data Centers, Devices, and Automotive

The chiplet revolution is accelerating adoption of glass interposers:

-

Data centers & AI computing: high bandwidth, low latency integration

-

5G & consumer electronics: ultra-thin, reliable packaging

-

Automotive electronics: ADAS, EVs, and advanced driver systems

Glass Interposers Market Regional Analysis – Why Asia Pacific Leads

Asia Pacific dominates due to its robust chip manufacturing hubs in Japan, South Korea, Taiwan, and China. The region benefits from:

-

Strong local supply chains

-

Government R&D funding and industry-academia collaboration

-

High-volume production capabilities

India is carving a niche in photonics, aerospace, and defense microelectronics, with research breakthroughs in laser-assisted patterning and hybrid bonding.

Segmentation Snapshot

By Product / Type

-

2D Glass Interposers: Mature, cost-effective, widely used in consumer electronics & networking

-

3D Glass Interposers: Fastest-growing, driven by AI, HPC, AR/VR, and premium electronics

By Wafer Size

-

300mm wafers: Large-scale efficiency, lower cost per unit, dominant in electronics & HPC

-

200mm wafers: Niche uses in aerospace, defense, and medical electronics

By Substrate Technology

-

TGV (Through-Glass Vias): High-frequency, low-loss, fine-pitch routing, key for RF & HPC

By Packaging Architecture

-

2.5D Packaging: Balanced, widely adopted for GPUs & high-bandwidth memory

-

Fan-Out Packaging: Slim design, strong adoption in smartphones & wearables

-

Glass Panel-Level Packaging: Cost-efficient, high-throughput for next-gen electronics

Key Players Driving Innovation

-

Corning Inc. – Advancing high-purity glass & panel-level processes

-

Plan Optik AG – Specializing in optical compatibility & wafer fabrication

-

SCHOTT AG – Innovating specialty glass for semiconductor packaging

Other notable companies: AGC Inc., Nippon Electric Glass, 3D Glass Solutions, TSMC, Murata, Samtec, Entegris.

Challenges and Industry Barriers

-

High precision requirements for TGV fabrication

-

Lower yields vs silicon & organic substrates

-

Capital-intensive transition for manufacturers

-

Limited standardization & expertise

-

Supply chain vulnerabilities in specialty glass

Case Study – India’s Rise in Specialty Microelectronics

Indian R&D institutions and startups are collaborating with global leaders to push photonics and aerospace applications. Breakthroughs in laser-assisted patterning and hybrid bonding showcase India’s innovation-driven growth.

Read Also: Segmented Flow Analyzer (SFA) Market

Explore full market insights, segmentation, and competitive analysis here: Request Sample Report

For inquiries: sales@precedenceresearch.com | +1 804 441 9344