Market Valuation Soars from USD 37.60 Billion in 2024 to USD 93.69 Billion by 2034 Amid Rising Chronic Diseases, Aging Demographics, and Organ Shortages

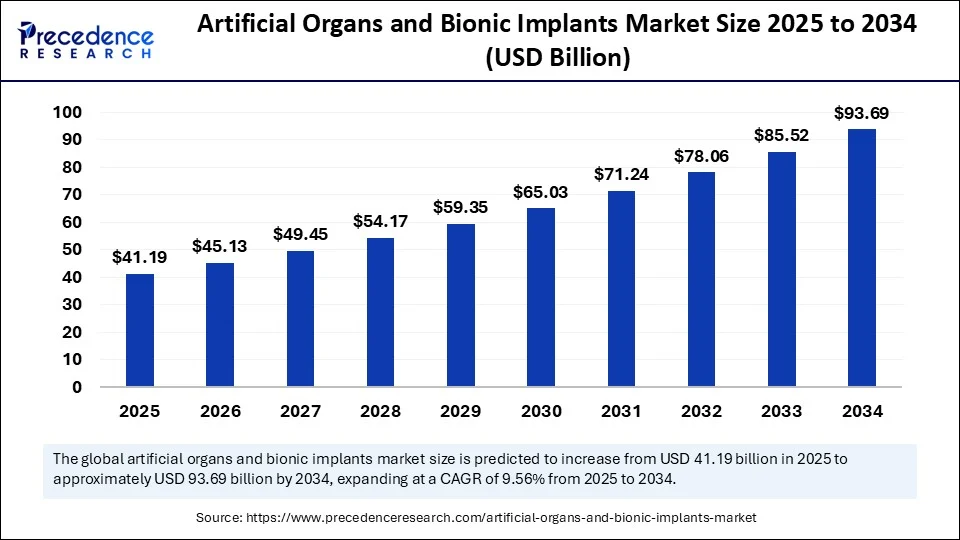

Precedence Research reported that the global artificial organs and bionic implants market was valued at USD 37.60 billion in 2024 and is projected to climb to USD 41.19 billion in 2025 before reaching USD 93.69 billion by 2034, delivering a robust CAGR of 9.56% from 2025 to 2034.

Sustained market expansion is driven by increasing chronic disease prevalence, organ supply shortages, a growing aging population, and rapid technological breakthroughs such as 3D bioprinting, neural bionics, biohybrid organs, AI integration, and miniaturized, self-powered implants.

Artificial Organs and Bionic Implants Market Quick Insights

-

The artificial organs and bionic implants market grew from USD 37.60 billion in 2024 to a forecast USD 41.19 billion in 2025.

-

Projected value of USD 93.69 billion by 2034 at a 9.56% CAGR from 2025 to 2034.

-

North America held the largest regional share in 2024, led by the U.S. market valued at USD 10.53 billion.

-

U.S. market expected to reach USD 26.75 billion by 2034 at a 9.77% CAGR.

-

Asia Pacific is the fastest-growing region, driven by healthcare access improvements, biotechnology investments, and aging populations.

-

Artificial organs dominated in 2024, with dialyzers and artificial kidneys as leading products.

-

Bionic implants—the fastest-growing segment—are propelled by cochlear implants and neurocontrolled limbs.

Market Revenue Breakdown

| Year | Global Market Size (USD Billion) | CAGR (%) |

|---|---|---|

| 2024 | 37.60 | – |

| 2025 | 41.19 | 9.56 |

| 2034 | 93.69 | 9.56 |

| Year | U.S. Market Size (USD Billion) | CAGR (%) |

|---|---|---|

| 2024 | 10.53 | – |

| 2025 | 11.60 | 9.77 |

| 2034 | 26.75 | 9.77 |

How Is Artificial Intelligence Shaping Next-Generation Organ and Bionic Solutions?

Artificial intelligence is revolutionizing implantable devices by enhancing human-machine synergy and real-time adaptability. Cloud-connected bionic limbs using 5G and edge computing have demonstrated naturalistic prosthetic control and heavy processing offload to external servers. AI-enabled bionic knees integrated with implanted neural electrodes have enabled amputees to climb stairs and navigate obstacles with unparalleled precision and an immersive sense of limb ownership.

At UC San Francisco in March 2025, a brain-computer interface allowed a paralyzed patient to operate a robotic arm solely through thought, adapting to evolving neural signals over months without retraining—demonstrating AI’s transformative role in seamlessly integrating implants as extensions of the human body to enhance mobility, sensory feedback, and independence.

Artificial Organs and Bionic Implants Market Growth Factors

The market’s momentum is underpinned by the following drivers:

-

A surge in chronic diseases such as end-stage renal disease and heart failure—over 37 million Americans suffer from chronic kidney disease, and 6 million live with heart failure.

-

Acute organ shortages: more than 103,223 patients await transplants in the U.S., with approximately 13 daily fatalities due to organ scarcity.

-

Rapid advancements in 3D bioprinting, biohybrid organs, and smart biomaterials.

-

Aging global population fuelling demand for life-supporting implants and mobility-enhancement devices.

-

Government and industry investments in organ transplantation programs and bionic prosthetics R&D.

Could Cutting-Edge Mechanical Hearts and Biohybrid Systems Redefine Treatment Paradigms?

Breakthroughs in fully implantable mechanical hearts and biohybrid constructs signal transformative opportunities. In May 2025, Australia’s first BiVACOR total artificial heart—a titanium, magnetically levitated ventricular pump—supported a patient for 105 days before successful transplantation, showcasing unprecedented durability and safety. Concurrently, University of Chicago researchers achieved lifelike touch sensations in bionic hands via advanced brain-computer interfaces, integrating tactile edges, textures, and movement cues with high fidelity. These innovations foreshadow a new era of regenerative and assistive medicine that redefines therapeutic possibilities.

Latest Breakthroughs from Industry Leaders

-

BiVACOR received FDA Breakthrough Device designation for its titanium total artificial heart, featuring a magnetically levitated rotor that powers both ventricles without mechanical wear points and demonstrates zero device-related complications in early clinical use.

-

University of Chicago engineered a brain-computer interface that endows prosthetic hands with realistic tactile feedback—users can now perceive pressure, shape, and texture, marking a leap in neuroprosthetic innovation.

Key Market Players: Medtronic PLC; Abbott; Boston Scientific; Asahi Kasei Medical; Cochlear Limited; Fresenius Medical Care; Abiomed; Baxter International; B.Braun; Nipro; MED-EL; Sonova; Getinge (Maquet); William Demant; LivaNova; Terumo; Syncardia; CorWave.

Artificial Organs and Bionic Implants Market Regional and Segmentation Analysis

North America: Dominant in 2024 owing to advanced healthcare infrastructure, high chronic disease rates, and streamlined FDA approval pathways. The U.S. leads with significant R&D investments in 3D bioprinting, tissue engineering, and neural-controlled prosthetics.

Asia Pacific: Fastest growing region, propelled by enhanced healthcare accessibility, public-private biotech collaborations, and a rapidly aging populace. Japan stands out for its leadership in medical robotics, regenerative medicine, and stem-cell–derived organs.

Product Type: Artificial organs commanded the largest share in 2024, driven by dialyzers and artificial kidneys. The artificial pancreas segment is accelerating due to closed-loop insulin delivery innovations.

Technology: Electronic bionics prevailed in 2024 through mature solutions such as cochlear implants and cardiac devices. Biohybrid bionics—merging living tissue with electronics—are forecasted to grow fastest, unlocking superior biocompatibility and feedback mechanisms.

Fixation Type: Implantable devices dominated in 2024 for long-term therapies. Externally worn systems, buoyed by non-invasive designs and portable form factors, will see the highest CAGR through 2034.

End User: Hospitals lead adoption of complex surgical implants. Home care settings are the fastest-growing end-user segment as portable bionic systems enable post-operative and geriatric care outside hospital walls.

Age Group: Adults held the largest share in 2024, driven by lifestyle-related organ failures. The geriatrics segment will expand most rapidly as aging-related organ degeneration intensifies demand for implants

Challenges and Cost Pressures

High costs and limited accessibility inhibit broad adoption, especially in emerging economies. Custom-engineered devices like bionic limbs and artificial hearts often exceed USD 250,000 per unit, with insurance coverage highly variable and specialized surgical expertise concentrated in urban centers. Manufacturing complexities and potential adverse effects further constrain market penetration despite urgent clinical need.

BiVACOR Case Study: Pioneering Total Artificial Heart

In July 2024, Baylor St. Luke’s Medical Center successfully implanted the BiVACOR Total Artificial Heart in a first-in-human trial. The magnetically levitated, dual-rotor pump replaced native ventricles without mechanical wear, demonstrating exceptional hemodynamic performance and safety. Following the 105-day support period, the patient underwent a successful transplant. FDA approval to expand trials to 15 additional patients underscores BiVACOR’s potential to redefine advanced heart failure management.

Read Also: Syphilis Immunoassay Diagnostics Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344