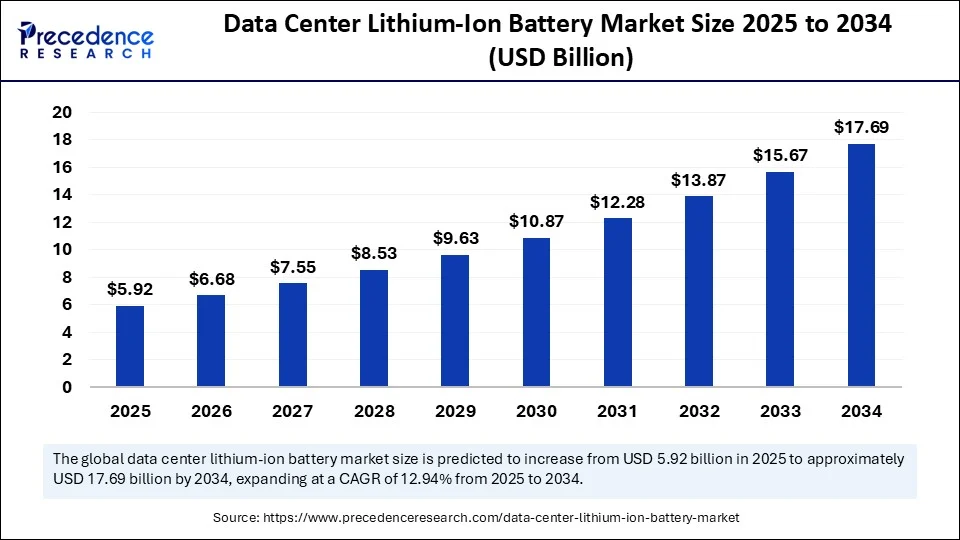

The global data center lithium-ion battery market is on a dynamic growth trajectory, projected to surge from USD 5.92 billion in 2025 to approximately USD 17.69 billion by 2034, representing a robust compound annual growth rate (CAGR) of 12.94%. This rapid expansion is driven by the escalating demand for reliable and energy-efficient backup power solutions amid the booming cloud computing sector, expanding data traffic, and increasing emphasis on sustainable energy infrastructure.

What fuels this impressive growth? The answer lies in the unique advantages of lithium-ion batteries, including their longer lifespan, faster charging capabilities, smaller footprint, and superior thermal performance compared to traditional valve-regulated lead-acid (VRLA) batteries. These factors are critical in data centers where uninterrupted power supply (UPS) and energy storage systems (ESS) are essential for maintaining uptime and operational efficiency.

Data Center Lithium-Ion Battery Market Quick Insights

-

The data center lithium-ion battery market stood at USD 5.24 billion in 2024 and is forecasted to reach USD 17.69 billion by 2034.

-

The market enjoys a CAGR of 12.94% from 2025 to 2034.

-

North America dominates the market share due to its large hyperscale data center presence and strict energy regulations.

-

Asia Pacific is the fastest-growing region, propelled by rapid digitalization and growing IT infrastructure investment.

-

Leading companies spearheading innovation include Schneider Electric, ABB, Eaton, Mitsubishi Electric Power Products Inc, and Narada.

Revenue Overview:

| Year | Market Size (USD Billion) |

|---|---|

| 2024 | 5.24 |

| 2025 | 5.92 |

| 2034 | 17.69 |

Role of Artificial Intelligence (AI) in the Market

Artificial Intelligence is revolutionizing the data center lithium-ion battery landscape by enhancing Battery Management Systems (BMS). AI algorithms continuously monitor battery health by analyzing parameters such as voltage, current, temperature, and state of charge. These insights enable predictive maintenance, reduce downtime, and prevent safety risks like thermal runaway. AI’s ability to optimize battery usage dynamically also helps data centers manage energy consumption more efficiently by adapting to real-time grid conditions and renewable energy availability, ultimately lowering operational costs.

Market Growth Factors

The surge in rack density within data centers, driven by advancements in server technology requiring compact and powerful backup solutions, strongly motivates the adoption of lithium-ion batteries. Their instant recharge capability, longer cycle life, and better heat tolerance complement the need for high availability and sustainability. Furthermore, regulatory pressure for energy efficiency and carbon footprint reduction encourages migration from lead-acid to lithium-ion technology.

Read Also: AMHS for Semiconductor Market

What Latest Opportunities and Trends Are Shaping the Data Center Lithium-Ion Battery Market?

How are cutting-edge developments and sustainability priorities influencing this market?

The industry is witnessing a trend towards integrating AI-powered BMS to optimize battery performance and lifecycle. Hyperscale data centers, colocation facilities, enterprise data centers, and edge and micro data centers are increasingly implementing lithium-ion batteries tailored for their unique operational demands. Additionally, energy storage applications within data centers are evolving to support renewable energy integration, load balancing, and peak shaving – further extending the utility of lithium-ion systems.

Regional Landscape

North America leads the market owing to widespread cloud adoption, extensive hyperscale data center networks, and rigorous energy regulations promoting sustainable power solutions.

Asia Pacific’s market growth outpaces others, fueled by accelerating digital transformation and infrastructure investment in countries like China, India, and Southeast Asia.

Segmental Insights

By Battery Chemistry:

-

Lithium Iron Phosphate (LFP): Dominated the market in 2024 due to safety, thermal stability, cost-effectiveness, and longer cycle life. Widely supported by government policies promoting green data centers.

-

Lithium Nickel Manganese Cobalt (NMC): Expected to grow at the fastest CAGR (2025-2034), driven by high energy density, scalability, and cost-effectiveness, often used in electric vehicles and high-performance applications.

By Data Center Type:

-

Hyperscale Data Centers: Held the largest market share in 2024, requiring zero downtime and reliable energy. Adoption of green energy with lithium-ion batteries supports this segment’s dominance.

-

Edge/Micro Data Centers: Expected to grow the fastest, fueled by IoT, 5G, and AI/ML technologies needing low latency, real-time processing, and high security.

By Application:

-

Uninterruptible Power Supply (UPS): Led the market in 2024, driving the shift from traditional lead-acid to Li-ion batteries due to longer lifespan, higher energy density, and faster recharge.

-

Energy Storage Systems (ESS): Forecasted to grow at the highest CAGR, supporting renewable energy integration and reliable power backup.

By Component:

-

Battery Racks/Modules: Dominated the market in 2024 because of their durability, scalability, and protective role for batteries.

-

Battery Management Systems (BMS): Expected to witness the fastest growth. BMS are crucial for monitoring battery health, preventing overheating, and enabling smart grid integration to reduce costs and extend battery life.

By End User:

-

Cloud Service Providers: Dominated in 2024, driven by cloud service adoption, big data, and IoT that require reliable, uninterrupted power.

-

Telecom Operators: Projected to see the fastest growth, supported by 5G expansion, higher mobile and internet usage, especially in rural areas, and government incentives for green energy adoption.

Key Components and Applications

The lithium-ion battery ecosystem includes battery racks/modules, Battery Management Systems (BMS), inverters/converters, and cooling systems—all essential for optimizing performance and reliability. These batteries mainly support Uninterruptible Power Supply (UPS) systems but are gaining traction in Energy Storage Systems (ESS), load management, frequency regulation, and power conditioning applications.

Data Center Lithium-Ion Battery Market Companies

- Vertiv Group Corp.

- Eaton Corporation

- Schneider Electric SE

- Legrand SA

- Delta Electronics Inc.

- Huawei Technologies Co., Ltd.

- Samsung SDI Co., Ltd.

- LG Energy Solution

- Contemporary Amperex Technology Co. Ltd. (CATL)

- BYD Company Limited

- Toshiba Corporation

- Tesla, Inc.

- Panasonic Holdings Corporation

- Narada Power Source Co., Ltd.

- Lithium Energy Storage

- Saft Groupe S.A. (TotalEnergies)

- ZincFive Inc.

- Exide Technologies

- Hitachi Energy Ltd.

- Riello UPS (RPS S.p.A.)

Challenges and Cost Pressures

Despite their advantages, lithium-ion batteries pose safety concerns, primarily due to risks of heat buildup and potential fire hazards. Environmental issues associated with lithium mining and battery disposal add to sustainability challenges. Additionally, the upfront cost of lithium-ion systems remains higher than traditional lead-acid batteries, presenting barriers for smaller data centers.

Case Study: Leading Data Center’s Transition to Lithium-Ion Technology

A major cloud service provider recently replaced its lead-acid battery backup systems with lithium-ion batteries across multiple data centers, resulting in a 30% reduction in operational costs and improved battery life by over 50%. This transition facilitated enhanced energy efficiency and aligned with the company’s sustainability goals by reducing carbon emissions.

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344