Projected 5.53% CAGR Backed by Rising GI Disorders, Home-Based Technology, and North American Leadership; Asia Pacific Emerges as Fastest Climber

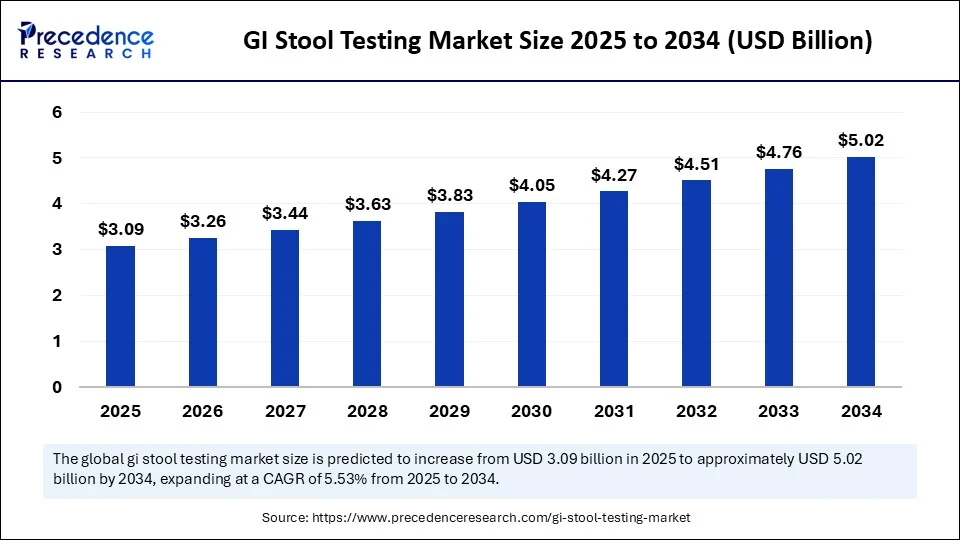

The global GI stool testing market was valued at $2.93 billion in 2024 and is poised to soar to $5.02 billion by 2034, registering a robust CAGR of 5.53% from 2025 to 2034. Drivers like the increasing prevalence of gastrointestinal disorders, public health initiatives, growing preference for non-invasive at-home tests—including AI-powered and advanced immunoassay assays—are steering this impressive market growth.

GI Stool Testing Market Quick Insights

-

The GI stool testing market will hit $5.02 billion by 2034, up from $3.09 billion in 2025.

-

North America is the dominant region, driven by advanced healthcare infrastructure and high early-detection rates.

-

Asia Pacific, especially nations like India, is the fastest-growing region due to rising digestive disorders and widening healthcare access.

-

The U.S. GI stool testing market alone is projected to be worth nearly $1.5 billion by 2034.

-

The colorectal cancer screening segment leads the applications, boosted by national screening initiatives.

-

Immunoassay technology currently dominates, while next-generation sequencing is the fastest-growing segment.

-

Top at-home RNA-based stool tests are reshaping early diagnosis, including FDA-approved innovations.

How Is AI Reimagining GI Stool Testing?

Artificial intelligence (AI) is revolutionizing GI stool testing by delivering highly accurate, accessible, and personalized non-invasive diagnostics. AI algorithms are now able to analyze large datasets of test results and generate personalized health recommendations and early alerts, making GI diagnostics more proactive and data-driven.

A noteworthy example includes Singaporean researchers launching “Poolice”—an app powered by deep learning and GANs—that detects blood in stool from smartphone images with 94% accuracy, marking a leap in early detection. U.S.-based Viome has deployed more than 500,000 at-home AI-enhanced stool testing kits analyzing RNA and metatranscriptomes, setting new standards in at-home diagnostic precision.

Market Growth Factors: What’s Driving Uptake?

Demand is being propelled by:

-

Increasing rates of GI-related illnesses (IBS, IBD, colorectal cancer, infections).

-

Higher awareness among both patients and clinicians about the pivotal role of gut health.

-

Improved public health initiatives and insurance reimbursement.

-

Surge in reliable, easy-to-use at-home testing kits.

-

Major R&D and technological breakthroughs in molecular and RNA-based diagnostics.

-

Expansion of hospital-based and laboratory-based standardized diagnostic infrastructure.

GI Stool Testing Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.02 Billion |

| Market Size in 2025 | USD 3.09 Billion |

| Market Size in 2024 | USD 2.93 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test Type, Technology, Sample Collection Method, Application, Sample Collection Method, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Opportunity & Trend: Could At-Home RNA-Based Tests Shape the Next Era?

-

Is remote, RNA-based testing the new frontier? With the U.S. FDA’s May 2024 approval of Geneoscopy’s ColoSense multitarget stool RNA test for home use, the industry is entering a phase dominated by patient-centered, remote diagnostics with heightened sensitivity and convenience.

-

Will microbiome testing reshape health management? As the gut health trend continues, the booming microbiome profiling segment is merging with consumer wellness and chronic disease prevention.

-

Can digital apps democratize early GI screening globally? With smartphone-enabled diagnostic apps and mail-in sample kits, access is broadening—even in rural and emerging markets.

Expert View: A Voice from Precedence Research

“The GI stool testing market is evolving rapidly—thanks to the fusion of advanced AI, molecular technologies, and consumer-friendly testing models. In the next decade, we’ll see GI health move to the center stage of preventive medicine, with unprecedented growth in both clinical and consumer sectors.”

— Dr. Priya K. Sharma, Principal Consultant, Precedence Research

GI Stool Testing Market Regional Analysis

North America: Market Dominance through Innovation and Infrastructure

-

Size and Leadership: North America maintained the largest market share in 2024, primarily due to its advanced diagnostic infrastructure, strong public health awareness, and increasing GI disease rates. The U.S. alone reported 141,902 new colorectal cancer cases in 2021 and 147,931 in 2022, underscoring the urgency around screening and early detection.

-

Growth Drivers: Federal screening initiatives (especially for colorectal cancer and infectious/inflammatory GI diseases), widespread insurance reimbursement, and rapid adoption of non-invasive and molecular diagnostics are key. Strong research partnerships between diagnostic firms and academic institutions continue to accelerate product innovation, while at-home and molecular diagnostic options see robust growth amid supportive healthcare policies.

Asia Pacific: Fastest-Growing, Led by India

-

Growth Factors: Asia Pacific is experiencing the briskest growth rate, attributed to rising cases of digestive disorders, broader access to healthcare, and greater awareness of preventive screening. Urbanization and shifting diets are contributing to higher incidence rates.

-

India’s Role: India stands out for its high GI disease burden, expanding public and private diagnostic infrastructure, greater preventive care adoption, and proliferation of affordable at-home testing modules. National health programs emphasizing early detection and innovative collection strategies are fueling market expansion and accessibility.

-

Technology Adoption: Surge in “point-of-care” and molecular diagnostics alongside enterprising at-home sample programs is transforming both urban and rural care.

Europe: Structured and Steady

-

Market Characteristics: Europe benefits from established, protocol-driven colorectal cancer screening—supported by both government and private healthcare sectors. Expansion in advanced molecular diagnostics is boosting precision and early detection. Consistent policies around organized screening and new technology integration are key to growth.

Latin America & Middle East/Africa: Room to Grow

-

Trends: These regions are experiencing gradual growth as healthcare delivery and screening awareness improve. As broader public health initiatives and infrastructure investments take root, adoption of preventive diagnostics is expected to accelerate.

GI Stool Testing Market Segmentation Analysis

By Test Type

-

Occult Blood Tests (FOBT, FIT): These remain the market’s foundational workhorse. Immunochemical-based FOBT/FIT tests led in 2024 thanks to accuracy, non-invasive sample handling, public screening integration, and a lack of prescreening dietary restrictions. They are central to organized colorectal cancer screening in many regions.

-

Microbiome Testing: On a rapid growth path—this segment is expanding as interest in gut health and chronic disease prevention grows. Innovations in sequencing, nutrition, and personalized medicine are propelling this segment forward.

By Technology

-

Immunoassay: Dominates for its cost-effectiveness, user-friendliness, and high-throughput compatibility—especially for large-scale, hospital-based screenings like fecal immunochemical tests. Labs and clinics rely on immunoassays as their primary diagnostic tool.

-

Next-Generation Sequencing (NGS): Set for the highest growth due to its precision, ability to profile gut microbes in detail, and increasing adoption in both clinical and research contexts—especially for complex microbiome analyses and personalized health applications.

By Application

-

Colorectal Cancer Screening: Remains the top revenue contributor, as heightened awareness, increasing disease prevalence, and inclusion in public health mandates drive demand for non-invasive diagnostics. FIT-based tests are crucial tools within these initiatives.

-

Microbiome & Infection Detection: Gains in these applications stem from rising consumer focus on digestive and immune health, as well as the need for rapid detection of infectious agents—especially in regions prone to outbreaks.

By Sample Collection Method

-

Hospital/Lab-Based: Remains the most trusted collection method in 2024 due to its controlled environment, professional handling, and standardized protocols—crucial for cancer screening and infectious disease diagnostics.

-

At-Home Kits: This segment is expanding quickly, driven by patient demand for privacy, convenience, and proactive health tracking. Home kits are democratizing diagnostics by reaching underserved and rural populations and prompting more frequent monitoring.

By End User

-

Hospitals & Clinics: Continue to lead as primary users, backed by their infrastructure, integration with screening programs, and central role in follow-up procedures (like colonoscopy) after initial screening.

-

Homecare/Individual Users: Experiencing the highest CAGR, as direct-to-consumer kits and digital health platforms lower barriers to regular GI health monitoring. Consumers now have greater control over their testing outside clinical settings, supported by easy-to-use sample kits and telehealth integrations.

Latest Breakthroughs & Key Companies

- Exact Sciences Corporation

- BioFire Diagnostics (bioMérieux)

- QuidelOrtho Corporation

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Becton, Dickinson and Company

- Roche Diagnostics

- Hologic, Inc.

- CerTest Biotec

- Alere Inc. (now part of Abbott)

- Genova Diagnostics

- Diagnostic Solutions Laboratory

- Promega Corporation

- Biomerica, Inc.

- Gastrointestinal Diagnostic Laboratory (GDX)

- Biomerieux SA

- Siemens Healthineers

- MyBioma

- DayTwo

- Seegene Inc.

Innovations:

-

FDA approved Geneoscopy’s ColoSense (May 2024): First multitarget stool RNA test for at-home colorectal screening, 94.4% sensitivity.

-

Viome distributed over 500,000 AI-powered RNA-based test kits for gut health management.

Pressure Points: Market Challenges

-

Patient reluctance and social stigma around stool sample collection limit wider adoption despite the ease and value of non-invasive screening.

-

Cost and complexity of next-generation molecular tests remain a barrier, especially in emerging markets.

-

Need for outreach and education to de-stigmatize testing and improve early-detection rates.

Case Study: Police AI App in Singapore

A Singaporean research team pioneered the “Poolice” app, a deep-learning solution that identifies GI blood from smartphone stool images enabling early detection even before symptoms appear, especially useful in remote and tech-savvy populations.