Laser Welding Machine Market Key Insights

- Asia Pacific emerged as the leading region in 2024 and is projected to maintain its dominant position throughout the forecast period.

-

Based on laser type, the fiber laser segment held the largest share in 2024 and is expected to expand steadily over the coming years.

-

In terms of operation mode, the automatic segment accounted for the highest market share in 2024.

-

Among technologies, keyhole welding led the market in 2024, while hybrid welding is anticipated to record substantial growth through 2034.

-

By application, seam welding was the leading segment in 2024, with hybrid welding applications projected to grow rapidly over the forecast period.

-

The automotive industry was the largest end-use segment in 2024, whereas the electronics & semiconductor industry is expected to register the fastest CAGR between 2025 and 2034.

-

In terms of power output, the 1 kW to 5 kW category held the major share in 2024, while the above 5 kW segment is forecasted to grow at the highest pace.

-

Based on machine type, robotic laser welding machines dominated the market in 2024, and the handheld laser welding segment is set to expand significantly in the coming years.

-

Regarding sales channels, the direct sales (OEM) segment led the market in 2024, while online platforms are expected to witness notable growth during the forecast period.

Market Overview

Laser welding machines use high-powered laser beams to join metal or thermoplastics with exceptional precision, speed, and minimal thermal distortion. These machines are essential in industries requiring intricate welding processes, such as automotive bodywork, medical devices, aerospace components, and microelectronics.

The market encompasses various machine types such as fiber laser, CO₂ laser, and solid-state laser welding systems. The shift toward Industry 4.0 and increasing adoption of high-precision, non-contact, and energy-efficient welding technologies are key global trends propelling market growth.

Laser Welding Machine Market Scope

| Report Coverage | Details |

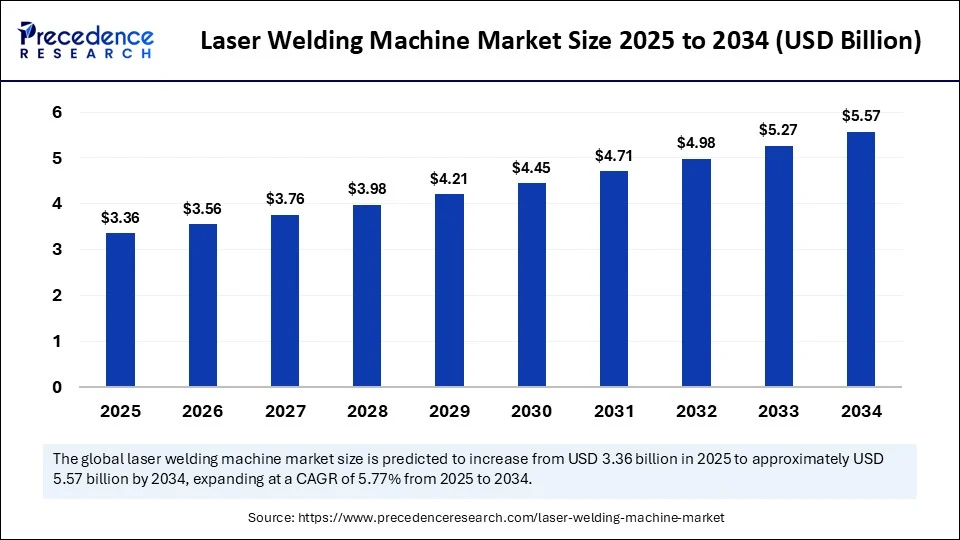

| Market Size by 2034 | USD 5.57 Billion |

| Market Size in 2025 | USD 3.36 Billion |

| Market Size in 2024 | USD 3.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.77% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Laser Type, Operation Mode, Technology, Application, End-Use Industry, Power Output, Machine Type, Sales Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Laser Welding Machine Market Dynamics

Drivers

-

Industrial Automation: The surge in automated manufacturing processes, especially in automotive and electronics sectors, has significantly increased demand for laser welding machines.

-

Rising Demand for Miniaturized Components: Growing use of compact, lightweight components in electronics and medical devices enhances the need for high-precision welding.

-

Energy Efficiency and Clean Processing: Laser welding offers minimal heat generation and clean seams, aligning with environmental and operational efficiency goals.

Restraints

-

High Capital Investment: The cost of purchasing and maintaining advanced laser welding systems remains a significant barrier for small and medium enterprises (SMEs).

-

Skill Gap: Operation and maintenance require skilled technicians, which can slow adoption in developing regions.

Opportunities

-

Integration with AI and IoT: Smart welding systems integrated with AI and IoT for real-time monitoring and predictive maintenance are gaining traction.

-

Expanding Aerospace and Medical Manufacturing: These industries demand ultra-precise welding, offering lucrative opportunities for market players.

Impact of Artificial Intelligence (AI) in Laser Welding Machine Market

AI is playing a transformative role in the laser welding machine market. Machine learning algorithms enable real-time quality monitoring, adaptive welding controls, and predictive maintenance, reducing downtime and improving productivity. AI-integrated systems can optimize welding parameters dynamically, leading to consistent output and reduced material wastage. Additionally, computer vision and deep learning technologies assist in defect detection and automated quality control.

Laser Welding Machine Market Segment Analysis

By Product/Technology Type

-

Fiber Laser Welding Machines (Dominant due to energy efficiency and compact size)

-

CO₂ Laser Welding Machines

-

Solid-State Laser Welding Machines

By Application

-

Automotive Parts

-

Medical Devices

-

Aerospace Components

-

Electronics & Semiconductors

-

Jewelry & Artisanal Products

By Industry Vertical

-

Automotive (Largest market share)

-

Electronics

-

Healthcare

-

Aerospace & Defense

-

Heavy Machinery

By Machine Type/Power/Capacity

-

Handheld Laser Welding Machines

-

Stationary/Fixed Systems

-

High-Power (>6 kW)

-

Medium-Power (1–6 kW)

-

Low-Power (<1 kW)

By Sales Channel

-

Direct Sales

-

Distributors/Dealers

-

Online Retail/Industrial Marketplaces

Regional Insights

Asia Pacific held the largest market share in 2024, led by China, Japan, South Korea, and India. The region benefits from robust automotive production, rapid electronics manufacturing expansion, and favorable government initiatives promoting smart factories.

Europe remains a strong market, especially in Germany and Italy, where precision engineering and advanced manufacturing are prevalent.

North America, particularly the United States, is anticipated to witness significant growth due to high adoption of AI-enabled manufacturing and demand from aerospace and defense sectors.

Recent Developments

-

April 2024: TRUMPF Group introduced its next-gen TruLaser Weld 5000 with integrated AI and vision systems, enhancing autonomous welding precision and productivity.

-

January 2024: IPG Photonics partnered with an electric vehicle manufacturer to supply high-speed laser welding systems for EV battery assemblies, underscoring the growing demand from e-mobility applications.

-

September 2023: Han’s Laser Technology launched a modular laser welding platform for medical device manufacturing, emphasizing the trend toward customizable and application-specific solutions.

Key Laser Welding Machine Market Players

-

TRUMPF Group

-

IPG Photonics Corporation

-

Coherent, Inc.

-

Han’s Laser Technology Industry Group Co., Ltd.

-

AMADA Co., Ltd.

-

Emerson Electric Co.

-

Mitsubishi Electric Corporation

-

Jenoptik AG

-

LaserStar Technologies Corporation

-

SPI Lasers (Trumpf Subsidiary)

The laser welding machine market is set to experience steady growth over the next decade, fueled by automation, AI adoption, and increasing precision manufacturing demands. Innovation in laser technology, coupled with regional industrial expansion, particularly in Asia Pacific and North America, will continue to shape the competitive landscape and create new growth avenues for market participants.

Read Also: Category Management Software Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344