Category Management Software Market Key Highlights

- North America led the global market in 2024, accounting for 41% of the total revenue share.

-

The Asia Pacific region is projected to witness robust growth with the fastest CAGR through 2034.

-

Based on deployment, the cloud-based segment dominated the market with a 63% share in 2024.

-

By component, the software segment held the largest share at 71% in 2024, while the services segment is forecasted to grow at a notable CAGR during the forecast period.

-

In terms of organization size, large enterprises accounted for 68% of the market in 2024, while the SMEs segment is expected to record the highest growth rate through 2034.

-

Among applications, product assortment optimization emerged as the top segment with a 27% share in 2024, whereas supplier collaboration and negotiation is set to expand at a promising CAGR going forward.

-

By end-user, the retail sector held the largest share at 36% in 2024, while the e-commerce and online marketplaces segment is projected to grow at the fastest pace from 2025 to 2034.

Category Management Software Market Overview

Category management software enables businesses—especially in the retail and consumer goods sectors—to manage product categories as strategic business units. These platforms support a wide array of functionalities including supplier collaboration, assortment planning, pricing strategies, and performance analytics, helping businesses streamline operations and enhance profitability in an increasingly complex retail landscape.

Category Management Software Market Growth Drivers

-

Increasing Use of Predictive Analytics: Retailers are leveraging forecasting models to anticipate trends and optimize decisions across product categories.

-

AI-Powered Personalization: Integration of AI is allowing businesses to offer more personalized shopping experiences, boosting customer satisfaction and loyalty.

-

Mobile-First Adoption: The rise in mobile-based retail interfaces is driving demand for cloud-native category planning solutions.

-

Supply Chain Resilience: Frequent disruptions are encouraging companies to invest in software that enhances sourcing flexibility and improves inventory management.

Market Scope

| Report Coverage | Details |

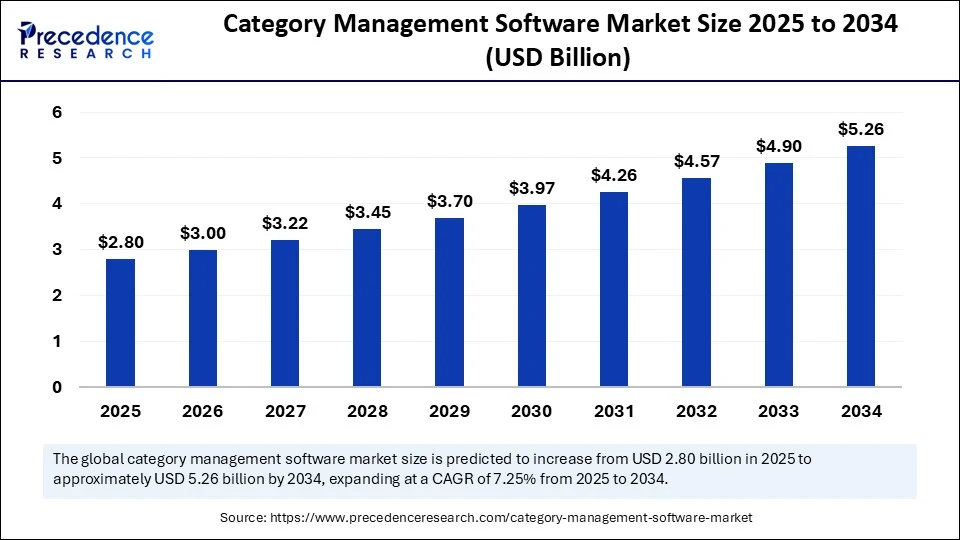

| Market Size by 2034 | USD 5.26 Billion |

| Market Size in 2025 | USD 2.80 Billion |

| Market Size in 2024 | USD 2.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.25% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Mode, Component, Organization Size, Application Area / Functionality, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Category Management Software Market Dynamics

Drivers

How is Real-Time Analytics Boosting Market Growth?

Retailers are increasingly adopting tools that offer rapid insights into inventory, pricing, and consumer trends. AI-driven analytics embedded in category management platforms support better decision-making and operational agility.

Restraint

Challenges of Data Silos and Operational Fragmentation

Fragmented retail ecosystems and lack of unified data systems are impeding seamless integration and real-time category planning, slowing overall market adoption.

Opportunity

What Role Does E-Commerce Expansion Play?

The rising integration of online and offline retail has increased the complexity of category management, creating opportunities for software providers to offer unified solutions that streamline cross-channel strategies.

Regional Insights

North America

North America dominated the market in 2024 due to mature retail infrastructure, high adoption of AI technologies, and leading vendors such as Oracle, SAP, and Blue Yonder. U.S.-based retailers are significantly investing in platforms that support predictive analytics and omnichannel planning.

-

U.S. Market Size (2024): USD 749.07 Million

-

Projected (2034): USD 1,535.24 Million

-

U.S. CAGR (2025–2034): 7.44%

Asia Pacific

This region is projected to grow at the fastest pace owing to rapid digitalization, rising disposable income, and growing e-commerce activity. Vendors like Zoho and Salsify are expanding their offerings tailored for local needs and cloud-first environments.

Category Management Software Market Segmental Insights

Deployment Mode Insights

Why Are Cloud-Based Solutions Leading?

Cloud-based platforms accounted for a 63% share in 2024 due to their affordability, flexibility, and ability to integrate real-time analytics. Vendors such as SAP, Salesforce, and Oracle continue to expand cloud-native offerings that reduce deployment times and enhance system scalability.

Component Analysis

Why Did Software Dominate in 2024?

The software segment represented 71% of the market, driven by the adoption of AI-enabled platforms for pricing, assortment, and supplier management. Gartner reports highlight a growing shift toward modular, composable software systems across the retail ecosystem.

Service Segment Outlook

Expected to grow rapidly due to increasing demand for third-party configuration, compliance updates, and ongoing system maintenance. Companies like TCS, Infosys, and Capgemini are boosting their service capabilities in this domain.

Organization Size Insights

Why Do Large Enterprises Dominate?

In 2024, large enterprises held a 68% share due to their need for robust, enterprise-grade platforms that manage complex product portfolios and supply chains. Strategic partnerships with cloud vendors like AWS and Google Cloud have further supported this segment.

SMEs on the Rise

SMEs are expected to grow at the fastest rate, driven by the availability of modular, affordable SaaS platforms. Players such as Zoho and Salsify offer tailored solutions that enable smaller retailers to compete with enterprise-scale players.

Application Insights

Why Product Assortment Optimization Leads

This segment captured 27% of the market in 2024, owing to the growing need for SKU rationalization and demand forecasting. AI-driven tools help analyze customer behavior and optimize shelf space allocation.

Supplier Collaboration to Witness Rapid Growth

Expected to grow significantly as companies seek more agile vendor negotiations, rebate management, and performance tracking. Vendors like GEP, Coupa, and Ivalua are introducing next-gen features to support this trend.

End-User Insights

Retail Sector Leads the Way

Retail—especially grocery and department stores—held 36% of the market share in 2024. The complexity of managing thousands of SKUs and supply chain uncertainties has driven adoption of category management software among major players like Kroger, Tesco, and Albertsons.

E-Commerce Shows Fastest Growth

As digital commerce expands, e-commerce players are increasingly turning to category management tools to standardize product information and optimize pricing across online marketplaces.

Impact of AI in Category Management Software

AI is reshaping the industry by enabling real-time analytics, automating recommendations, and driving predictive planning. With AI, businesses can personalize promotions, monitor supplier performance, and fine-tune assortments based on localized demand—ultimately enhancing customer experience and profitability.

Category Management Software Market Recent Developments

-

May 2025: Coupa acquired Cirtuo, enhancing its AI-powered category management capabilities.

-

June 2024: Danone launched a digital platform offering category tools and planograms for convenience retailers.

-

Feb 2025: RELEX Solutions introduced RELEX Space, a new platform for space planning and category reviews aimed at enhancing shelf-level execution using data-driven insights.

Leading Category Management Software Market Players

-

Oracle Corporation

-

SAP SE

-

Blue Yonder (JDA Software)

-

IBM Corporation

-

GEP

-

Coupa Software

-

PROS Holdings

-

Infor Inc.

-

RELEX Solutions

-

Periscope by McKinsey

-

Vistex Inc.

-

Ivalua

-

dotActiv

-

Retail Insight

-

Clear Demand

-

Wiser Solutions

-

Salsify

-

Zoho

-

RangeMe

-

4R Systems

-

Hubert Company (a Bunzl Company)

Segmentation Overview

By Deployment Mode

-

Cloud-Based

-

On-Premise

-

Hybrid

By Component

-

Software

-

Services (Consulting, Integration, Maintenance)

By Organization Size

-

Large Enterprises

-

SMEs

By Application Area

-

Product Assortment Optimization

-

Supplier Collaboration & Negotiation

-

Space Planning & Planogramming

-

Pricing & Promotion Management

-

Inventory & Replenishment Optimization

-

Category Performance Analytics

By End-User

-

Retail

-

E-Commerce

-

CPG

-

Grocery & Supermarkets

-

Apparel, Electronics, Healthcare, Automotive, Logistics

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

Read Also: Aircraft Leasing Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344