Aircraft Leasing Market Key Highlights

- North America led the market in 2024, holding the largest regional share of 41%.

-

The Asia Pacific region is anticipated to experience the fastest growth rate throughout the forecast period.

-

Based on lease type, the dry lease segment held the dominant share of the market in 2024, while the wet lease segment is forecasted to register notable growth through 2034.

-

By aircraft type, narrow-body aircraft accounted for the largest share in 2024, whereas the wide-body aircraft segment is expected to grow at a robust pace over the coming years.

-

When categorized by lease term, long-term leases were the leading segment in 2024, with short-term leases projected to grow at the highest CAGR during the forecast period.

-

On the basis of lessee type, commercial airlines emerged as the primary users in 2024, while the cargo operators segment is set to expand at the fastest rate from 2025 to 2034.

Market Overview

Aircraft leasing allows airlines to use aircraft without owning them outright, helping carriers manage capacity and capital more efficiently. Leasing companies (lessors) purchase aircraft and lease them to airlines (lessees) under two primary models: dry leasing (aircraft only) and wet leasing (aircraft, crew, maintenance, and insurance). As airlines recover from pandemic-induced losses and fuel prices continue to fluctuate, operational flexibility and capital-light models are driving the leasing sector. An increasing preference for new-generation aircraft with lower emissions is also reshaping lease portfolios.

What Are the Key Market Figures and Highlights?

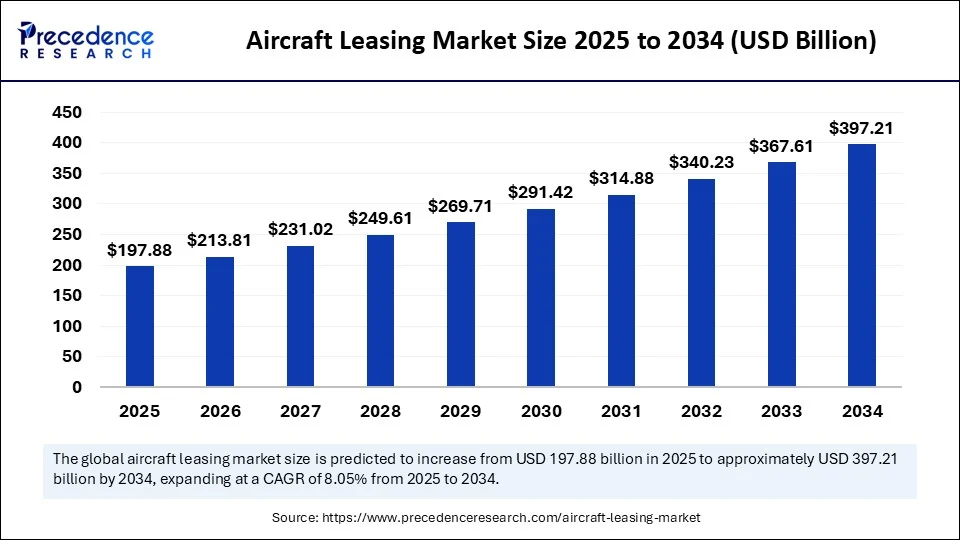

In 2024, the aircraft leasing market reached USD 183.13 billion, with projections indicating it will climb to USD 397.21 billion by 2034. The CAGR of 8.05% reflects strong and steady expansion. North America dominated the global market in 2024 with a 41% share, supported by the presence of major lessors and advanced aviation infrastructure. However, Asia Pacific is projected to grow at the fastest rate due to rising air travel demand and expanding low-cost carrier (LCC) networks. Among leasing types, dry leasing holds the dominant share due to its long-term cost efficiency and preference among commercial airlines.

What Are the Major Challenges Facing the Market?

The aircraft leasing sector is not without challenges. Geopolitical risks—such as sanctions or cross-border leasing restrictions—can complicate international transactions. Interest rate fluctuations influence the cost of financing for lessors, affecting lease rates and profitability. Additionally, residual value uncertainty of aircraft post-lease introduces financial risk for lessors. The industry also faces regulatory complexities in different jurisdictions, particularly concerning repossession rights, tax implications, and lease compliance.

Where Do the Key Opportunities Lie?

Significant opportunities exist within the aircraft leasing market. The adoption of AI and data analytics offers opportunities for predictive maintenance, lease optimization, and risk assessment. Emerging markets in Africa, Southeast Asia, and Latin America are also key growth zones due to expanding airline networks and infrastructure investment. Moreover, sustainability-linked financing, such as green leasing tied to environmental KPIs, is becoming a preferred route for investors and lessors aiming to align with global ESG goals.

How Is AI Revolutionizing Aircraft Leasing?

Artificial Intelligence (AI) is transforming the aircraft leasing sector by introducing predictive and data-driven decision-making tools. AI applications in the industry include predictive maintenance, which reduces aircraft downtime and increases leasing efficiency, and automated lease management systems that streamline contract compliance and fleet optimization. AI also helps in risk modeling for lessee profiling and lease pricing, thus enhancing return on investment (ROI) for lessors while minimizing risk exposure.

What Are the Regional Market Insights?

In 2024, North America led the market with a 41% share, largely due to its mature aviation ecosystem and concentration of leading lessors. The region is also focused on modernizing fleets with fuel-efficient aircraft, aligning with ESG goals. Asia Pacific, however, is expected to witness the highest growth rate, fueled by a rapidly growing middle class, the rise of low-cost carriers, and significant infrastructure development. Countries like China, India, and Indonesia are expanding their airline operations rapidly. Meanwhile, Europe remains a mature market but is increasingly adopting sustainable aviation solutions under EU mandates.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 397.21 Billion |

| Market Size in 2025 | USD 197.88 Billion |

| Market Size in 2024 | USD 183.13 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.05% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Lease Type, Aircraft Type, Lease Term, Lessee Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

How Is the Market Segmented?

-

By Type: Dry leasing dominates the segment due to its long-term cost advantages, while wet leasing is popular for seasonal or emergency fleet needs.

-

By Lease Term: The long-term leasing segment holds the largest share, offering more stable revenue streams and operational consistency.

-

By Application: Commercial aviation is the primary application area, but cargo aviation is gaining traction, especially with rising global e-commerce demand.

-

By End-User: Low-cost carriers (LCCs) and full-service airlines are the major end-users, with LCCs increasingly relying on leasing for fast market entry and expansion.

Recent Key Developments

From 2024 to early 2025, the aircraft leasing market saw several major developments. Avolon entered a lease deal with Thai Airways for 10 Airbus A350s. Air Lease Corporation increased its order for next-generation aircraft to enhance its sustainable fleet. BBAM adopted AI-powered systems for lifecycle asset management. Dubai Aerospace Enterprise (DAE) invested $750 million in new aircraft, while SMBC Aviation Capital merged with Goshawk Aviation to expand its global reach and asset base.

Major Players in This Market

-

AerCap Holdings N.V. – The world’s largest lessor with a broad global portfolio.

-

Air Lease Corporation – Focused on long-term leases of fuel-efficient aircraft.

-

SMBC Aviation Capital – Strong presence in Asia, investing in green finance.

-

Avolon – Aggressively expanding into emerging markets and sustainable aviation.

-

BOC Aviation – Backed by Bank of China, serving Asia-Pacific and beyond.

-

BBAM – Leveraging AI and tech for efficient fleet operations.

-

Dubai Aerospace Enterprise (DAE) – Expanding global footprint and fleet.

-

Nordic Aviation Capital (NAC) – Specializes in regional and turboprop aircraft.

-

ICBC Leasing – Key Chinese player growing its global presence.

What Does the Future Hold for the Aircraft Leasing Market?

The future of the aircraft leasing market looks dynamic and technology-driven. As airlines increasingly seek asset-light operating models, leasing will become even more critical for fleet expansion and modernization. The adoption of AI, digital twins, and blockchain for contract management and maintenance will optimize leasing cycles. In addition, the shift toward net-zero emissions, green aircraft, and sustainable finance instruments will reshape leasing portfolios. Investors and lessors who prioritize data, innovation, and ESG alignment are likely to lead the next decade of growth.

Who Are the Major Players in This Market?

-

AerCap Holdings N.V. – The world’s largest lessor with a broad global portfolio.

-

Air Lease Corporation – Focused on long-term leases of fuel-efficient aircraft.

-

SMBC Aviation Capital – Strong presence in Asia, investing in green finance.

-

Avolon – Aggressively expanding into emerging markets and sustainable aviation.

-

BOC Aviation – Backed by Bank of China, serving Asia-Pacific and beyond.

-

BBAM – Leveraging AI and tech for efficient fleet operations.

-

Dubai Aerospace Enterprise (DAE) – Expanding global footprint and fleet.

-

Nordic Aviation Capital (NAC) – Specializes in regional and turboprop aircraft.

-

ICBC Leasing – Key Chinese player growing its global presence.

What Does the Future Hold for the Aircraft Leasing Market?

The future of the aircraft leasing market looks dynamic and technology-driven. As airlines increasingly seek asset-light operating models, leasing will become even more critical for fleet expansion and modernization. The adoption of AI, digital twins, and blockchain for contract management and maintenance will optimize leasing cycles. In addition, the shift toward net-zero emissions, green aircraft, and sustainable finance instruments will reshape leasing portfolios. Investors and lessors who prioritize data, innovation, and ESG alignment are likely to lead the next decade of growth.

Also Read: Decanter Centrifuge Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344