Wearable Inertial Sensors Market Key Takeaways

- North America led the market in 2024 with a dominant share of 40%, while the Asia Pacific region is anticipated to grow at a substantial rate over the forecast period.

-

By sensor type, accelerometers held the largest market share in 2024, whereas inertial measurement units (IMUs) are expected to record the highest CAGR through 2034.

-

In terms of axis configuration, the 3-axis sensors segment was the market leader in 2024, while 9-axis sensors (combining accelerometer, gyroscope, and magnetometer) are projected to grow significantly.

-

Based on connectivity, wireless sensors (such as Bluetooth, Wi-Fi, ANT+) captured the highest market share in 2024, whereas wired sensors (USB, serial interfaces) are expected to grow steadily over the forecast period.

-

By application, the sports and fitness tracking segment dominated the market in 2024, while the elderly monitoring and fall detection segment is poised for strong growth.

-

Regarding form factor, wearable bands and watches held the leading share in 2024, whereas sensor patches and clip-ons are projected to grow at a rapid CAGR.

-

In terms of end-use sector, consumer electronics accounted for the majority market share in 2024, while the industrial and occupational safety segment is anticipated to expand significantly through 2034.

How is AI Impacting the Wearable Inertial Sensors Market?

Artificial Intelligence (AI) is revolutionizing the wearable inertial sensors market by drastically improving data interpretation, error correction, and real-time feedback capabilities. Through the integration of AI algorithms, these sensors can process vast data streams, eliminate noise, provide predictive insights, and deliver personalized user experiences. Particularly in healthcare, AI-powered inertial sensors support early disease detection, real-time health monitoring, and custom treatment planning. These advancements have driven a surge in demand for smart, efficient, and accurate wearable technologies.

A notable development occurred in May 2025 when STMicroelectronics launched the LSM6DSV320X, an inertial measurement unit with built-in AI processing. This compact sensor enables precise activity tracking and high-impact measurements, improving overall user experience through event reconstruction capabilities.

What is the Size and Growth Forecast for the U.S. Wearable Inertial Sensors Market?

The U.S. wearable inertial sensors market was valued at USD 1.99 billion in 2024 and is projected to grow to USD 4.04 billion by 2034, expanding at a CAGR of 7.34% from 2025 to 2034. This growth is driven by innovations in healthcare, consumer electronics, and strong technological adoption in the country.

Why is North America the Leading Region in the Wearable Inertial Sensors Market?

North America led the global wearable inertial sensors market in 2024 due to its advanced technological infrastructure, high adoption of wearable technologies, and significant investments in research and innovation. The well-developed healthcare ecosystem, high penetration of smart consumer devices, and the presence of major players like Apple, Fitbit, and Garmin reinforce this dominance. The U.S. especially is a hub for innovation in AI, VR/AR, and IoT, all of which incorporate inertial sensor technologies.

What Trends Are Driving Growth in the Asia Pacific Wearable Inertial Sensors Market?

Asia Pacific is experiencing the fastest growth in the wearable inertial sensors market, thanks to rising disposable incomes, growing demand for consumer electronics, and expanding middle-class populations. Countries like China and India are propelling this growth through strong manufacturing sectors, government initiatives like “Make in China,” and increased adoption of health and fitness tech. The region’s embrace of automation, robotics, and Industry 4.0 further supports long-term market expansion.

What Are the Key Factors Fueling Market Growth in Europe?

Europe’s wearable inertial sensors market is growing steadily due to its strong R&D capabilities, expanding healthcare applications, and increasing awareness of personal health and fitness. Countries like Germany are leading the regional charge, leveraging their automotive and aerospace industries to integrate advanced sensors in various applications such as autonomous navigation and health monitoring systems.

What is the Current Overview of the Wearable Inertial Sensors Market?

The wearable inertial sensors market consists of compact motion-tracking components—like accelerometers, gyroscopes, and magnetometers—integrated into wearable devices. These sensors support applications in healthcare, sports, rehabilitation, industrial safety, and consumer electronics by enabling real-time movement, posture, and orientation tracking. The increased interest in health tracking and advanced sensor technologies, including AI and IoT integration, continues to drive market growth and innovation.

Wearable Inertial Sensors Market Scope

| Report Coverage | Details |

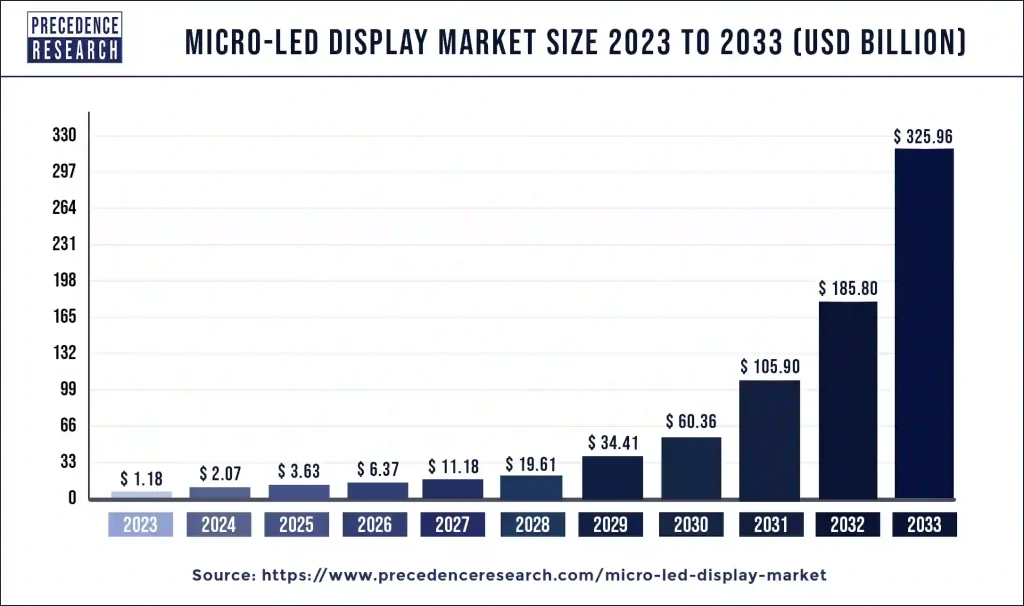

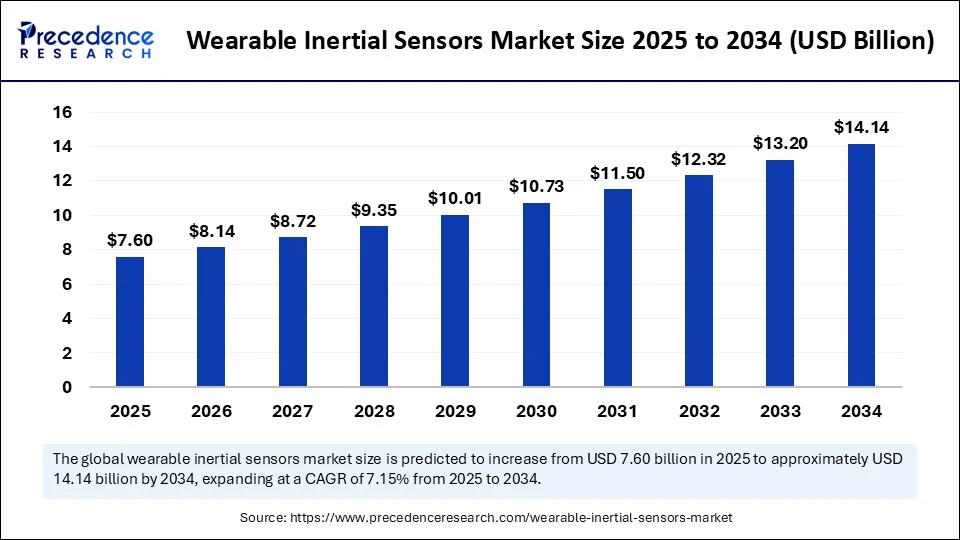

| Market Size by 2034 | USD 14.14 Billion |

| Market Size in 2025 | USD 7.60 Billion |

| Market Size in 2024 | USD 7.09 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.15% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Sensor Type, Axis Configuration, Connectivity, Application, Form Factor, End-Use Sector, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Wearable Inertial Sensors Market Dynamics

What Are the Main Factors Driving Market Growth?

Health Awareness: The growing focus on fitness and wellness has led to increased adoption of wearable devices.

Healthcare Sector Adoption: Wearable sensors are extensively used for remote patient monitoring and disease detection.

Industrial Applications: These sensors are gaining traction in sectors like consumer electronics and automotive for innovation.

Smartphone Integration: The seamless connection of smartphones with wearable devices enhances user convenience and market demand.

Agricultural Robots and Drones Market Size to Attain USD 24.26 Bn by 2034

What Challenges Are Limiting Market Growth?

Data Privacy and Security Concerns: As wearable sensors collect sensitive personal information, data breaches and privacy risks present significant challenges. Regulatory compliance and robust cybersecurity measures are critical for maintaining consumer trust.

What Opportunities Are Emerging in the Entertainment and Gaming Industry?

Wearable inertial sensors are increasingly used in VR, AR, and gaming to improve motion tracking and user interaction. They enable gesture recognition and immersive experiences, which are becoming essential in next-gen entertainment technologies. The integration of these sensors into smartwatches and fitness trackers further enhances user engagement.

Which Sensor Type Leads the Market?

The accelerometers segment held the largest share in 2024, thanks to its use in fitness trackers and smartwatches. These sensors offer high accuracy and low power consumption, making them suitable for wearable devices.

Meanwhile, Inertial Measurement Units (IMUs) are expected to grow rapidly due to their multi-sensor integration (accel + gyro + magneto), offering precise motion and orientation detection.

Why Are 3-Axis Sensors the Most Popular?

3-axis sensors dominated the market in 2024 due to their ability to accurately track movements like steps and orientation. They are widely used in health devices, consumer electronics, and automobiles for their reliability and effectiveness.

9-axis sensors are gaining traction for their enhanced performance in VR, fitness, and navigation due to advanced motion tracking capabilities.

Why Are Wireless Sensors in High Demand?

Wireless sensors using Bluetooth, Wi-Fi, and ANT+ dominated the market in 2024. These sensors offer low power consumption and user convenience by enabling seamless data transmission. Their mobility and integration ease make them highly desirable.

Wired sensors, though slower growing, are valued for their reliability in specialized applications and cost-effectiveness.

What Makes Sports & Fitness Tracking the Top Application?

In 2024, the sports & fitness tracking segment led the market due to widespread adoption of smartwatches and personalized fitness regimes. The demand for real-time activity tracking and health monitoring has been a major growth driver.

Elderly monitoring & fall detection is also expanding quickly, with innovative devices like smart gloves helping in disease monitoring and prevention for seniors.

Why Are Wearable Bands & Watches Leading the Form Factor Segment?

Wearable bands and smartwatches led the market due to their multifunctionality, fashionable appeal, and integration with motion sensors. Their increasing popularity in health and fitness tracking makes them the dominant form factor.

Sensor patches & clip-ons are expected to grow rapidly as they offer real-time data monitoring, especially in medical and fitness applications.

Which End-Use Sector Holds the Largest Market Share?

In 2024, consumer electronics was the dominant end-use sector, with inertial sensors widely embedded in smartwatches, trackers, and smart rings. Growing urbanization and the need for compact, efficient devices are pushing this segment forward.

The industrial & occupational safety segment is projected to grow rapidly, with industries focusing on improving workplace safety and monitoring through wearable tech.

Wearable Inertial Sensors Market Key Players

-

Xsens (Movella Inc.)

-

STMicroelectronics

-

Analog Devices, Inc.

-

InvenSense (TDK)

-

Bosch Sensortec

-

Noraxon USA Inc.

-

Shimmer Sensing

-

MBientLab Inc.

-

Vicon Motion Systems

-

TE Connectivity

-

ActiGraph LLC

-

Notch Interfaces Inc.

-

Kinexon GmbH

-

Trigno (Delsys Inc.)

-

Stryd

-

Hexoskin

-

Thales Group

What Are Some Recent Developments in the Market?

-

June 2025: Doublepoint Technologies introduced its gesture control system for Snap’s Spectacles 5 AR glasses.

-

June 2025: Bosch Sensortec unveiled the BMV080—the world’s smallest particulate matter sensor—at Sensors Converge 2025.

-

December 2023: Panasonic Life Solutions India launched a 6DoF inertial sensor for automotive applications.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344