Agricultural Robots and Drones Market Key Insights

-

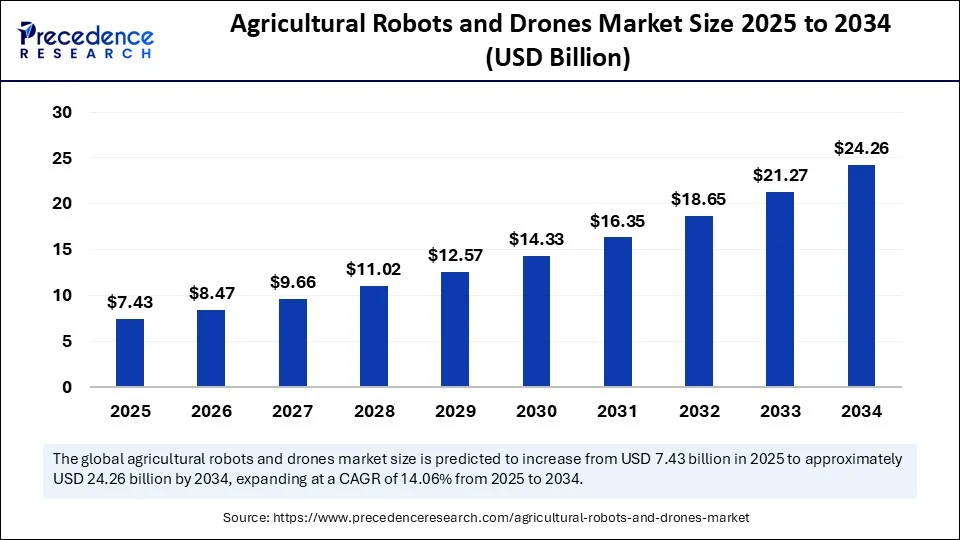

The global agricultural robots and drones market was valued at USD 6.51 billion in 2024 and is projected to reach USD 24.26 billion by 2034, growing at a CAGR of 14.06% from 2025 to 2034.

-

North America led the market in 2024 with the largest share of 36%, while Asia Pacific is poised for notable growth throughout the forecast period.

-

By product type, drones (UAVs) held the dominant market share in 2024, while weeding and spraying robots are anticipated to grow at the fastest pace.

-

In terms of components, the hardware segment was the largest contributor in 2024, whereas the software segment is expected to grow significantly during the forecast years.

-

Looking at applications, crop monitoring and analysis emerged as the leading segment in 2024, while livestock monitoring is projected to expand rapidly.

-

Based on farm type, field crops accounted for the largest market share in 2024, with specialty crops expected to grow at a strong CAGR over the forecast period.

-

By mobility type, aerial robots dominated the market in 2024, whereas hybrid systems are expected to witness substantial growth in the coming years.

-

For end-use, large commercial farms held the majority share in 2024, while small and family farms are projected to grow steadily over the forecast period.

Agricultural Robots and Drones Market Growth Factors

The primary growth drivers for the agricultural robots and drones market include rising labor shortages, especially in developed nations, and increasing labor costs that make automation an economically attractive option. In addition, the need for sustainable agricultural practices and efficient resource management—particularly of water, fertilizers, and pesticides—is compelling farmers to adopt precision agriculture solutions. Climate change has added further urgency by forcing farmers to optimize production with minimal environmental impact.

Government support and subsidies for smart farming technologies, especially in regions such as North America and Europe, are also playing a critical role in market expansion. Technological advancements in sensor technology, GPS, machine vision, and battery life have made drones and autonomous machines more reliable and affordable, broadening their appeal to mid- and small-sized farms.

AI Role in the Agricultural Robots and Drones Market

Artificial intelligence is at the core of innovation in the agricultural robots and drones market. AI algorithms enable machines to interpret sensor data, detect crop diseases, classify plant health, and determine optimal harvesting times with remarkable accuracy. In drone applications, AI-powered image recognition and computer vision are used to analyze aerial imagery for early pest detection, nutrient deficiencies, and water stress.

AI is also improving route optimization for autonomous tractors and harvesters, allowing them to cover fields more efficiently. Furthermore, predictive analytics powered by AI is helping farmers make data-driven decisions about planting cycles, weather risks, and yield forecasting. AI integration is not only enhancing the performance of agricultural robots and drones but also making them more adaptive, scalable, and user-friendly for farmers of all sizes.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 24.26 Billion |

| Market Size in 2025 | USD 7.43 Billion |

| Market Size in 2024 | USD 6.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.06% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Component, Application, Farm Type, Mobility Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

Several market drivers are propelling the adoption of robotics and drones in agriculture. One of the key drivers is the increasing need for precision farming to maximize yield and minimize waste. Additionally, population growth is accelerating the global demand for food, putting pressure on existing farmlands to produce more with fewer resources. In this context, robotics and aerial surveillance help farmers manage large-scale operations with greater control and real-time insight.

The growing adoption of smart farming techniques among technologically aware younger farmers is also stimulating market growth. Moreover, growing awareness about the environmental impact of traditional farming methods has led to increased interest in sustainable agricultural practices, for which robotics and AI-driven solutions are ideal enablers.

Opportunities

The market presents significant opportunities for technological expansion and commercialization. One promising area is the integration of robotics with Internet of Things (IoT) platforms, which can create interconnected farm systems that operate with minimal human intervention. Emerging economies in Asia-Pacific, Africa, and Latin America, where agricultural modernization is still nascent, represent massive untapped markets for affordable, adaptable automation solutions.

There is also a growing demand for multi-functional robots capable of handling various tasks—from planting to harvesting—within a single system, creating opportunities for equipment manufacturers to innovate modular designs. Collaborations between agri-tech startups and major agricultural machinery companies could drive the development of scalable and cost-effective solutions tailored to local farming conditions.

Challenges

Despite the promising outlook, the agricultural robots and drones market faces several challenges. High upfront costs and lack of financing options for small and medium-sized farms often deter adoption, especially in developing countries. Technological complexity and the need for technical expertise to operate and maintain these machines can also be barriers. Data privacy and cybersecurity concerns are emerging as potential risks as more farming operations become digitally connected.

Furthermore, regulatory frameworks for drone usage vary significantly across regions, creating compliance challenges and hindering cross-border adoption. Weather dependence also affects drone operations, particularly in regions with high humidity, rainfall, or wind speeds. Additionally, the lack of standardization in hardware and software platforms can make system integration difficult, affecting the scalability of these technologies.

Regional Outlook

North America currently dominates the agricultural robots and drones market, with a substantial share of approximately 36% in 2024. The region benefits from advanced agricultural infrastructure, high technology adoption rates, and strong government support for precision farming initiatives. The United States, in particular, leads the charge with large-scale farms that are ideally suited for automation and have the capital to invest in high-end technologies.

Europe follows closely, driven by environmentally conscious farming policies and aggressive sustainability goals under frameworks such as the EU’s Green Deal.

Asia-Pacific is the fastest-growing market, with countries like China, Japan, and India investing heavily in smart agriculture to meet food security challenges and reduce labor dependency. Government incentives and increasing digital literacy among farmers are contributing to rapid adoption.

Latin America and the Middle East & Africa are still emerging markets, but with vast arable land and growing awareness of the benefits of automation, these regions are expected to see a steady rise in adoption, especially with the introduction of low-cost drone and robot solutions tailored to their specific needs.

Agricultural Robots and Drones Market Companies

- John Deere

- DJI

- AGCO Corporation (Fendt, Massey Ferguson)

- Trimble Inc.

- Kubota Corporation

- Yamaha Motor Co., Ltd.

- Blue River Technology (John Deere)

- Naïo Technologies

- ecoRobotix SA

- AgEagle Aerial Systems

- PrecisionHawk

- CNH Industrial (Raven Industries)

- Agrobot

- Octinion (RoboJob)

- XAG Co., Ltd.

- Delaval Inc. (Milking Robotics)

- Small Robot Company

- SwarmFarm Robotics

- Taranis

- Skyx (Autonomous Sprayers)

Segments covered in the report

By Product Type

- Drones (UAVs)

- Fixed-wing

- Rotary-wing

- Hybrid VTOL

- Autonomous Tractors & Harvesters

- Milking Robots

- Weeding & Spraying Robots

- Planting & Seeding Robots

- Robotic Grippers & Arms

- Livestock Monitoring Robots

By Component

- Hardware

- Sensors (LIDAR, multispectral, thermal, cameras)

- GPS/GNSS Modules

- Actuators & Controllers

- Frames and Mobility Platforms

- Software

- AI/ML for crop recognition, yield mapping

- Farm Management Systems

- Real-time Decision Support Tools

- Services

- Drone-as-a-Service (DaaS)

- Predictive Maintenance

- Data Processing & Analytics

By Application

- Crop Monitoring & Analysis

- Soil & Field Mapping

- Planting & Seeding

- Harvesting & Picking

- Weed & Pest Control

- Irrigation Management

- Livestock Monitoring

By Farm Type

- Field Crops

- Horticulture

- Dairy Farms

- Greenhouses

- Specialty Crops (e.g., vineyards, floriculture)

By Mobility Type

- Aerial Robots (Drones)

- Ground Robots

- Wheeled

- Tracked

- Hybrid Systems

By End-User

- Large Commercial Farms

- Medium Farms

- Small & Family Farms

Read Also: Data Labeling Solution and Services Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344\