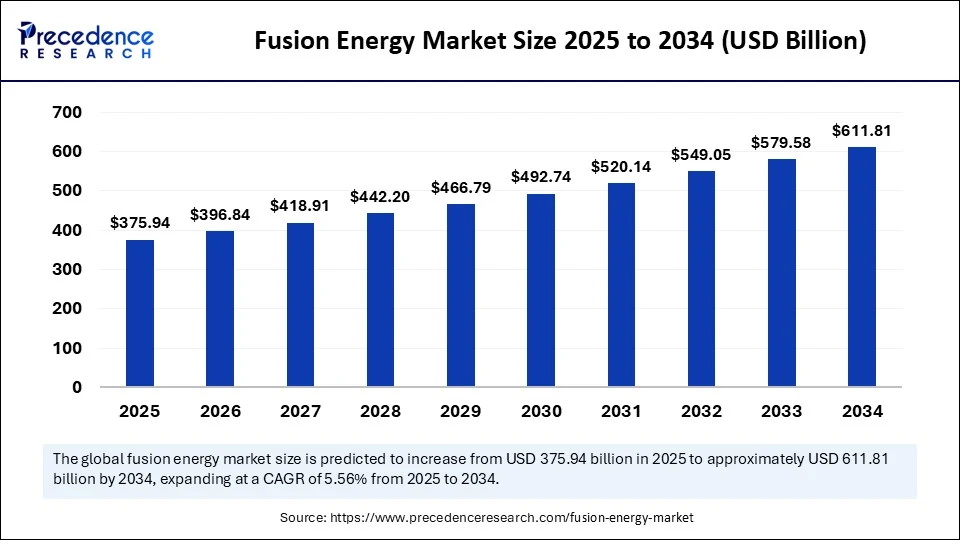

The global fusion energy market size is expected to reach around USD 611.81 billion by 2034 increasing from USD 356.14 billion in 2024, with a CAGR of 5.56%. This trajectory reflects a global push for large‑scale, carbon‑free baseload power, expanded public‑private funding streams, and a string of high‑profile technical milestones—most notably continuous plasma‑burn achievements in magnetic‑confinement tokamaks and net‑energy‑gain shots in laser‑driven inertial systems.

Fusion Energy Market Key Highlights

-

The global fusion energy market was valued at USD 356.14 billion in 2024 and is projected to reach USD 611.81 billion by 2034, expanding at a CAGR of 5.56% from 2025 to 2034.

-

North America led the market with a dominant 36% share in 2024, while the Asia Pacific region is anticipated to grow at the fastest CAGR during the forecast period.

-

By technology, magnetic confinement fusion accounted for the largest market share in 2024.

-

The inertial confinement fusion segment is projected to grow at the highest CAGR from 2025 to 2034.

-

In terms of application, power generation was the leading segment in 2024.

-

The space propulsion segment is expected to grow significantly throughout the forecast period.

-

By fuel type, the deuterium-tritium segment held a significant share in 2024.

-

The deuterium-deuterium segment is forecasted to expand at a notable CAGR over the coming years.

-

Based on investment type, the public sector investments segment captured the highest market share in 2024.

-

By system type, pilot plants generated the largest share in 2024, while commercial reactors are expected to grow at a robust CAGR between 2025 and 2034.

Fusion Energy Market Growth Factors

Several key factors are fueling the growth of the fusion energy market. First, global climate commitments and net-zero carbon emission targets are encouraging the development of non-polluting, base-load power sources like fusion. Second, significant public and private investments are being made, with government-backed initiatives and venture capital supporting pilot plant development and reactor design. Third, technological advancements—such as high-temperature superconducting magnets, advanced plasma control systems, and additive manufacturing—are lowering costs and accelerating progress. Lastly, the maturing supply chain for critical components like tritium breeding systems and radiation-resistant materials is addressing long-standing infrastructure bottlenecks.

Role of AI in the Fusion Energy Market

Artificial Intelligence (AI) is playing a transformative role in advancing the fusion energy market. AI algorithms are being used to manage and stabilize plasma reactions in real-time, making fusion systems more efficient and safe. Machine learning models help optimize reactor design by simulating millions of configurations, accelerating the R&D process. Predictive analytics assist in identifying equipment failures before they occur, reducing downtime and operational risk. AI also supports autonomous monitoring and diagnostics, which are especially important for future remote or space-based fusion applications. Overall, AI is helping to reduce development timelines, costs, and complexity in fusion reactor projects.

Fusion Energy Market Drivers

Fusion energy is gaining momentum due to several critical market drivers. The most prominent is the global push for clean energy to combat climate change, as fusion offers a carbon-free and sustainable power source. Another driver is the increasing collaboration between public institutions and private companies, which is reducing financial risk and accelerating development. Technological spillovers from adjacent sectors—such as superconductivity, robotics, and advanced computing—are contributing to progress in fusion development. Additionally, increasing investor confidence, fueled by large funding rounds in fusion startups, is enabling the scale-up of research into commercial demonstration projects.

Opportunities

There are several promising opportunities emerging within the fusion energy market. The most immediate is the successful transition from pilot plants to fully operational commercial fusion power facilities, which would revolutionize the global energy landscape. Fusion also presents unique opportunities in aerospace, particularly in high-efficiency propulsion systems for deep-space missions. Furthermore, the exploration of advanced fuels such as deuterium-deuterium or proton-boron could reduce reactor complexity and radiation concerns. Lastly, companies specializing in AI-driven analytics and grid integration software are well-positioned to offer value-added services as fusion becomes grid-compatible.

Challenges

Despite its potential, the fusion energy market faces several critical challenges. The biggest technical hurdle remains achieving and maintaining stable plasma confinement at temperatures exceeding millions of degrees. Additionally, the cost of building fusion reactors is extremely high, requiring multi-billion-dollar investments and long-term funding commitments. The scarcity and handling of tritium fuel pose logistical and regulatory issues, while safety protocols and community acceptance of fusion facilities also require attention. Regulatory frameworks are still evolving, creating uncertainty around licensing and compliance, especially for first-of-a-kind commercial reactors.

Fusion Energy Market Regional Outlook

Regionally, North America leads the fusion energy market, thanks to substantial government support, advanced R&D facilities, and a vibrant ecosystem of startups. The United States in particular is investing in milestone-based fusion development programs. Europe is also a key player, driven by the progress of the ITER project in France and the DEMO program aimed at commercial reactor deployment. However, longer regulatory processes could slightly slow Europe’s momentum. The Asia-Pacific region is the fastest-growing, with countries like China, Japan, and South Korea making significant strides through national programs and successful tokamak operations. Latin America and the Middle East & Africa are emerging regions, exploring partnerships and future infrastructure investments to secure long-term energy independence.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6314

Fusion Energy Market Segmental Insights

By Technology, magnetic confinement fusion (MCF) held the largest market share in 2024 due to the success of tokamak and stellarator designs. These systems have demonstrated the most consistent results in sustaining high-temperature plasma, making them central to both public and private fusion initiatives. Meanwhile, inertial confinement fusion (ICF), which uses laser ignition, is the fastest-growing technology due to recent breakthroughs in energy yield and its potential in both defense and compact space applications.

By Application, power generation dominates the market, accounting for the majority of revenue. Fusion offers a clean, reliable source of electricity without the intermittency issues of solar or wind. However, space propulsion is emerging as the fastest-growing application, with fusion’s high energy density and thrust-to-weight ratio opening new frontiers in space travel.

By Fuel Type, the deuterium-tritium (D-T) combination leads the market because it is the easiest to ignite and has been most widely used in experiments. Nevertheless, deuterium-deuterium (D-D) fusion is growing rapidly due to ongoing research into aneutronic fuels that could reduce radioactive byproducts and simplify reactor designs.

By System Type, pilot plants currently hold the largest market share as several national and private efforts are focused on proving commercial viability. However, commercial reactors are projected to grow the fastest over the next decade as more pilot projects transition to grid-connected power generation.

By Investment Type, public-sector funding continues to dominate, particularly for large-scale experimental facilities like ITER. At the same time, private-sector investment is increasing at a rapid pace, with numerous fusion startups securing record funding rounds, indicating growing market confidence and interest in faster innovation cycles.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 611.81 Billion |

| Market Size in 2025 | USD 375.94 Billion |

| Market Size in 2024 | USD 356.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.56% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology Outlook, Application Outlook, Fuel Type Outlook, System Type Outlook, Investment Type Outlook and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Fusion Energy Market Companies

- Commonwealth Fusion Systems

- European Organization for Nuclear Research

- First Light Fusion

- General Fusion

- Helion Energy

- ITER Organization

- Korea Superconducting Tokamak Advanced Research

- Lawrence Livermore National Laboratory

- MAX IV Laboratory

- National Renewable Energy Laboratory

- Princeton Plasma Physics Laboratory

- Russian Federal Nuclear Center

- Tokamak Energy

- United States Department of Energy

Read Also: Financial App Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344\