Cash Back and Rewards App Market Key Insights

- In 2024, North America led the cash back and rewards app market, holding the largest regional share. Meanwhile, Asia Pacific is projected to experience the fastest growth between 2025 and 2034.

- By type, cash back apps accounted for a notable share of the market in 2024, while reward points apps are expected to grow significantly during the forecast period.

- On the basis of platform, mobile apps dominated the market in 2024, whereas web-based platforms are anticipated to expand at the fastest rate in the coming years.

- In terms of distribution channel, the direct-to-consumer segment held the majority share in 2024, while the partnered merchants segment is set to grow at a substantial CAGR through 2034.

Cash Back and Rewards App Market Overview

The Cash Back and Rewards App Market has emerged as a pivotal segment within the broader fintech and digital commerce ecosystem. These apps are designed to incentivize consumer spending by offering financial rewards, discounts, and loyalty points on purchases made through partner retailers or service providers. With the global proliferation of smartphones, digital wallets, and e-commerce platforms, consumers are increasingly turning to these apps to maximize savings and enhance the value of their purchases. Whether integrated into retail ecosystems or functioning as standalone platforms, cashback and rewards apps serve as digital loyalty programs that build brand engagement, drive repeat purchases, and provide marketers with valuable consumer behavior insights.

This market has grown rapidly, fueled by shifts in consumer behavior toward value-conscious spending, especially in the aftermath of economic disruptions like COVID-19 and inflationary pressures. Businesses across industries—from retail and travel to banking and dining—are leveraging cashback and rewards systems to differentiate themselves in competitive markets. Simultaneously, the ability of these apps to collect granular data on purchasing habits has made them increasingly attractive to advertisers and analytics providers. As consumer expectations evolve, cashback and rewards platforms are becoming more sophisticated, incorporating gamification, location-based targeting, and personalized offers to retain users and deepen engagement.

Cash Back and Rewards App Market Growth Factors

A number of interrelated factors are contributing to the robust growth of the cashback and rewards app market. Firstly, the surge in digital transactions and mobile commerce globally has created a fertile environment for reward-based platforms. Consumers are not only more comfortable transacting online, but they also expect added value from their purchases, such as instant cashback, loyalty points, or exclusive deals. This behavior shift is particularly evident among Gen Z and Millennials, who actively seek out apps that deliver tangible benefits in exchange for their brand loyalty.

Secondly, the rising penetration of smartphones and mobile internet in emerging markets is unlocking new user segments and expanding the total addressable market. Countries like India, Indonesia, Brazil, and South Africa are experiencing a fintech boom, and rewards apps are piggybacking on digital wallet adoption and mobile banking infrastructure.

Moreover, the increased integration of rewards programs with point-of-sale systems and e-commerce platforms is helping businesses to seamlessly deliver personalized incentives. The growing importance of customer retention in highly competitive markets has made cashback apps an essential part of marketing and CRM strategies.

Lastly, consumer sensitivity to inflation and economic uncertainty is boosting demand for financial incentives on everyday purchases. Cashback apps are positioned as smart saving tools, which appeal to both budget-conscious shoppers and digitally savvy consumers.

Impact of AI on the Cash Back and Rewards App Market

Artificial Intelligence (AI) is rapidly reshaping the cashback and rewards app market by enhancing personalization, targeting, and efficiency. One of the most transformative uses of AI is in predictive analytics, where user behavior and purchase history are analyzed to deliver highly relevant and timely offers. AI helps apps determine not only what rewards to offer, but when and how to deliver them for maximum engagement and conversion.

Another major area where AI plays a role is dynamic segmentation and recommendation engines. Instead of offering generic cashback options, AI enables apps to tailor rewards based on individual user preferences, past behavior, and even location data. This level of personalization boosts user satisfaction, encourages app stickiness, and improves redemption rates.

AI is also increasingly used in fraud detection and user verification, ensuring that cashback and rewards systems are not exploited through fake accounts, bot traffic, or duplicate redemptions. AI-driven algorithms can flag suspicious activity in real time, protecting merchant and app revenue.

Moreover, natural language processing (NLP) is enhancing customer support functions, allowing apps to deploy chatbots and virtual assistants that can help users with onboarding, offer redemptions, and FAQs—improving customer experience and reducing support costs.

In the backend, AI contributes to campaign performance optimization, enabling brands and retailers to track which rewards drive the most engagement and ROI, and to tweak campaigns accordingly in real time.

Market Scope

| Report Coverage | Details |

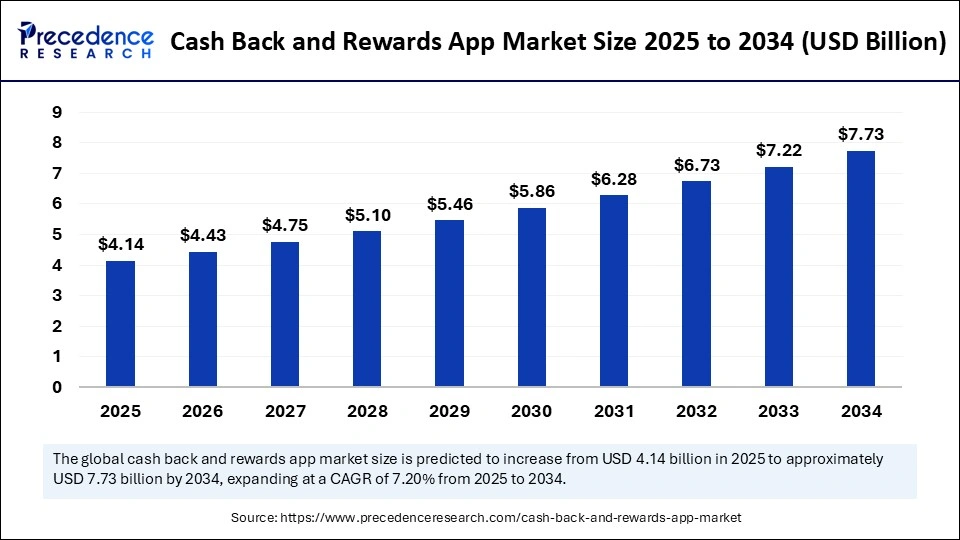

| Market Size by 2034 | USD 7.73 Billion |

| Market Size in 2025 | USD 4.14 Billion |

| Market Size in 2024 | USD 3.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Platform, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

-

Proliferation of e-commerce and digital payment platforms, which provide the infrastructure and partnerships needed for cashback integration.

-

Shift in consumer mindset toward value-seeking behavior, especially during times of economic slowdown or inflation.

-

Growing demand for personalized shopping experiences, where consumers are more likely to engage with brands that reward loyalty.

-

Business need for customer retention and data-driven marketing, where rewards programs offer both incentive and behavioral data.

-

Increased merchant and brand participation, which improves offer variety and boosts app value to consumers.

Opportunities

-

Expansion into underpenetrated geographies, particularly in rural or semi-urban areas of emerging markets where mobile adoption is high, but reward-based digital tools are still new.

-

Partnerships with fintech and banking players, enabling embedded cashback solutions directly into credit/debit cards and digital wallets.

-

Introduction of cryptocurrency or blockchain-based rewards, offering new value propositions for digitally native users and cross-border shoppers.

-

Integration of sustainability-focused rewards, such as carbon credit incentives or rewards for eco-friendly purchases, aligning with growing ESG concerns.

-

AI-powered gamification and loyalty tiers, which increase user engagement and create competitive advantages for apps with advanced behavioral design.

Challenges

-

Data privacy concerns and regulatory compliance—as these apps gather large volumes of user data, complying with GDPR, CCPA, and other data protection laws is critical but complex.

-

User retention issues, as consumers often install multiple apps and may not remain loyal to any one unless consistently incentivized with superior value.

-

Over-saturation and market fragmentation, leading to reduced differentiation among apps and increasing customer acquisition costs.

-

Fraud and system abuse, such as duplicate accounts, false referrals, and fraudulent redemptions, can undermine the financial viability of cashback ecosystems.

-

Technical integration with retailers, especially for offline transactions or small vendors lacking advanced POS systems.

Regional Outlook

North America is currently one of the most mature and lucrative markets for cashback and rewards apps, driven by high smartphone penetration, widespread digital payment use, and a well-established culture of loyalty programs. The U.S. and Canada are home to several major players offering integrated solutions for both online and brick-and-mortar purchases.

Europe also holds a significant share, particularly in the UK, Germany, and France, where digital loyalty adoption is strong, and fintech collaboration is common. European consumers are generally cautious but highly responsive to rewards that offer real monetary value.

Asia-Pacific is the fastest-growing region, led by countries like China, India, Indonesia, and South Korea. These markets combine high digital engagement with rising consumer spending and intense mobile commerce activity. Super apps and digital wallets often feature in-app rewards, making cashback part of daily life for millions.

Latin America is seeing increasing traction, especially in Brazil and Mexico, where mobile banking and QR-based payments are becoming more common. Reward apps are being used as entry points into the digital economy, especially among younger consumers.

The Middle East and Africa, though relatively nascent in this market, are witnessing gradual adoption, thanks to smartphone proliferation and the expansion of digital financial services. Governments and banks are also supporting fintech innovations, paving the way for more regional players in this space.

Cash Back and Rewards App Market Companies

- Upromise

- Rakuten

- Ibotta

- Checkout 51

- Honey Science

- Travelzoo

- Boost Holdings

- Receipt Hog

- Fetch Rewards

- Dosh

- Drop

Segments Covered in the Report

By Type

- Cash Back Apps

- Rewards Points Apps

- Hybrid Apps

By Platform

- Mobile Apps

- Web-based Platforms

By Distribution Channel

- Direct to Consumer

- Partnered Merchants

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Read Also: Mobile Identification Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6081

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344