Noise, Vibration, And Harshness Testing Market Key Points

-

Asia Pacific held the largest market share of 38% in 2024.

-

China is projected to grow at a strong CAGR of 7.5% from 2025 to 2034.

-

North America is expected to expand at a CAGR of 6% during the forecast period.

-

By component, the hardware segment dominated the market with a 60% share in 2024.

-

The software segment is forecasted to grow at a CAGR of 7.1% over the predicted timeframe.

-

In terms of application, the sound intensity and quality analysis segment accounted for a 53% share in 2024.

-

The powertrain performance testing segment is growing at a notable CAGR of 7.32% between 2025 and 2034.

-

By end-use, the automotive segment led the market with a 44% share in 2024.

-

The consumer electronics segment is anticipated to grow steadily at a CAGR of 6.6% in the coming years.

Noise, Vibration, And Harshness Testing Market Overview

The Noise, Vibration, and Harshness (NVH) Testing Market is a critical subset of the automotive and manufacturing sectors, focused on measuring, analyzing, and mitigating sound and vibration characteristics in vehicles and mechanical systems. NVH testing plays a vital role in enhancing product quality, customer comfort, regulatory compliance, and brand perception. It is extensively used in the automotive industry for engine, powertrain, and cabin acoustics optimization, and also finds increasing applications in aerospace, railways, consumer electronics, and industrial machinery.

As vehicle and equipment manufacturers strive to deliver quieter, smoother, and more comfortable experiences, NVH testing has become a key pillar of product development. The shift toward electric and hybrid vehicles, which operate more quietly than traditional internal combustion engines, has further intensified the focus on subtle noise sources, making advanced NVH analysis indispensable. The demand for NVH solutions is also being driven by stricter noise regulations across the globe and heightened consumer expectations for refinement, especially in luxury and premium segments.

Noise, Vibration, And Harshness Testing Market Growth Factors

The NVH testing market is witnessing substantial growth fueled by multiple converging factors. The automotive sector’s rapid evolution, particularly the development of electric vehicles (EVs), is a primary growth driver. Unlike conventional vehicles where engine noise masks other sounds, EVs expose even the smallest rattles and road noise, thus necessitating more sensitive NVH testing procedures.

Increasing regulatory pressures related to environmental noise and occupational health standards are also pushing industries to invest in advanced NVH testing and mitigation technologies. From city planning regulations on vehicle noise to in-cabin sound level limits, companies need to validate compliance through rigorous testing.

Moreover, consumer demand for refined product experiences, especially in luxury vehicles and high-end electronics, is encouraging manufacturers to focus heavily on minimizing noise and vibration. This includes everything from minimizing fan noise in laptops to reducing drone propeller resonance or railway cabin rumble.

Advancements in sensor technologies, data acquisition systems, and simulation tools are further supporting market expansion, allowing more precise diagnostics and virtual prototyping that reduce the need for physical trials.

Impact of AI on the Noise, Vibration, And Harshness Testing Market

Artificial Intelligence (AI) is playing a transformative role in reshaping the NVH testing landscape. Traditionally, NVH testing has been a data-heavy and time-consuming process, requiring expert interpretation. AI is now streamlining and augmenting these processes through automation, pattern recognition, and predictive analytics.

One major AI-driven advancement is in anomaly detection and root cause analysis. Machine learning algorithms can be trained on massive datasets to identify abnormal vibration signatures or noise frequencies that deviate from expected norms, enabling quicker diagnostics and preventive measures.

AI also enhances predictive maintenance in NVH-sensitive systems by correlating real-time vibration data with historical failure patterns. This is particularly useful in industrial machinery and aerospace components, where even slight deviations can lead to safety risks or performance drops.

Furthermore, AI-powered tools are improving simulation and modeling capabilities, allowing manufacturers to run virtual NVH tests during the design phase, thereby reducing prototyping costs and shortening time-to-market. Generative AI is even being used to simulate acoustic environments and optimize materials or structures for vibration damping.

Natural Language Processing (NLP) tools are also being integrated into NVH systems, enabling voice-command diagnostics or technician support, enhancing accessibility and usability.

Overall, AI is not only reducing the complexity of NVH testing but is also unlocking its scalability across smaller devices, real-time applications, and embedded systems.

Noise, Vibration, And Harshness Testing Market Market Drivers

- Rising demand for electric and hybrid vehicles, which require more refined NVH control due to their quieter operations and unique component acoustics.

- Stringent government regulations related to environmental noise pollution, occupational safety, and emission standards that indirectly affect sound-related components.

- Consumer expectations for high-performance, low-noise products across automotive, aerospace, and electronics sectors.

- Technological advancements in sensors, microphones, accelerometers, and signal processing, allowing more accurate and real-time NVH analysis.

- Increased investment in R&D by OEMs and Tier 1 suppliers, particularly in automotive and rail, to differentiate products through sound quality and user experience.

Opportunities

- The emergence of autonomous and electric mobility is opening new avenues for NVH innovation, including noise masking, active sound design, and digital sound enhancement for pedestrian safety.

- Smart manufacturing and Industry 4.0 initiatives are integrating NVH testing into real-time monitoring systems on factory floors, creating demand for embedded and edge-based NVH analytics.

- Growing consumer electronics and wearable markets present opportunities for compact NVH solutions focused on micro-vibration and acoustic clarity, especially in AR/VR devices, smartphones, and drones.

- Green building and HVAC industries are adopting NVH testing to minimize mechanical noise, enhance indoor comfort, and comply with sustainability certifications.

- The rise of virtual prototyping and simulation software for NVH prediction is creating new business models for software vendors and consultancy services.

Challenges

Integration issues between traditional NVH testing tools and new digital platforms (like AI, IoT, and digital twins) can also slow adoption, especially among legacy manufacturers.

Lack of skilled professionals in vibration and acoustics engineering is another bottleneck. Proper interpretation of NVH data still relies heavily on domain expertise, though AI is helping to mitigate this challenge.

Additionally, difficulty in standardizing testing protocols across industries and regions can result in inconsistent data quality or regulatory compliance burdens, especially in global manufacturing networks.

Market Scope

| Report Coverage | Details |

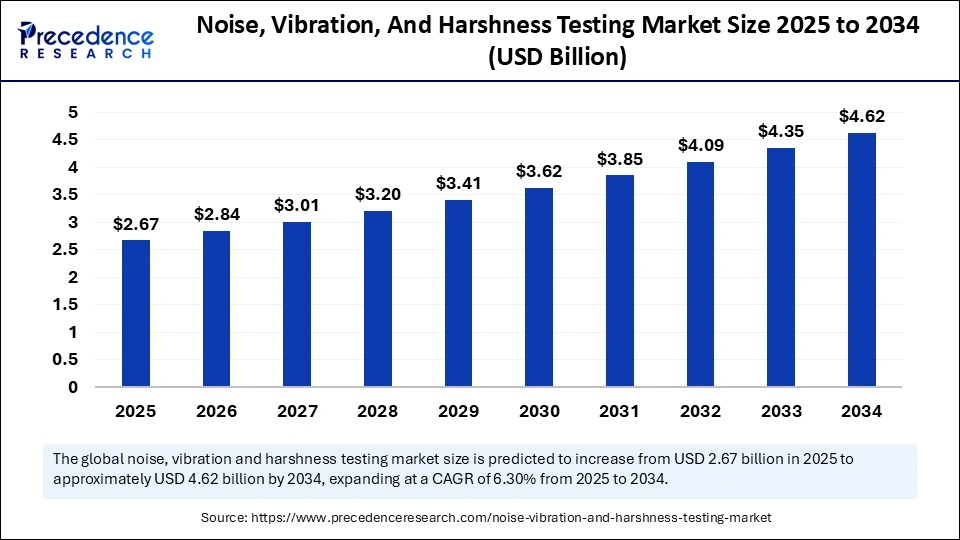

| Market Size by 2034 | USD 4.62 Billion |

| Market Size in 2025 | USD 2.67 Billion |

| Market Size in 2024 | USD 2.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.30% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | China |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, End-Use,and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Outlook

North America remains a leading region in the NVH testing market, driven by strong automotive innovation, aerospace R&D, and industrial automation. The U.S. houses several major NVH equipment manufacturers and test facilities supporting next-generation vehicle development.

Europe follows closely, with countries like Germany, France, and the UK leading in premium automotive manufacturing and railway noise control systems. The EU’s stringent noise and environmental regulations further drive demand for advanced NVH testing across industries.

Asia-Pacific is the fastest-growing market, led by automotive hubs such as China, Japan, South Korea, and India. The expansion of EV manufacturing, infrastructure development, and industrial growth are creating strong demand for localized NVH testing solutions. Japan’s leadership in robotics and high-speed rail also contributes significantly to this region’s share.

Latin America, the Middle East, and Africa are emerging markets where infrastructure modernization, vehicle localization, and energy sector developments (especially wind and thermal power plants) are driving niche NVH testing applications.

Noise, Vibration, And Harshness Testing Market Companies

- Hottinger Brüel & Kjær (Spectris)

- HEAD Acoustics GmbH

- Dewesoft d.o.o.

- Siemens

- Data Physics Corporation

- NATIONAL INSTRUMENTS CORP. (Emerson Electric Co.)

- Axiometrix Solutions

- IMV Corporation

- Prosig Ltd.

- Norsonic

- Signal.X Technologies, LLC

- Bertrandt

- Schaeffler AG

Segments Covered in the Report

By Component

- Hardware

- Sensors and Transducers

- Data Acquisition Systems

- Analyzers

- Excitation Devices

- Others

- Software

- Services

By Application

- Buzz, Squeak and Rattle Noise Testing

- Sound Intensity and Quality Analysis

- Powertrain Performance Testing

- Pass-by Noise Testing

- Others

By End-Use

- Aerospace & Defense

- Automotive

- Consumer Electronics

- Construction

- Energy & Utility

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Read Also: Artificial Intelligence of Things (AIoT) Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6092

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344