Heart Valve Devices Market Key Highlights

-

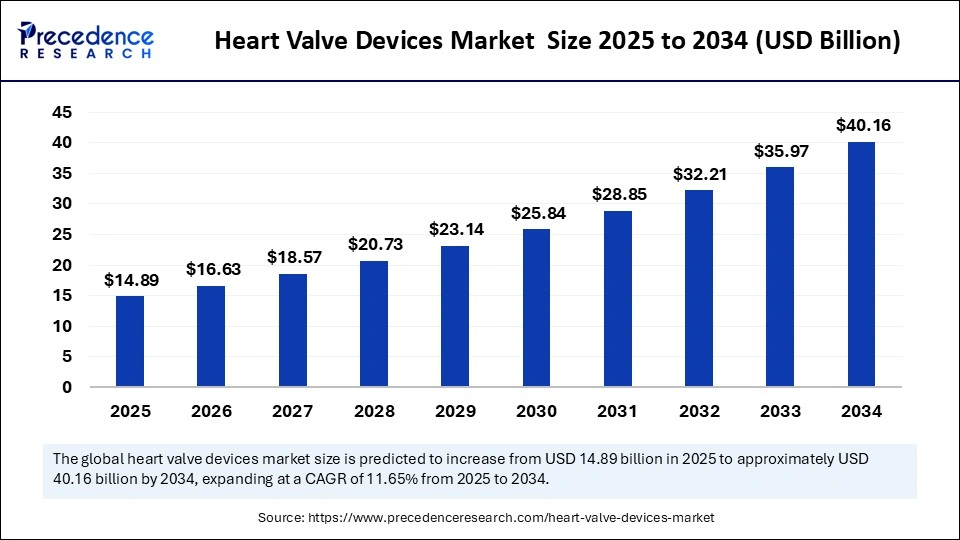

The global heart valve devices market was valued at USD 13.34 billion in 2024 and is projected to reach USD 40.16 billion by 2034.

-

The market is expected to grow at a CAGR of 11.65% from 2025 to 2034.

-

North America dominated the global heart valve devices market in 2024.

-

Asia Pacific is anticipated to witness the fastest CAGR in the market between 2025 and 2034.

-

By type of heart valve, the aortic valve segment held the largest market share in 2024.

-

The mitral valve segment is projected to grow at a significant CAGR during the forecast period.

-

Based on material, the biological valve segment accounted for the highest market share in 2024.

-

The mechanical valve segment is expected to grow at the fastest CAGR over the projected timeframe.

-

By age group, the adults segment led the market in 2024.

-

The geriatric patients segment is forecasted to expand at a notable CAGR over the coming years.

-

Among end-users, hospitals contributed the largest share of the market in 2024.

-

The ambulatory surgical centers segment is expected to grow at the highest CAGR throughout the forecast period.

Market Overview

The Heart Valve Devices Market is witnessing robust growth, fueled by the rising global prevalence of valvular heart diseases (VHD), particularly among aging populations. Heart valve devices are used to repair or replace dysfunctional heart valves that hinder normal blood flow through the heart. These devices include mechanical valves, biological (tissue) valves, and transcatheter valves (used in less-invasive procedures like TAVR and TMVR). With the continuous evolution of cardiovascular technologies and the increasing shift toward minimally invasive interventions, the demand for innovative and patient-centric heart valve devices is accelerating.

The growing burden of cardiovascular disorders, combined with improvements in diagnostic capabilities, has led to an increase in the number of patients diagnosed with valve defects. As a result, surgical and transcatheter valve replacement procedures are rising globally. The industry is also being shaped by favorable reimbursement policies, increasing clinical research, and strategic collaborations between medtech companies and healthcare providers. Overall, the heart valve devices market is expected to see strong and sustained growth in the years ahead, especially as healthcare systems in developing regions improve access to cardiac care and intervention.

Heart Valve Devices Market Growth Factors

Several factors are driving the expansion of the heart valve devices market. One of the primary growth accelerators is the rapidly aging global population. With age being a major risk factor for valvular heart diseases such as aortic stenosis and mitral regurgitation, the incidence of such conditions is increasing significantly among elderly patients, creating heightened demand for both surgical and transcatheter valve interventions.

Another key factor is the surge in minimally invasive procedures, especially Transcatheter Aortic Valve Replacement (TAVR) and Transcatheter Mitral Valve Repair (TMVR). These procedures offer reduced recovery times, fewer complications, and increased patient satisfaction compared to traditional open-heart surgery, making them the preferred choice for high-risk and elderly patients.

Technological advancements are also fueling market growth. Innovations in materials, valve durability, imaging guidance systems, and delivery catheters have significantly improved device performance and expanded the range of patients eligible for treatment. Additionally, increasing awareness of heart diseases, growing cardiovascular screening programs, and improved healthcare infrastructure are contributing to early diagnosis and timely intervention, especially in developing nations.

Impact of AI on the Heart Valve Devices Market

Artificial Intelligence (AI) is playing an increasingly transformative role in the heart valve devices market by enhancing the accuracy, efficiency, and personalization of cardiac care. AI is being utilized in the early diagnosis of valvular heart diseases through advanced imaging analysis, predictive analytics, and automated echocardiogram interpretation, enabling clinicians to detect valve abnormalities with greater precision.

AI also supports procedure planning and simulation, particularly in complex transcatheter interventions. For example, AI-driven 3D imaging and modeling can create patient-specific anatomical maps, helping physicians determine the most suitable valve size and placement strategy while minimizing procedural risks.

Furthermore, AI-enabled remote monitoring and predictive analytics are revolutionizing post-operative care by identifying early signs of complications, guiding follow-ups, and reducing hospital readmissions. In research and development, AI accelerates device innovation by simulating how new valve designs would perform under different physiological conditions, thus reducing the time and cost of clinical trials.

As AI continues to integrate with robotic-assisted surgery, telecardiology, and digital twin technologies, it is expected to drive precision in valve selection, surgical planning, and patient recovery, ultimately improving outcomes and expanding the reach of heart valve treatments worldwide.

Market Drivers

Increasing prevalence of heart valve diseases, driven by lifestyle changes, hypertension, and aging.

Rising preference for minimally invasive valve replacement therapies, especially among elderly and high-risk patients.

Technological innovations, including improved valve durability, biocompatible materials, and catheter-based delivery systems.

Rising awareness and early diagnosis due to enhanced access to echocardiography and cardiac imaging.

Favorable reimbursement policies and regulatory support, which are encouraging the adoption of advanced valve devices across major healthcare markets.

Strong R&D pipeline and active clinical trials from major players such as Edwards Lifesciences, Medtronic, Abbott, and Boston Scientific, further boosting the market trajectory.

Opportunities

The heart valve devices market presents abundant opportunities, especially with the increasing demand for transcatheter heart valve procedures in emerging economies. As healthcare infrastructure improves in regions like Latin America, Southeast Asia, and Africa, the market for cost-effective and minimally invasive valve solutions is expanding rapidly.

Another promising opportunity lies in next-generation tissue-engineered valves and personalized valve implants, which offer longer durability and better biocompatibility. The use of 3D printing technology to create patient-specific heart valve models is also gaining interest, particularly for complex pediatric cases.

Furthermore, there is growing potential in the development of robotically assisted heart valve surgeries, which offer enhanced precision and reduced invasiveness. Startups and medtech innovators have ample room to introduce disruptive technologies that improve affordability, accessibility, and procedural outcomes.

Finally, the integration of AI and digital health ecosystems opens the door for remote monitoring and decision support tools, providing a continuum of care for patients post-surgery and helping physicians track outcomes in real-time.

Challenges

Despite the optimistic growth prospects, the market faces several challenges. High costs associated with heart valve devices and procedures, especially transcatheter interventions, remain a barrier to adoption in low- and middle-income countries. Limited access to advanced cardiac care and skilled interventional cardiologists also hinders market penetration in resource-constrained settings.

Stringent regulatory approval processes and lengthy clinical trial timelines can delay the commercialization of novel devices, particularly in regions with complex compliance requirements. In addition, device-related complications, such as valve thrombosis, paravalvular leaks, and structural deterioration, pose risks that require continuous innovation and clinical oversight.

Another key challenge is limited long-term durability data for newer valve designs, especially those used in younger patients. While minimally invasive solutions are gaining popularity, their long-term safety and effectiveness still need more validation through large-scale, longitudinal studies.

Heart Valve Devices Market Regional Outlook

North America holds the largest share of the global heart valve devices market, driven by advanced healthcare systems, high disease prevalence, and early adoption of transcatheter therapies. The United States is a key innovator and consumer of heart valve devices, supported by strong reimbursement policies and continuous R&D investment.

Europe follows closely, with countries like Germany, France, and the UK witnessing steady adoption of heart valve interventions. The region benefits from well-established cardiac centers and increasing elderly populations. The European market is also supported by collaborative clinical trials and the CE marking pathway, which facilitates quicker access to new devices.

Asia Pacific is expected to experience the fastest growth rate, fueled by rising healthcare spending, increasing awareness of cardiovascular health, and rapid expansion of catheterization labs. Countries such as China, India, Japan, and South Korea are investing in cardiac care infrastructure and training, opening significant growth opportunities for both domestic and international device manufacturers.

Latin America and the Middle East & Africa are emerging markets showing gradual uptake of heart valve devices. While challenges like limited funding and infrastructure persist, ongoing health reforms, public-private partnerships, and technology transfers are creating a conducive environment for future growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 40.16 Billion |

| Market Size in 2025 | USD 14.89 Billion |

| Market Size in 2024 | USD 13.34 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.65% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Heart Valve, Material, Age Group, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Heart Valve Devices Market Companies

- Medtronic plc

- Boston Scientific Corporation

- Abbott

- Edwards Lifesciences Corporation

- Foldax Inc.

- Novostia SA

- Meril Life Sciences Pvt. Ltd.

- Corcym UK Limited

- JenaValve Technology, Inc.

- Micro Interventional Devices, Inc.

- Auto Tissue Berlin GmbH

- Anteris Technologies Ltd

- Thubrikar Aortic Valve, Inc.

- MicroPort Scientific Corporation

- Biosensors International Group, Ltd.

Segments Covered in the Report

By Type of Heart Valve

- Aortic Valve

- < 20 mms

- 20–23 mm

- 23–26 mm

- >26 mm

- Mitral Valve

- < 26 mm

- 26–28 mm

- 29–31 mm

- >31 mm

- Tricuspid Valve

- Pulmonary Valve

By Material

- Biological Valve

- TAVI

- Surgical

- Others

- Mechanical Valve

By Age Group

- Pediatric Patients

- Adults

- Geriatric Patients

By End-User

- Hospitals

- Home Care

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Read Also: Selective Laser Sintering Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6257

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344