Isononanoic Acid Market Key Points

- North America is expected to experience the fastest growth throughout the forecast period.

- By product type, the synthetic isononanoic acid segment held the largest market share in 2024.

- The natural isononanoic acid segment is projected to witness notable growth over the coming years.

- Based on application, the lubricants segment led the market in 2024.

- The plasticizers segment is expected to grow at a significant rate in the upcoming period.

- By end-use industry, the automotive segment accounted for the largest market share in 2024.

- The construction segment is projected to expand at a noteworthy CAGR from 2025 to 2034.

Market Overview

The Isononanoic acid market has been steadily growing, driven by its widespread applications across several end-use industries such as lubricants, cosmetics and personal care, chemicals, and coatings. Isononanoic acid (INA), a branched-chain saturated carboxylic acid, is primarily used as a precursor in the synthesis of esters and metal salts. These derivatives are essential in formulating synthetic lubricants, corrosion inhibitors, plasticizers, and fragrance agents. The unique molecular structure of INA lends it superior performance characteristics such as excellent thermal and oxidative stability, making it highly valued in high-performance lubricants and coatings used in the automotive and industrial sectors.

In the cosmetics and personal care industry, INA finds application as an emollient and skin-conditioning agent, offering enhanced spreadability and a non-greasy feel, which makes it ideal for skincare formulations. Moreover, the demand for high-performance lubricants with longer lifespans and better resistance to extreme temperatures is further propelling the need for INA-based products. With industrialization expanding globally and the need for efficient and sustainable chemical intermediates on the rise, the isononanoic acid market is expected to witness significant growth in the coming years.

Isononanoic Acid Market Growth Factors

A key growth driver for the isononanoic acid market is the rising demand for synthetic lubricants across automotive and industrial applications. As modern machinery and automotive engines become more complex and performance-oriented, the need for lubricants that can perform under high pressure, extreme temperatures, and extended durations increases. Esters derived from INA serve this purpose, offering improved thermal stability, low volatility, and high viscosity index—properties critical for next-generation lubricants.

Another strong growth factor is the booming cosmetics and personal care industry, especially in emerging markets like Asia-Pacific and Latin America. Consumers are increasingly seeking high-quality skincare products with better sensory attributes, and INA-based esters provide formulations with excellent texture, spreadability, and moisturization without clogging pores. Its role as a non-irritant and non-sensitizing ingredient also makes it a preferred choice in dermatologically-tested products.

Urbanization, increased disposable income, and industrial automation are other key growth catalysts. These macroeconomic trends are driving construction, automotive production, and electronics manufacturing—all of which use INA derivatives either in surface coatings, lubricants, or as corrosion protection agents. Additionally, growing awareness of the environmental benefits of synthetic esters over mineral oil-based lubricants has spurred the shift toward INA as a greener alternative.

Impact of AI on the Isononanoic Acid Market

Artificial Intelligence (AI) is beginning to influence the isononanoic acid market in several strategic ways—particularly in process optimization, supply chain management, product development, and customer analytics. In manufacturing, AI-powered predictive analytics are being deployed to monitor reaction kinetics, optimize production yields, and reduce energy consumption in the synthesis of INA. This not only enhances operational efficiency but also lowers production costs and environmental impact.

In R&D, AI facilitates molecular modeling and simulation, accelerating the discovery of novel INA-based compounds with tailored performance attributes for specific end-uses like high-temperature lubricants or long-lasting cosmetic esters. Machine learning algorithms are also helping chemical companies predict product compatibility and performance in various formulations, shortening the product development cycle and improving time-to-market.

On the commercial side, AI is revolutionizing demand forecasting and inventory management. By analyzing global consumption trends, seasonality, and raw material price fluctuations, AI systems help manufacturers and distributors make data-driven decisions about production planning, pricing, and distribution. AI-enabled CRM platforms also provide insights into evolving customer preferences and regulatory shifts, helping companies stay ahead of demand and compliance requirements.

Furthermore, AI is aiding in regulatory compliance and sustainability tracking, ensuring that INA-based products meet stringent environmental and safety standards across global markets. This is particularly valuable in regions like Europe, where REACH regulations demand robust documentation and sustainability reporting.

Market Scope

| Report Coverage | Details |

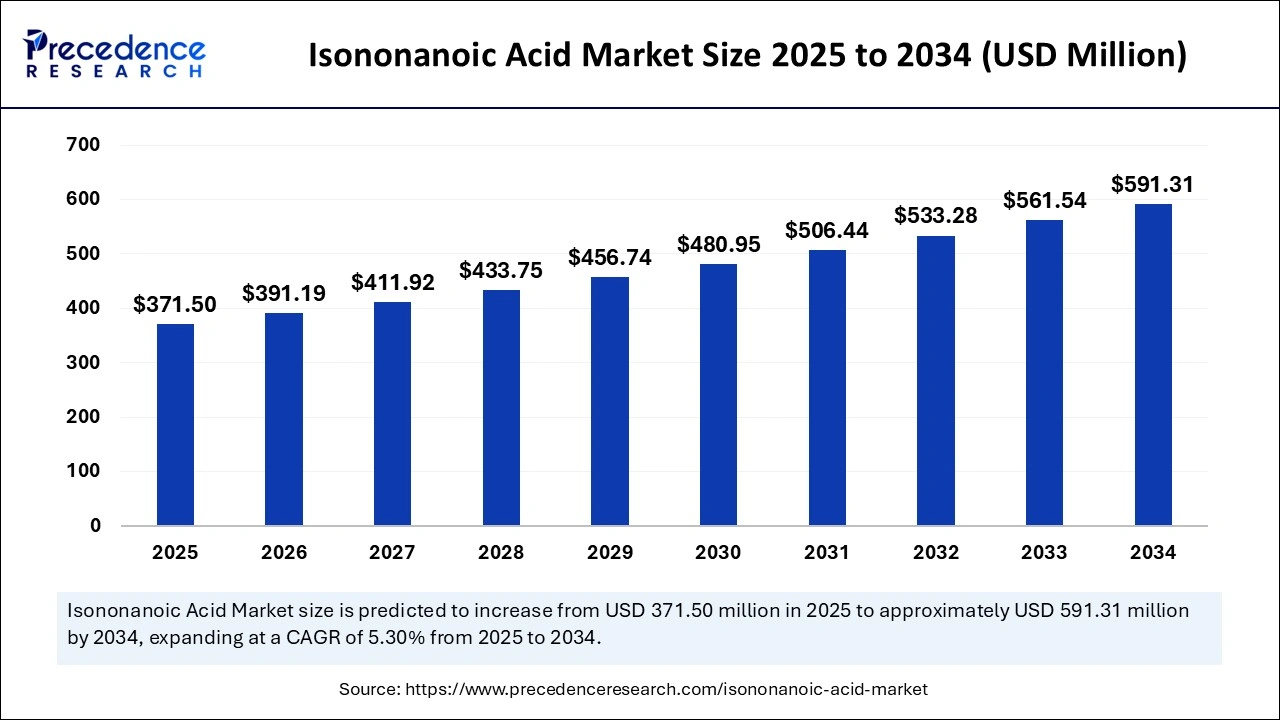

| Market Size by 2034 | USD 591.31 Million |

| Market Size in 2025 | USD 371.50 Million |

| Market Size in 2024 | USD 352.80 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.30% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, End-use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Isononanoic Acid Market Market Drivers

Key drivers of the isononanoic acid market include the increasing use of high-performance lubricants in automotive and industrial sectors. With the growth of electric vehicles (EVs) and advanced manufacturing systems, the need for synthetic lubricants that can withstand severe operating conditions is higher than ever. INA-derived esters offer excellent lubrication, thermal resistance, and biodegradability, making them highly attractive to OEMs and lubricant formulators.

The expansion of the coatings industry is another major driver. Isononanoic acid is used to synthesize metal salts like cobalt, manganese, and zinc naphthenates, which act as driers and corrosion inhibitors in paints and coatings. As the construction and automotive industries rebound post-pandemic, demand for durable coatings and anti-corrosion products is surging globally.

Additionally, the cosmetics industry’s shift toward non-toxic and dermatologically safe ingredients is benefiting the market. INA-based emollients offer excellent formulation flexibility and skin compatibility, meeting the clean-label and performance expectations of modern skincare brands.

Global supply chain diversification and the rising preference for chemical intermediates with multifunctional applications also continue to drive the market, especially as companies seek alternatives to volatile petrochemical feedstocks.

Opportunities

There are several promising opportunities in the isononanoic acid market. One lies in the growing demand for bio-based and sustainable chemical intermediates. Manufacturers are investing in greener production pathways for INA, including renewable feedstocks and low-emission synthesis techniques, to cater to environmentally conscious industries and comply with tightening global regulations.

Another key opportunity is in emerging applications of INA in energy storage and electronics. Researchers are exploring INA esters in thermal management fluids and dielectric cooling solutions for batteries and data centers, driven by the global shift toward electrification and high-density computing.

Geographic expansion into high-growth economies—particularly in Southeast Asia, the Middle East, and Africa—presents a lucrative opportunity, as industries such as automotive, paints and coatings, and cosmetics continue to grow in these regions. Companies that invest in local production facilities, distribution networks, and partnerships are likely to gain a competitive edge.

Further opportunities exist in specialty chemical and performance additive markets, where INA’s branched structure offers versatility in creating custom formulations. Tailoring INA derivatives for niche segments like marine coatings, biodegradable lubricants, or pharmaceutical excipients could open up high-margin product lines.

Challenges

Despite its positive outlook, the isononanoic acid market faces several challenges. One major hurdle is the volatility of raw material prices, particularly petrochemical feedstocks derived from n-butene or isononyl alcohol. Supply chain disruptions and geopolitical tensions can significantly affect input costs and profit margins for manufacturers.

Environmental concerns related to traditional chemical synthesis methods, including emissions and waste generation, pose another challenge. As regulations tighten around chemical manufacturing, especially in Europe and North America, producers are under pressure to adopt greener technologies—often requiring significant capital investments.

Market competition and pricing pressure also challenge growth. The presence of multiple regional and global suppliers, especially from China and Southeast Asia, can lead to commoditization and margin compression in bulk applications like lubricants and coatings.

Moreover, technical barriers in product formulation—such as ensuring compatibility with other ingredients, maintaining stability, and meeting evolving performance benchmarks—can hinder market expansion, particularly in regulated end-use sectors like cosmetics and pharmaceuticals.

Lastly, complex and varying international regulatory frameworks add compliance burdens, especially when exporting across different regions with unique environmental, safety, and labeling standards.

Isononanoic Acid Market Regional Outlook

North America represents a mature and significant market for isononanoic acid, driven by the robust presence of chemical manufacturers, a thriving cosmetics industry, and a strong automotive sector demanding synthetic lubricants. The U.S. leads in R&D for high-performance esters and sustainable chemical formulations, making it a hub for innovation.

Europe is a major consumer and regulatory trendsetter in this market, particularly due to stringent REACH regulations and sustainability goals. Countries like Germany, France, and the Netherlands are investing in clean technologies and bio-based chemicals, which is pushing the demand for environmentally friendly INA derivatives in coatings, cosmetics, and industrial applications.

Asia-Pacific is the fastest-growing region, with China, India, Japan, and South Korea leading the charge. Rapid industrialization, expanding automotive production, and a growing middle-class consumer base have accelerated demand for INA in lubricants and personal care products. Local manufacturing capacity and cost advantages make Asia-Pacific a key production and consumption hub.

Latin America and the Middle East & Africa are emerging markets showing increased demand for specialty chemicals and performance additives. Growth in infrastructure development, automotive aftermarket, and cosmetic imports are supporting INA demand in these regions. However, market penetration is moderated by economic volatility and regulatory challenges.

Isononanoic Acid Market Companies

- BASF SE

- Evonik Industries AG

- OXEA GmbH

- KH Neochem Co., Ltd.

- ExxonMobil Chemical Company

- Shell Chemicals

- Dow Chemical Company

- Eastman Chemical Company

- Perstorp Holding AB

- Lanxess AG

- Mitsubishi Chemical Corporation

- INEOS Group Holdings S.A.

- LG Chem Ltd.

- SABIC (Saudi Basic Industries Corporation)

- Arkema Group

- Croda International Plc

- Clariant AG

- Solvay S.A.

- Akzo Nobel N.V.

- Huntsman Corporation

Segments Covered in the Report

By Product Type

- Synthetic Isononanoic Acid

- Natural Isononanoic acid

By Application

- Lubricants

- Plasticizers

- Coatings

- Adhesives

- Others

By End-use Industry

- Automotive

- Construction

- Electronics

- Personal care

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6111

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344