Telecom Billing and Revenue Management Market Key Points

- North America led the global market in 2024, holding the largest market share of 36%.

- Asia Pacific is projected to register the fastest CAGR of 12.24% during the forecast period.

- By component, the solutions segment accounted for the largest share of 65% in 2024.

- The services segment is anticipated to grow at the fastest CAGR throughout the forecast timeline.

- Based on deployment, the on-premise segment dominated the market in 2024.

- The cloud segment is expected to experience the highest growth rate in the coming years.

- By application, the mobile operators segment held a significant share of the market in 2024.

- The internet service providers (ISPs) segment is projected to expand at a rapid pace during the forecast period.

Telecom Billing and Revenue Management Market Overview

The telecom billing and revenue management market plays a central role in the operational backbone of telecommunications service providers. It encompasses systems, solutions, and platforms that support the accurate charging, billing, revenue assurance, fraud detection, and financial management of telecom services. As telecom operators deal with increasingly complex service portfolios—ranging from traditional voice and SMS to high-speed internet, IoT connectivity, and content streaming—efficient billing and revenue management solutions have become mission-critical. The market spans both legacy on-premise systems and modern cloud-based platforms, serving mobile network operators (MNOs), internet service providers (ISPs), and digital communication service providers.

With rising customer expectations for real-time services, transparent pricing, and digital engagement, telecom billing systems are being upgraded to support multi-play offerings, convergence billing, and dynamic usage-based pricing. At the same time, revenue management solutions are needed to ensure profitability, reduce leakages, and streamline financial operations. As telecom operators navigate the transition to 5G, edge computing, and digital transformation, the billing and revenue management landscape is evolving rapidly, creating a sizable and growing market opportunity.

Telecom Billing and Revenue Management Market Growth Factors

The telecom billing and revenue management market is being propelled by a number of key growth factors. One of the most prominent is the rollout of 5G networks, which introduces complex use cases such as network slicing, ultra-low latency services, and massive machine-type communication. These use cases demand real-time billing and highly agile revenue management systems capable of supporting differentiated service tiers and dynamic pricing models.

Another important growth factor is the rapid increase in mobile data consumption and digital service offerings. As consumers and enterprises subscribe to OTT platforms, cloud services, e-learning, and IoT-based solutions through telecom networks, service providers need robust systems to manage billing across diverse services and partnerships.

The increased adoption of convergent billing systems that unify billing for multiple services (voice, data, content, and value-added services) under a single platform is also fueling market demand. These systems offer a seamless customer experience and simplify backend operations.

Moreover, regulatory compliance requirements and tax reforms—especially in emerging markets—are pushing operators to modernize their billing systems. Regulations such as real-time tax calculation, e-invoicing mandates, and consumer data protection laws are driving investments in compliant, secure, and scalable billing infrastructures.

Impact of AI on the Telecom Billing and Revenue Management Market

Artificial Intelligence (AI) is profoundly reshaping the telecom billing and revenue management market by introducing new levels of automation, efficiency, and intelligence. AI-powered systems can enhance accuracy in billing processes by automatically detecting discrepancies, anomalies, and leakages across large volumes of transactional data. This is especially valuable in revenue assurance, where AI algorithms are capable of identifying under-billing or over-billing scenarios in real time.

AI is also revolutionizing fraud detection and prevention within billing systems. Machine learning models can monitor user behavior, flag suspicious activities, and adapt to new fraud patterns without manual intervention. For telecom operators, this translates into minimized revenue loss and enhanced operational trust.

In the realm of customer experience, AI is enabling predictive billing and personalized pricing strategies. Based on a user’s historical usage patterns, preferences, and credit behavior, AI can suggest the most suitable plans or detect churn risks early, enabling proactive retention strategies. AI chatbots and virtual assistants are also improving self-service options for billing inquiries and payment support.

Furthermore, AI enhances dynamic monetization models by helping telecom operators simulate and optimize new business models—such as pay-per-use, freemium services, and usage-based pricing in IoT ecosystems. As 5G and edge computing scale, AI-driven billing will become essential for managing micro-transactions and real-time billing for latency-sensitive applications like gaming, autonomous vehicles, and smart cities.

Market Scope

| Report Coverage | Details |

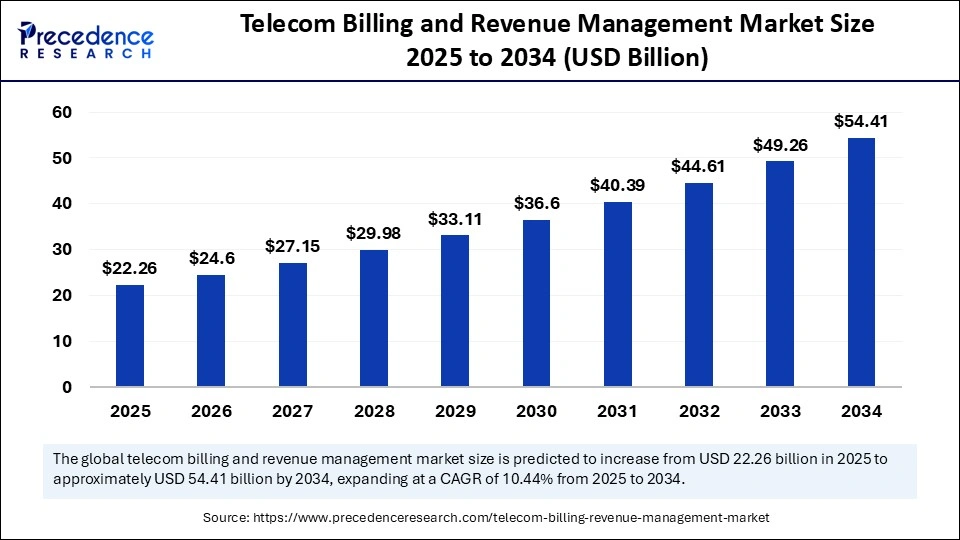

| Market Size by 2034 | USD 54.41 Billion |

| Market Size in 2025 | USD 22.26 Billion |

| Market Size in 2024 | USD 20.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.44% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Application, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

Key drivers fueling the growth of the telecom billing and revenue management market include the increasing complexity of service offerings and customer expectations. Consumers now demand flexible plans, real-time usage visibility, bundled services, and accurate, transparent bills. To meet these demands, telecom operators must invest in next-gen billing platforms that can handle multi-channel, multi-currency, and multi-device transactions.

The digital transformation of telecom operators is another major driver. As telcos pivot to become digital service providers, they require agile billing systems capable of supporting not only connectivity services but also digital content, cloud storage, e-commerce, and enterprise solutions. This shift demands platforms that integrate seamlessly with CRM, analytics, and partner ecosystems.

The rise of partnership-driven revenue models in telecom—such as MVNOs, B2B2X models, and OTT bundling—requires transparent and scalable revenue sharing mechanisms. Billing systems must be able to allocate, track, and reconcile revenues across multiple stakeholders in real time.

Additionally, cost pressure and operational efficiency mandates are pushing operators to adopt cloud-native billing solutions that reduce IT overhead, offer modularity, and enable rapid deployment. Subscription billing, AI-driven automation, and low-code platforms are accelerating innovation in this space.

Opportunities

The telecom billing and revenue management market presents numerous opportunities, especially in emerging markets where mobile penetration is growing rapidly. Telcos in Africa, Southeast Asia, and Latin America are transitioning from basic voice services to digital ecosystems, opening new opportunities for flexible billing solutions tailored to prepaid and unbanked customers.

A significant opportunity lies in the expansion of billing systems for 5G enterprise use cases—such as smart manufacturing, connected healthcare, logistics, and smart cities. As telecom operators provide network-as-a-service and other B2B solutions, they need billing platforms that can support SLAs, on-demand provisioning, and metered usage models.

Another opportunity is the integration of blockchain in revenue management. Blockchain-based smart contracts and distributed ledgers can improve transparency in partner settlements, reduce disputes, and streamline multi-party billing agreements—particularly in complex roaming or content-sharing scenarios.

The growth of IoT connectivity billing represents another key area, as enterprises deploy thousands or millions of connected devices across networks. IoT billing systems must handle micro-payments, event-based charging, and flexible plan management, presenting opportunities for software vendors and managed service providers.

Challenges

Despite promising growth, the telecom billing and revenue management market faces several challenges. One of the biggest is the legacy infrastructure still used by many telecom operators. These older systems are often rigid, siloed, and expensive to upgrade, making it difficult to adopt real-time and convergent billing solutions without significant investment and risk.

Another challenge is the increasing complexity of billing scenarios, particularly with the emergence of new technologies like 5G, network slicing, and B2B2X ecosystems. Operators must navigate a labyrinth of use cases, pricing models, and compliance needs while maintaining system performance and customer satisfaction.

Data integration and interoperability issues also persist, especially as telcos merge, expand, or partner with third parties. Billing systems must seamlessly interface with CRM, ERP, payment gateways, analytics, and digital platforms—each of which may have its own data standards and security protocols.

Security and compliance are additional concerns. With growing data privacy regulations (like GDPR and CPRA), billing systems must ensure that customer data is protected, auditable, and handled in accordance with jurisdictional laws.

Lastly, the high cost of transformation can deter smaller telecom players from upgrading their billing systems, making them vulnerable to inefficiencies, revenue leakage, and poor customer experience.

Regional Outlook

North America dominates the telecom billing and revenue management market, owing to its early adoption of 5G, large customer bases, and presence of major telecom operators and tech vendors. U.S. and Canadian operators are investing in cloud-based billing, real-time charging, and AI-enhanced customer engagement tools.

Europe follows closely, with robust regulatory frameworks and a highly competitive telecom environment pushing operators toward convergent and digital billing platforms. The EU’s emphasis on consumer rights and data protection further supports investments in transparent and compliant billing systems.

Asia Pacific is the fastest-growing region, led by countries like China, India, Japan, and South Korea. The region’s massive mobile user base, growing digital ecosystems, and aggressive 5G rollout are driving strong demand for scalable and flexible billing platforms. Additionally, high smartphone penetration and low ARPU markets are fueling innovations in prepaid and hybrid billing models.

Latin America and Middle East & Africa offer promising long-term potential, as telecom operators upgrade infrastructure and introduce bundled digital services. Regional challenges include economic volatility and regulatory diversity, but the growing demand for mobile broadband and e-wallets presents strong opportunities for innovative billing solutions.

Telecom Billing and Revenue Management Market Companies

- Amdocs

- Cerillion Technologies Ltd

- Comarch SA

- CSG Systems, Inc.

- Formula Telecom Solutions Ltd

- Huawei Technologies Co., Ltd

- Intracom Telecom

- Comviva

- Netcracker

- Optiva, Inc.

- Oracle

- SAP SE

- STL Tech

- SUBEX

- Telefonaktiebolaget LM Ericsson

Segments Covered in the Report

By Component

- Solutions

- Services

By Deployment

- On-premise

- Cloud

By Application

- Mobile operators

- Internet service providers

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Read Also: Digital Forensics Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6253

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344