Credit Risk Assessment Market Key Points

-

North America dominated the credit risk assessment market with the largest share of 36% in 2024.

-

Asia Pacific is projected to grow at the highest CAGR from 2025 to 2034.

-

By component, the software segment held the major market share in 2024.

-

The service segment, by component, is expected to grow at the fastest CAGR between 2025 and 2034.

-

By deployment model, the on-premises segment contributed the largest market share in 2024.

-

The cloud segment, by deployment model, is projected to expand at a significant CAGR between 2025 and 2034.

-

By organization size, the large enterprises segment led the market in 2024.

-

The SMEs segment, by organization size, is expected to grow at a substantial CAGR over the forecast period.

-

By vertical, the BFSI segment accounted for the largest market share in 2024.

-

The telecom & IT segment, by vertical, is projected to grow at a notable CAGR in the coming years.

-

By technology, traditional credit risk assessment held the dominant market share in 2024.

-

The AI and ML-enabled credit risk assessment segment is anticipated to register the highest CAGR from 2025 to 2034.

Credit Risk Assessment Market Overview

The global credit risk assessment market is experiencing substantial growth due to the increasing demand for efficient financial risk management across banking, financial services, and insurance (BFSI) sectors. As credit risk represents one of the most significant risks faced by lenders and investors, organizations are increasingly investing in advanced analytics, artificial intelligence (AI), and machine learning (ML) models to enhance the accuracy and speed of credit risk evaluation. This market encompasses various tools and platforms designed to assess the probability of a borrower defaulting on their financial obligations.

The market includes software, services, and integrated solutions used for credit scoring, financial behavior analysis, and fraud detection. With the rise in digital banking, the proliferation of credit data, and regulatory pressures to improve transparency and capital adequacy, the credit risk assessment market is transitioning from traditional scoring models to real-time, data-driven systems. In 2024, the market was led by North America, accounting for a 36% share, and is projected to grow steadily through the forecast period from 2025 to 2034.

Credit Risk Assessment Market Growth Factors

A combination of regulatory reforms, technological advancements, and the growing need for automation in financial operations is fueling the growth of the credit risk assessment market. One of the primary growth factors is the increasing volume of credit applications, particularly from small and medium-sized enterprises (SMEs) and retail customers in emerging economies. This has necessitated the development of scalable and efficient risk evaluation frameworks.

Moreover, the integration of big data analytics, AI, and predictive modeling allows financial institutions to gain deeper insights into customer behavior, payment patterns, and financial health, thereby improving the quality of credit decisions. Additionally, the digital transformation of the banking sector, accelerated by the COVID-19 pandemic, has further underscored the importance of automated and remote-friendly risk assessment solutions, adding to the market’s momentum.

Market Scope

| Report Coverage | Details |

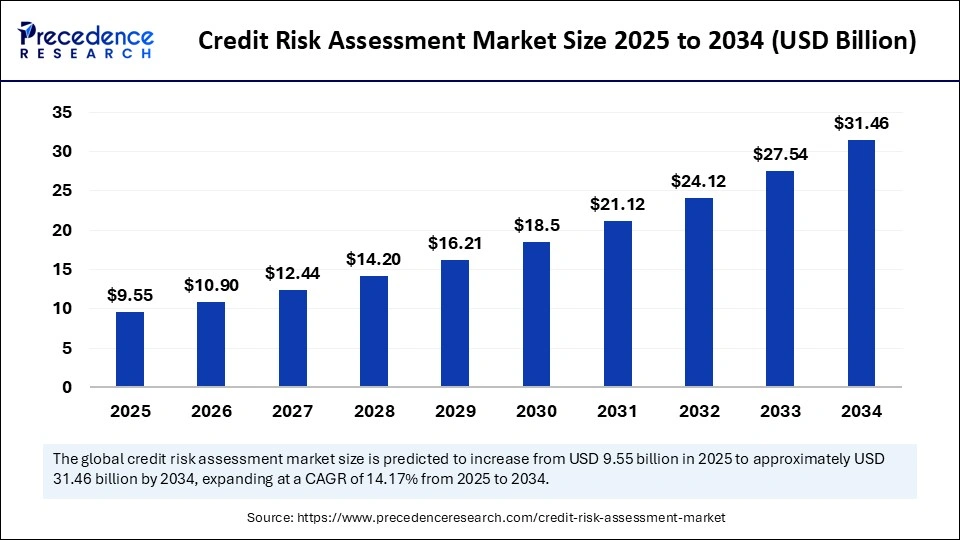

| Market Size by 2034 | USD 31.46 Billion |

| Market Size in 2025 | USD 9.55 Billion |

| Market Size in 2024 | USD 8.36 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.17% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Model, Organization Size, Vertical, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

Key drivers propelling the credit risk assessment market include the increasing complexity of financial transactions, the rise in non-performing loans (NPLs), and the need for improved operational efficiency in credit management. Regulatory mandates such as Basel III and IFRS 9 have pushed financial institutions to adopt advanced risk management practices, including real-time monitoring and scenario-based stress testing.

Furthermore, the growing incidence of cyber threats and identity fraud has driven demand for credit risk platforms that offer fraud detection and identity verification capabilities. The advent of cloud-based risk assessment solutions also acts as a significant driver, enabling institutions to scale and adapt to changing compliance requirements without investing in expensive IT infrastructure.

Opportunities

The credit risk assessment market presents several promising opportunities, particularly in emerging markets across Asia Pacific, Latin America, and Africa, where financial inclusion is increasing rapidly. With more individuals and businesses gaining access to formal credit systems, there is a rising need for credit evaluation tools tailored to thin-file and unbanked customers. This opens the door for alternative data sources such as mobile usage, utility payments, and e-commerce behavior to be used in credit scoring models.

Moreover, fintech companies and neobanks are exploring innovative credit risk platforms that are more inclusive and flexible than traditional models. Partnerships between traditional financial institutions and technology providers also offer lucrative growth opportunities, especially in developing integrated platforms that combine credit risk assessment with loan origination, underwriting, and portfolio management.

Challenges

Despite its growth potential, the credit risk assessment market faces several challenges. Data privacy concerns and stringent regulatory standards regarding the use of personal and financial data present significant hurdles. In regions with fragmented regulatory frameworks, inconsistent data availability and quality can hinder the development of reliable credit models.

Additionally, the high cost and complexity of implementing advanced risk management systems can be a barrier for smaller institutions. There is also a growing concern about algorithmic bias and the ethical implications of AI-based credit scoring, which could result in discriminatory lending practices if not properly managed. These challenges call for robust governance, transparent algorithms, and regular audits to ensure fairness and compliance.

Regional Outlook

Regionally, North America dominates the credit risk assessment market due to the strong presence of major financial institutions, fintech innovators, and a well-established regulatory environment. The region continues to invest heavily in AI and analytics to enhance credit risk capabilities. Europe is also a key market, driven by stringent compliance norms such as GDPR and an increasing focus on ESG (Environmental, Social, and Governance) risks in lending decisions.

Asia Pacific is expected to register the highest CAGR from 2025 to 2034, fueled by expanding digital banking ecosystems, government initiatives to increase financial inclusion, and a surge in fintech activity across countries like India, China, and Indonesia. In Latin America and Africa, the market is gaining traction as mobile banking and alternative lending platforms become more prevalent, although challenges like limited credit data and regulatory fragmentation persist. Overall, the global credit risk assessment market is poised for steady expansion as it adapts to new technologies and the evolving needs of a digital-first financial landscape.

Credit Risk Assessment Market Companies

- ACL

- BRASS

- Equifax

- Experian

- FICO

- Fiserv

- Genpact

- IBM

- Kroll

- Misys

- Moody’s Analytics

- Oracle

- Pegasystems

- PRMIA

- Risk data

- Risk Spotter

- Riskonnect

- SAP

- SAS Institute

- TransUnion

Segments covered in the report

By Component

- Services

- Software

By Deployment Model

- Cloud

- On-premises

By Organization Size

- Large Enterprises

- SMEs

By Vertical

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Telecom & IT

- Others

By Technology

- AI & ML-enabled Credit Risk Assessment

- Traditional Credit Risk Assessment

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Read Also: AI-enabled Fleet Management System Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6242

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344