Next Generation Non-Volatile Memory Market: Revolutionizing the Future of Data Storage

As data volumes explode across industries, traditional storage technologies are reaching their physical and performance limitations. This shift has paved the way for innovations in memory architecture, particularly in the form of next-generation non-volatile memory (NVM) solutions. Combining the speed of volatile memory with the data retention of non-volatile types, these emerging technologies are transforming everything from mobile devices and AI systems to automotive electronics and cloud infrastructure.

This blog explores the key dynamics shaping the next-generation non-volatile memory market, including technology trends, growth drivers, challenges, competitive landscape, and future prospects.

What is Next Generation Non-Volatile Memory?

Non-volatile memory retains data even when power is turned off, making it essential for data storage devices. Traditional forms like NAND flash and NOR flash have served the industry well, but as demand for faster, denser, and more energy-efficient memory grows, they are increasingly inadequate.

Next Generation Non-Volatile Memory refers to advanced memory technologies that offer significant improvements in speed, scalability, endurance, and power efficiency. These include:

-

Resistive RAM (ReRAM)

-

Magnetoresistive RAM (MRAM)

-

Phase-Change Memory (PCM)

-

Ferroelectric RAM (FeRAM)

-

3D XPoint (Intel’s Optane)

-

Nano-RAM (NRAM)

These technologies are designed to bridge the gap between traditional DRAM (volatile) and flash (non-volatile), enabling faster boot times, enhanced application performance, and better energy management in smart devices and enterprise systems.

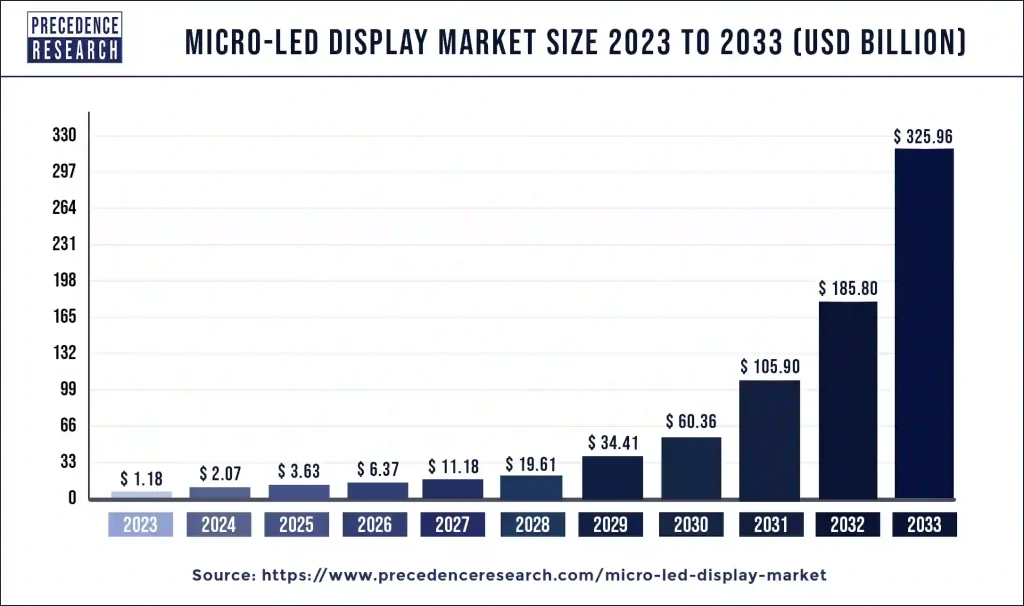

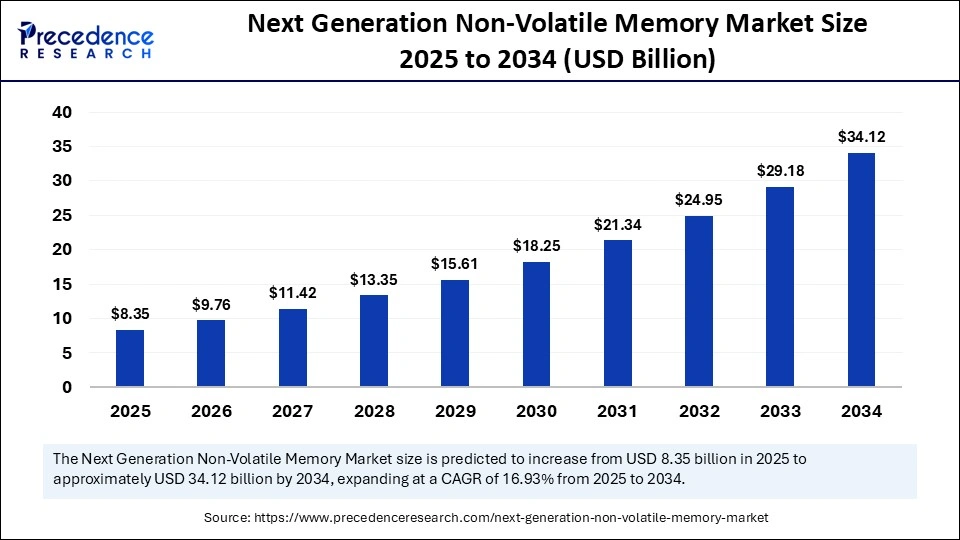

Next Generation Non-Volatile Memory Market Size and Forecast

The global next generation non-volatile memory market size is calculated at USD 8.35 billion in 2025 and is forecasted to reach around USD 34.12 billion by 2034, accelerating at a CAGR of 16.93% from 2025 to 2034.

This surge is fueled by the increasing demand for advanced memory in data centers, automotive electronics, IoT devices, and AI-enabled platforms. The rise in cloud computing, edge devices, and big data analytics also places pressure on legacy systems, creating opportunities for memory technologies with higher endurance and faster access times.

North America currently leads the market, followed by Asia Pacific, which is expected to witness the fastest growth due to rising chip manufacturing capabilities in countries like China, South Korea, and Taiwan.

Growth Drivers of the Market

One of the primary drivers of the Next Generation Non-Volatile Memory Market is the growing demand for high-speed, low-power memory in consumer electronics and enterprise applications. Smartphones, wearables, gaming consoles, and autonomous vehicles require fast read/write capabilities and robust energy efficiency—criteria that next-gen NVM technologies meet effectively.

Another major factor is the need for scalability and miniaturization. As device sizes shrink and functionality increases, there’s a growing demand for compact, high-density memory solutions. Next-gen memories, especially 3D-structured ones like 3D XPoint, allow for higher data densities while minimizing latency.

In automotive and industrial automation, the shift toward electric vehicles (EVs), advanced driver-assistance systems (ADAS), and smart factories is amplifying demand for memory that is not only fast and durable but also able to operate reliably under extreme conditions. Technologies like MRAM and ReRAM are emerging as ideal candidates for these use cases due to their robustness and low power requirements.

Additionally, AI and machine learning workloads are pushing conventional DRAM and flash storage to their limits. Next-generation NVM offers a faster alternative that supports real-time data processing and model training, particularly in edge AI applications.

Next Generation Non-Volatile Memory Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 34.12 Billion |

| Market Size in 2025 | USD 8.35 Billion |

| Market Size in 2024 | USD 7.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.93% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type Outlook, Wafer Size Outlook, Application Outlook, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Key Challenges and Restraints

Despite the promising outlook, several challenges inhibit the broader adoption of next-generation non-volatile memory. The high cost of development and manufacturing is a significant barrier, especially for startups or small-scale device manufacturers. Compared to traditional NAND or DRAM, many next-gen solutions remain expensive and are primarily used in niche or high-performance markets.

Another issue is limited backward compatibility. Integrating new memory technologies often requires modifications to system architecture, software, and interfaces, which can be costly and time-consuming. Adoption is therefore slower in industries with legacy systems.

Additionally, low production volumes and limited supplier networks can restrict availability and increase pricing volatility. Reliability concerns and the lack of standardization in some technologies also make it difficult for OEMs to scale deployment across diverse product lines.

As research matures and volume production increases, these limitations are expected to decline—but for now, they remain key hurdles.

Technology Landscape and Competitive Dynamics

The market is segmented by technology, application, end-user, and region. Among technologies:

-

MRAM is gaining traction for embedded applications and in automotive sectors due to its endurance and low latency.

-

ReRAM is emerging as a strong candidate for IoT devices and edge computing, providing low power consumption with high density.

-

PCM is ideal for applications requiring multilevel cell storage and is being explored for storage-class memory (SCM) use cases.

-

3D XPoint, developed by Intel and Micron, is being positioned as an ultra-fast alternative to NAND in data centers and high-performance computing.

-

FeRAM finds niche uses in smart cards, RFID, and small sensor systems due to its low energy and fast write performance.

On the competitive front, the market includes both tech giants and specialized startups. Key players include:

-

Intel Corporation

-

Micron Technology Inc.

-

Samsung Electronics Co. Ltd.

-

Western Digital Corporation

-

Everspin Technologies

-

Avalanche Technology

-

Adesto Technologies (Dialog Semiconductor)

-

Crossbar Inc.

-

Fujitsu Ltd.

-

Nantero Inc.

These companies are investing in R&D, IP development, and strategic collaborations with OEMs to scale their technologies. Collaborations between foundries and memory developers are also on the rise, enabling faster commercialization and integration of new memory types into consumer and industrial devices.

Regional Market Insights

North America dominates the next-gen NVM landscape due to its strong semiconductor R&D base, early tech adoption, and investments in AI and data centers. The presence of leading players like Intel and Micron further enhances regional innovation.

Asia Pacific is the fastest-growing market, with South Korea, China, and Japan at the forefront of memory chip production. Government-backed initiatives in semiconductor self-reliance and growing local demand from the consumer electronics and automotive sectors are propelling the region’s growth.

Europe also holds significant potential, especially with its focus on automotive innovation and industrial automation. The region is investing in building a resilient semiconductor supply chain and promoting collaborations across academia and industry.

Middle East & Africa and Latin America are emerging markets with growing demand for connected devices, digital infrastructure, and smart city projects—all of which will need next-gen memory solutions.

Emerging Trends and Innovations

Several trends are shaping the future of the next-generation NVM market:

-

Storage-Class Memory (SCM): Bridging the performance gap between DRAM and SSD, SCM allows faster access to stored data and is seen as a key enabler for in-memory computing.

-

AI-Integrated Memory Systems: Next-gen NVM is being integrated into AI accelerators and neuromorphic computing platforms to allow for data processing closer to the memory layer, reducing latency.

-

Embedded NVM in Microcontrollers: Applications in IoT and automotive demand memory that can retain data with minimal energy usage. Embedded MRAM and ReRAM are increasingly replacing EEPROM and NOR flash in these devices.

-

Flexible and Wearable Memory Devices: Research is advancing into NVMs that are printable, bendable, and suitable for use in wearables and biomedical sensors.

-

Open Source and Ecosystem Development: To drive adoption, companies are investing in SDKs, APIs, and software layers that allow developers to optimize performance for NVM-specific use cases.

Conclusion

The next generation non-volatile memory market represents the future of high-speed, energy-efficient, and scalable data storage. As digital transformation accelerates across industries, the need for memory solutions that can meet real-time processing, reliability, and miniaturization requirements is more pressing than ever.

While cost, integration, and production challenges persist, ongoing innovation and investment from technology giants and governments alike suggest a strong growth trajectory. The increasing convergence of NVM with AI, IoT, and automotive systems will ensure that this market remains at the heart of next-gen computing.

For investors, OEMs, and technologists, now is the ideal time to engage with and shape the rapidly evolving NVM ecosystem.

Also Read: Photonic Integrated Circuit Market

Also Read: Distributed Temperature Sensing Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6209

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344