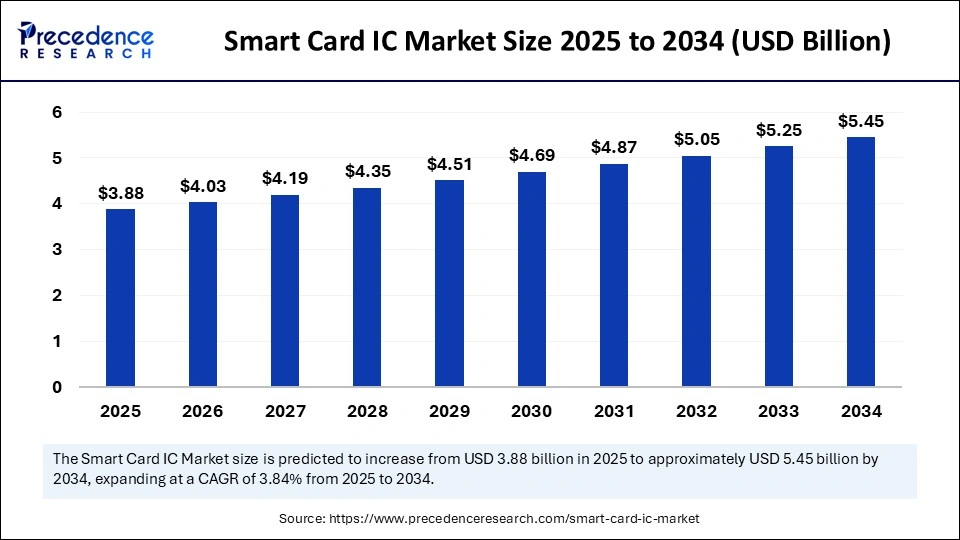

Smart Card IC Market Key Points

-

Asia Pacific led the global smart card IC market with the largest revenue share in 2024.

-

North America is projected to grow at the fastest CAGR from 2025 to 2034.

-

By type, the contactless segment accounted for the major revenue share in 2024.

-

The contact segment is expected to grow at the highest CAGR during the forecast period.

-

In terms of architecture, the 16-bit segment dominated the market in 2024.

-

The 32-bit segment is anticipated to expand at the fastest CAGR between 2025 and 2034.

-

By configuration, microprocessor-based cards held the largest market revenue share in 2024.

-

The hybrid smart cards segment is projected to grow at a significant CAGR in the coming years.

-

Based on application, the ID cards segment contributed the biggest revenue share in 2024.

-

Among end-users, the government segment led the market in 2024.

-

The healthcare segment is expected to witness significant growth over the projected period.

Overview of Smart Card IC

Smart Card IC (Integrated Circuit) is a microchip embedded in smart cards that enables secure data storage and processing. These chips are the core components of contact and contactless smart cards used in banking, identification, healthcare, telecom (SIM cards), and transit systems. Smart Card ICs support encryption, authentication, and secure communication, making them critical for protecting sensitive information and enabling secure transactions. The IC typically includes a microcontroller, memory (EEPROM, ROM, RAM), and security logic.

Market Growth and Applications

The global market for smart card ICs is growing steadily due to rising demand for digital identity verification, cashless payments, and data security. The financial sector remains the largest consumer, especially with the widespread adoption of EMV (Europay, Mastercard, and Visa) standards. Government initiatives like e-passports, national ID programs, and healthcare cards are further fueling growth. Technological advancements such as dual-interface chips, biometric integration, and improved cryptographic features are enhancing the functionality and security of smart card ICs, ensuring their continued relevance in an increasingly digital and security-conscious world.

How Is AI Enhancing the Smart Card IC Market?

AI is driving innovation in smart card integrated circuits by enabling adaptive and intelligent functionality directly within the chip. Using embedded neural network models, smart card ICs can perform real-time biometric verification, contextual authentication, and secure data exchanges without relying on external systems. For example, AI-enhanced smart cards can identify trusted devices, adjust interactions based on usage context, and even support advanced features such as dynamic data display or peer-to-peer communication. These capabilities significantly improve security, user experience, and flexibility across sectors like banking, healthcare, and access control.

On the production and development side, AI accelerates the design and manufacturing of smart card chips by analyzing extensive process and market data. It helps optimize chip layouts, predict potential performance issues, and maintain quality consistency. This enables faster rollout of next-gen smart cards with advanced features like dual-interface capabilities, embedded biometrics, and improved resistance to tampering. As demand rises for secure digital identity, contactless payments, and IoT authentication, AI is proving essential in making smart card ICs more reliable, efficient, and adaptable to evolving security needs.

Smart Card IC Market Growth Factors

-

Secure Contactless & Payment Demand

The widespread adoption of contactless solutions for payments, transport, and access control is increasing the need for secure, tamper-resistant smart card ICs. -

Government ID & E-Governance Programs

Government initiatives such as e-passports, digital identity cards, and social security cards are driving large-scale deployments of smart card ICs for authentication and data protection. -

Telecommunications & eSIM Expansion

The expansion of mobile communication, 5G networks, and connected devices is boosting demand for SIM and eSIM cards that rely on smart card ICs. -

Advancements in Biometric & Multi-Application ICs

Innovations such as biometric authentication, embedded encryption, and multifunctional system-on-chip solutions are enhancing smart card capabilities across industries. -

Emerging Market Penetration

Rapid digitalization in regions like Asia-Pacific, Latin America, and Africa is creating high demand for smart card ICs in areas such as banking, transit, healthcare, and telecommunications. -

IoT & Secure Element Integration

Smart card ICs are being integrated into IoT and connected devices to act as secure elements, enabling cryptographic security and trusted computing features. -

COVID-Era Boost in Contactless & Security Needs

The pandemic accelerated the shift toward contactless payments and digital IDs, increasing the demand for secure smart card ICs in both public and private sectors.

Market Drivers

The smart card IC (integrated circuit) market is being propelled by the increasing demand for secure and contactless payment solutions in both developed and developing economies. As digital transactions become more prevalent, there is a growing need for smart card ICs to enable secure authentication and data encryption in applications such as banking cards, SIM cards, national ID cards, transit passes, and access control systems.

Governments across the globe are actively adopting smart cards for e-governance and healthcare identification programs, boosting the market further. The rise of EMV (Europay, Mastercard, and Visa) standards and regulatory compliance mandates have accelerated the migration from magnetic stripe to chip-based cards, especially in financial services.

Additionally, the widespread deployment of mobile and contactless payment technologies, such as NFC (Near Field Communication), has increased the use of dual-interface and contactless smart card ICs, enhancing both convenience and security for users.

Opportunities

Significant growth opportunities exist in emerging markets where digital banking and government digitization initiatives are rapidly expanding. Countries in Asia, Africa, and Latin America are increasingly investing in national ID programs, smart transit systems, and financial inclusion initiatives that require secure IC-enabled cards.

The healthcare sector is another area of opportunity, with smart cards being used for storing medical histories, insurance information, and biometric data. Furthermore, the integration of smart card ICs into IoT ecosystems presents an avenue for expanding beyond traditional cards to devices and wearables that require secure authentication. Innovations in chip design, including the development of smaller, energy-efficient, and more secure ICs, offer vendors the chance to differentiate their products and enter new verticals such as automotive and smart homes.

The trend toward multi-application smart cards—combining identification, payment, and access control functionalities—also provides room for market expansion.

Challenges

Despite its growth potential, the smart card IC market faces several challenges. One of the major hurdles is the threat posed by alternative technologies such as biometric authentication and mobile-based digital IDs, which may reduce dependency on physical smart cards in the long term.

High initial costs associated with advanced ICs and infrastructure upgrades, especially in cost-sensitive markets, can hinder adoption. Cybersecurity remains a constant concern, as hackers continuously seek vulnerabilities in chip architectures, demanding constant innovation in encryption and secure chip design. Additionally, the market is characterized by intense competition among global and regional players, which can lead to price erosion and pressure on profit margins.

Regulatory and compliance differences across countries and sectors can also pose obstacles for standardization and large-scale implementation. Lastly, supply chain disruptions, particularly in semiconductor manufacturing, can impact production timelines and lead to shortages or cost increases for smart card ICs.

Regional Outlook

Asia-Pacific dominates the global smart card IC market, led by major manufacturing hubs in China, South Korea, Taiwan, and Japan, along with growing demand from India and Southeast Asian countries for financial, telecom, and government ID applications. China’s strong presence in semiconductor production and its push for digital identity and cashless transactions fuel regional dominance. North America holds a significant market share, driven by widespread use of EMV cards, secure access systems, and strong adoption of smart technologies in banking and retail.

Europe is also a mature market, with a high penetration of smart card systems in transport, healthcare, and national ID programs, particularly in countries like Germany, France, and the UK. Meanwhile, Latin America and the Middle East & Africa are emerging markets with increasing adoption of smart card technologies, particularly in mobile communications and digital government services.

However, infrastructure limitations and cost concerns in these regions can affect growth rates. Going forward, global regulatory alignment and technological convergence are expected to streamline smart card IC adoption across all geographies.

Smart Card IC Market Companies

- Infineon Technologies

- NXP Semiconductors

- STMicroelectronics

- Samsung Electronics

- IDEMIA

- Giesecke+Devrient

- Microchip Technology

- Texas Instruments

- Toshiba Corporation.

- Nations Technologies Inc.

Segment Covered in the Report

By Type

- Contact

- Contactless

By Architecture

- 16-bit

- 32-bit

By Configuration

- Memory Cards

- Microprocessor-based Cards

- Dual-interface Cards

- Hybrid Smart Cards

By Application

- SIM Cards

- ID Cards

- Employee IDs

- Citizen IDs

- ePassports

- Driving Licenses

- Financial Cards

- IoT Devices

- Others

By End-user

- IT & Telecommunications

- BFSI

- Government

- Healthcare

- Transportation

- Retail

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Also Read: RF Test Equipment Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6205

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344