Pet Calming Products Market Key Points

-

North America accounted for the largest revenue share of 39% in 2024.

-

Asia Pacific is projected to register the fastest CAGR of 7.2% from 2025 to 2034.

-

By pet type, the dog segment led the market with a 53% revenue share in 2024.

-

The cat segment is anticipated to grow at the fastest CAGR of 6.9% during the forecast period.

-

By product, the snacks and treats segment contributed the highest revenue share of 39% in 2024.

-

The gel and ointment segment is expected to grow at a notable CAGR of 8.2% between 2025 and 2034.

-

By type, the over-the-counter (OTC) segment held the largest revenue share of 64% in 2024.

-

The prescription segment is projected to expand at a CAGR of 6.9% over the forecast period.

-

By ingredient, the melatonin segment accounted for the highest revenue share of 27% in 2024.

-

The herbal segment is forecasted to grow at the highest CAGR of 6.8% from 2025 to 2034.

-

By distribution channel, the offline segment dominated with a 64% revenue share in 2024.

-

The online segment is expected to grow at a CAGR of 6.6% during the forecast period.

What Are Pet Calming Products and Why Are They Used?

Pet calming products are designed to help manage anxiety, stress, and behavioral issues in animals, especially in situations like travel, loud noises (fireworks, thunderstorms), separation, or visits to the vet. These products work by promoting relaxation without sedation and come in various forms such as treats, chews, sprays, diffusers, collars, supplements, and CBD-infused products. They are widely used for both dogs and cats, although the market for cats is growing rapidly.

These products often contain natural calming agents like chamomile, valerian root, L-theanine, melatonin, and pheromones, and are available in both over-the-counter (OTC) and prescription forms. The increasing trend of pet humanization and concern for animal well-being are key factors fueling their popularity.

How is AI Enhancing the Pet Calming Products Market?

AI is bringing innovation to the pet calming products market by helping manufacturers better understand pet behavior and personalize solutions. Through AI-powered monitoring devices and behavior-tracking apps, data on pets’ stress triggers, activity levels, and responses to calming aids can be collected and analyzed. This allows for the development of more targeted and effective calming products, such as treats, wearables, or diffusers tailored to individual pet needs.

Additionally, AI aids in product recommendation and customer engagement. By analyzing purchase history and pet profiles, AI-driven platforms can suggest the most suitable calming solutions for specific breeds, ages, or anxiety conditions. This personalization boosts customer satisfaction and supports product development that aligns with actual pet behaviors and needs, making AI a valuable asset in the growing pet wellness industry.

Pet Calming Products Market Growth Factors

The pet calming products market is expanding rapidly, fueled by the rising trend of pet humanization—where pets are regarded as family members and owners are willing to invest in their emotional well-being. Growing awareness of anxiety triggers such as thunderstorms, travel, and multi-pet households has led to increasing demand for calming supplements, pheromone diffusers, treats, and holistic remedies.

Natural ingredients like chamomile, valerian root, and CBD have gained popularity amid consumer preference for organic and clean-label solutions, while demand for specialized products for small or exotic pets is also on the rise. Online and offline retail expansion through e-commerce platforms, supermarkets, pet specialty stores, and veterinary clinics has made these products more accessible to pet owners.

Marker Scope

| Report Coverage | Details |

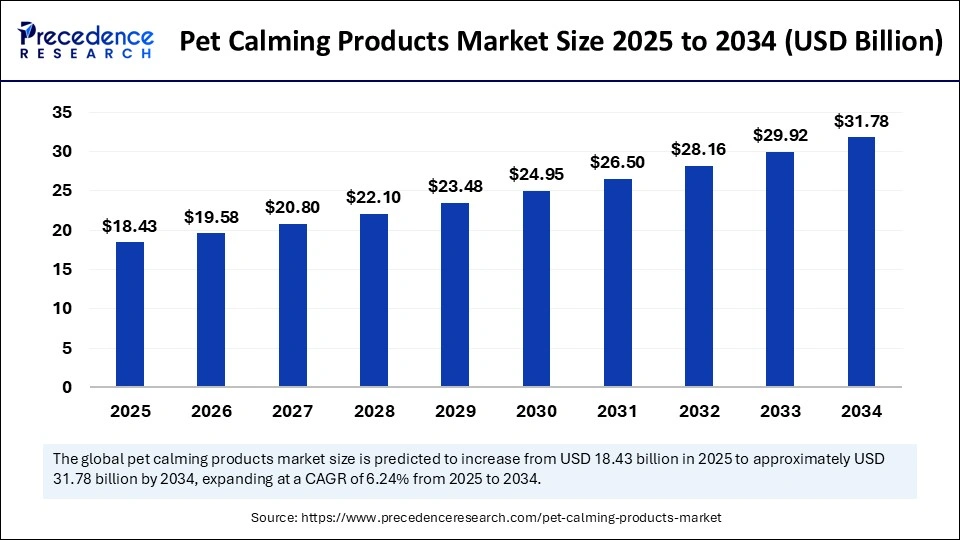

| Market Size by 2034 | USD 31.78 Billion |

| Market Size in 2025 | USD 18.43 Billion |

| Market Size in 2024 | USD 17.35 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Pet, Product, Type, Ingredient, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The pet calming products market is being propelled by the rising awareness among pet owners regarding pet health and wellness, particularly mental and emotional well-being. As more people treat pets as family members, there’s an increasing willingness to invest in products that help manage behavioral issues such as anxiety, aggression, hyperactivity, and stress. Common triggers like loud noises, travel, separation, and vet visits often lead to behavioral problems, especially in dogs and cats, creating strong demand for calming aids.

Furthermore, the growth in pet adoption, especially during and after the COVID-19 pandemic, has contributed to a surge in pet product sales, including those designed for emotional and behavioral health. The availability of diverse calming solutions—ranging from natural supplements and pheromone sprays to calming treats, vests, diffusers, and essential oils—caters to different pet owner preferences, thereby expanding the overall market. The increasing influence of e-commerce and social media, which amplify product visibility and customer reviews, also acts as a significant growth driver.

Market Opportunities

The pet calming products market offers vast opportunities for innovation and expansion. One major opportunity lies in the development of safe, organic, and veterinarian-approved formulations that appeal to health-conscious consumers. As pet owners increasingly seek clean-label and holistic options, brands offering herbal and non-toxic calming solutions have a strong competitive edge. Additionally, there is growing interest in CBD-based calming products, particularly in regions where regulations permit their use for pets.

Product differentiation through unique delivery formats—such as lickable gels, transdermal patches, and flavored chews—can also attract more customers. Technological advancements, including wearable calming devices or AI-based anxiety detection, present new product possibilities. Moreover, increased spending on pet wellness in emerging markets, coupled with greater pet humanization trends, offers significant potential for global market expansion. Collaboration with veterinarians, influencers, and pet care platforms for marketing and education can further fuel product adoption.

Market Challenges

Despite its growth, the pet calming products market faces a few significant challenges. One of the primary issues is the lack of standardized regulation and oversight, particularly for natural and CBD-infused calming products. This leads to inconsistent product efficacy, quality concerns, and potential health risks, which can erode consumer trust. Educating pet owners about the safe and appropriate use of these products remains a challenge, as misuse or overuse may lead to unintended side effects.

Furthermore, differentiating truly effective solutions from placebo-like products is difficult due to the subjective nature of pet behavior improvement, making it harder for new entrants to establish credibility. Price sensitivity among consumers, especially in developing countries, can also limit access to premium calming aids. Additionally, stringent regulatory frameworks in certain regions may restrict the marketing or sale of CBD and other alternative calming ingredients, constraining growth in those markets.

Regional Outlook

North America dominates the pet calming products market due to high pet ownership rates, elevated spending on pet wellness, and widespread awareness of pet anxiety issues. The U.S., in particular, is a mature market with a strong presence of premium brands, advanced veterinary infrastructure, and favorable conditions for product innovation, including CBD pet products. Europe follows closely, driven by strong animal welfare standards and a growing emphasis on pet mental health.

Countries like Germany, the UK, and France show increasing demand for natural and therapeutic pet care solutions. The Asia-Pacific region is emerging as a high-growth area, fueled by rising disposable incomes, increasing pet adoption in urban areas, and growing pet humanization trends in countries like China, India, Japan, and South Korea. However, awareness and product penetration remain lower compared to Western markets.

Latin America and the Middle East & Africa represent smaller market shares but hold long-term potential as pet ownership continues to grow, and retail infrastructure improves. Localizing product offerings and enhancing educational outreach will be key to unlocking growth in these regions.

Recent Developments in Pet Wellness Products

- In May 2025, SIGNS, a global leader in pheromone research and pet well-being, introduced a new line of scientifically advanced pheromone products: SecureCat, SecureDog, and SecureBunny. Designed for both pet owners and veterinary professionals, these products help animals interpret signals that promote a sense of calm and reassurance, effectively communicating that “everything is OK.”

- In February 2025, Elanco Animal Health Incorporated launched Pet Protect, a veterinarian-formulated supplement line for dogs and cats. The product range addresses a variety of pet health needs and is crafted to support overall wellness through targeted nutrition.

Roles of Key Companies in the Pet Calming Products Market

Zesty Paws

Zesty Paws is a leading provider of natural calming supplements and treats formulated with ingredients like chamomile, L-tryptophan, and melatonin. Their products focus on promoting relaxation and reducing anxiety in pets without the use of pharmaceuticals, appealing to health-conscious pet owners.

Nestlé Purina Petcare

Nestlé Purina Petcare offers a broad portfolio of pet calming products, including supplements and treats designed to alleviate stress and anxiety in dogs and cats. Leveraging its strong brand presence and veterinary partnerships, Purina integrates calming solutions into its comprehensive pet wellness offerings.

Virbac

Virbac specializes in veterinary health products, including calming supplements and pheromone-based solutions. The company provides clinically tested products aimed at managing anxiety-related behaviors in pets, often recommended by veterinarians.

THUNDERWORKS

THUNDERWORKS is best known for its ThunderShirt, a calming vest that applies gentle, constant pressure to reduce anxiety, fear, and over-excitement in pets. Their non-pharmaceutical approach has made them a popular choice for managing separation anxiety and noise phobias.

NOWFoods

NOWFoods produces natural pet supplements, including calming products that use herbal ingredients and amino acids. The company targets pet owners seeking holistic and natural remedies for pet anxiety and stress.

Zoetis Inc.

Zoetis develops veterinary pharmaceuticals and biologics, including calming medications and pheromone products. Their offerings are designed to address behavioral issues and anxiety in pets, supported by scientific research and veterinary endorsements.

CEVA (ADAPTIL)

CEVA markets the Adaptil brand, which includes pheromone diffusers and sprays that mimic natural calming signals in dogs. These products are widely used to reduce stress and promote calm behavior, often recommended by veterinarians.

GARMON CORP.

GARMON CORP. offers natural calming supplements under brands like NaturVet. Their products include herbal blends and nutraceuticals designed to ease anxiety and promote relaxation in pets.

PetHonesty

PetHonesty provides a range of natural calming supplements formulated with ingredients such as chamomile and L-theanine. Their products are designed for ease of use and palatability, targeting pet owners looking for effective, drug-free anxiety relief.

PetIQ, LLC.

PetIQ supplies a broad portfolio of pet health products, including calming supplements and devices. The company focuses on accessible, affordable solutions for pet anxiety, distributing through veterinary clinics, retail, and online channels.

Segments Covered in the Report

By Pet

- Dog

- Cat

- Others

By Product

- Food & Supplements

- Snack & Treats

- Gel & Ointment

- Spray & Mist

- Others

By Type

- Prescription

- Over-the-Counter (OTC)

By Ingredient

- Melatonin

- L-theanine

- Vitamin B1

- Herbal Ingredients

- Others

By Distribution Channel

- Offline

- Online

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Also read: Heat-Shrink Tubing Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6185

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344