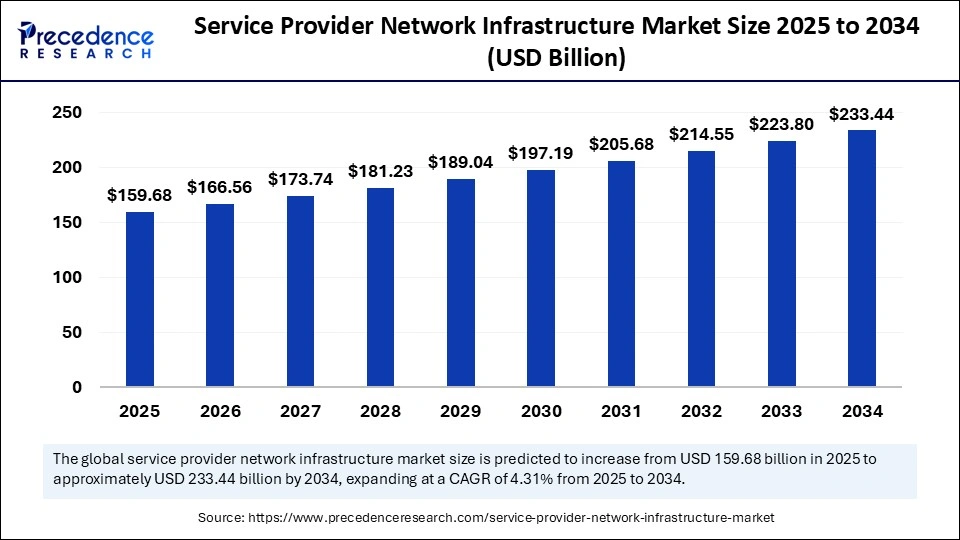

The global service provider network infrastructure market size is expected to surge around USD 233.44 billion by 2034 increasing from USD 153.08 billion in 2024, with a CAGR of 4.31%.

Service Provider Network Infrastructure Market Key Highlights

-

In 2024, North America led the service provider network infrastructure market, accounting for the largest share of revenue.

-

The Asia Pacific region is projected to grow at a notable compound annual growth rate (CAGR) between 2025 and 2034.

-

By technology, the broadband access and optical transport segment held the dominant share of the market in 2024.

-

The wireless packet core segment is expected to experience steady growth at a notable CAGR over the coming years.

-

Based on enterprise size, large enterprises contributed the highest revenue share in 2024.

-

The small and medium-sized enterprises (SMEs) segment is anticipated to expand significantly throughout the forecast period.

-

Among industries, the banking, financial services, and insurance (BFSI) sector led the market with the highest revenue in 2024.

-

The healthcare industry is expected to register strong growth during the projected timeframe.

Service Provider Network Infrastructure: An Overview

Service Provider Network Infrastructure refers to the collective hardware, software, and technology systems that enable telecommunications companies, internet service providers (ISPs), and mobile network operators to deliver voice, data, video, and broadband services to end-users. This infrastructure includes core network components such as routers, switches, transmission systems (like optical transport networks), broadband access technologies (DSL, fiber, cable), wireless base stations, and packet cores.

Modern network infrastructure is increasingly defined by high-speed connectivity, software-defined networking (SDN), and network functions virtualization (NFV), which enhance scalability, agility, and cost-efficiency. This transformation is driven by increasing data consumption, the rollout of 5G, cloud computing, and the proliferation of IoT devices. Service providers are investing in upgrading legacy systems to support these emerging technologies, ensuring seamless connectivity, improved user experiences, and competitive service delivery.

Role of AI in Service Provider Network Infrastructure Market

Artificial Intelligence (AI) plays a transformative role in the Service Provider Network Infrastructure Market by enhancing the efficiency, reliability, and scalability of network operations. AI-driven analytics and automation enable service providers to proactively manage and optimize their networks, reducing downtime and improving service quality. For instance, AI algorithms can predict network failures or congestion by analyzing real-time data, allowing for preemptive maintenance and load balancing. This predictive capability minimizes disruptions and ensures a smoother user experience.

Moreover, AI facilitates intelligent traffic management within complex network infrastructures. By dynamically routing data based on current network conditions, AI helps maximize bandwidth utilization and reduce latency. This is particularly critical as service providers face increasing demand for high-speed, low-latency connectivity driven by 5G, IoT, and cloud services. Additionally, AI-powered security solutions bolster network defenses by detecting and mitigating cyber threats in real time, thereby safeguarding sensitive data and maintaining network integrity.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/6162

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 233.44 Billion |

| Market Size in 2025 | USD 159.68 Billion |

| Market Size in 2024 | USD 153.08 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.31% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Industry, Enterprise Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

One of the primary drivers propelling the service provider network infrastructure market is the explosive growth in global data traffic. With the proliferation of smartphones, IoT devices, video streaming, cloud computing, and AI applications, telecom service providers are under immense pressure to upgrade their network capacity and speed. The ongoing rollout of 5G technology has become a game-changer, compelling providers to invest in next-generation infrastructure such as fiber-optic networks, edge computing systems, and small cell deployments.

Additionally, the need for low-latency and high-bandwidth networks for industrial automation, autonomous vehicles, smart cities, and remote healthcare has led to a surge in demand for robust and scalable network infrastructure. Increasing investments in software-defined networking (SDN) and network function virtualization (NFV) further accelerate market growth, offering more flexible and cost-effective network management.

Opportunities

The market presents significant opportunities for innovation and expansion through the adoption of virtualization technologies and cloud-native architectures. Service providers are increasingly migrating from legacy hardware-based systems to software-centric infrastructure, allowing for greater agility, scalability, and cost efficiency. The integration of AI and machine learning for network optimization, predictive maintenance, and customer experience enhancement offers a transformative path forward.

Edge computing is another emerging opportunity, enabling real-time processing of data closer to the user, which is crucial for applications requiring ultra-low latency. Furthermore, network slicing in 5G presents potential for monetization through customized network segments tailored to specific industry needs. As service providers explore new revenue streams—such as private 5G networks, IoT services, and enterprise connectivity—vendors have substantial prospects to provide differentiated solutions that cater to these evolving demands.

Challenges

Despite the promising outlook, the service provider network infrastructure market faces several challenges. Chief among them is the high capital expenditure (CapEx) required to build and maintain next-gen networks. The deployment of 5G, fiber optics, and edge nodes demands substantial upfront investment, which can be a deterrent for smaller telecom players or those in developing economies. The complexity of transitioning from traditional hardware-centric networks to software-defined and cloud-native environments also presents technical and operational hurdles.

Interoperability issues between new and legacy systems, shortage of skilled professionals, and the risk of service disruptions during upgrades further complicate the process. Moreover, cybersecurity concerns are intensifying as network complexity increases, making networks more vulnerable to sophisticated attacks, especially with the expansion of IoT and open network architectures.

Regional Outlook

North America currently holds a significant share of the service provider network infrastructure market, led by the U.S., which has aggressively pushed for 5G infrastructure deployment, supported by major players like AT&T, Verizon, and T-Mobile. The region’s advanced technology ecosystem and early adoption of cloud and virtualization technologies have bolstered growth. Europe is also making steady progress, with increasing investments in cross-border 5G networks and digital transformation initiatives under the European Union’s Digital Agenda.

However, the most dynamic growth is expected in the Asia-Pacific region, where countries like China, India, South Korea, and Japan are driving large-scale 5G deployments, expanding broadband coverage, and investing in next-gen infrastructure to support massive urbanization and industrial digitization. China, in particular, is a major force with state-backed programs for network expansion and dominance in telecom equipment manufacturing. Latin America and the Middle East & Africa are gradually catching up, driven by mobile-first strategies and rising internet penetration, though challenges related to funding and regulatory frameworks persist.

Service Provider Network Infrastructure Market Companies

- Alcatel–Lucent S.A.

- Aruba Networks Inc.

- Avaya Inc.

- Bluecoat Systems In.

- Brocade Communications Systems Inc.

- Ericsson Inc.

- Huawei Technologies Co. Ltd.

- Juniper Networks Inc

- Nokia Siemens Networks

- ZTE Corporation

Segments Covered in the Report

By Technology

- Broadband Access & Optical Transport

- Carrier IP Telephony

- Microwave transmission & Mobile Backhaul

- Routers & Switches

- Wireless Packet Core

By Industry

- Banking, Financial Services, & Insurance

- Government & Defense

- Healthcare

- Information Technology & Telecommunications

- Manufacturing

- Retail and eCommerce

- Others

By Enterprise Size

- Large Enterprises

- SMEs

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Also Read: Quantum Computing in Energy and Utility Market

Source: https://www.precedenceresearch.com/service-provider-network-infrastructure-market