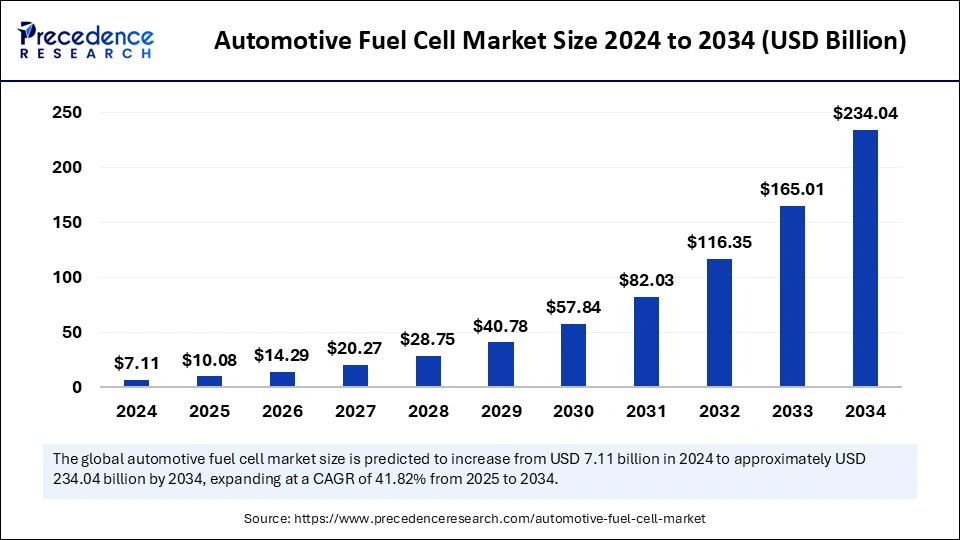

The global automotive fuel cell market size was valued at USD 7.11 billion in 2024 and is expected to reach around USD 234.04 billion by 2034, growing at a CAGR of 41.82% from 2025 to 2034.

What Is an Automotive Fuel Cell and Why Is It Gaining Importance in Clean Mobility?

An automotive fuel cell is a clean energy technology that powers electric vehicles by converting hydrogen gas into electricity through an electrochemical reaction. Unlike traditional combustion engines, fuel cells produce electricity without burning fuel, resulting in zero tailpipe emissions—only water and heat are released as by-products. These systems consist of a fuel cell stack (with anode, cathode, and electrolyte), a hydrogen fuel tank, and electric motors, delivering efficient performance and long driving ranges.

Automotive fuel cells are gaining traction as a sustainable alternative in the transportation sector, especially for heavy-duty and commercial vehicles where long range and fast refueling are critical. With growing environmental regulations, investments in hydrogen infrastructure, and advances in fuel cell durability and cost, this technology is increasingly viewed as a viable complement to battery electric vehicles for a low-carbon future.

Automotive Fuel Cell Market Key Points

-

In 2024, Asia Pacific dominated the global automotive fuel cell market with the largest share of 74%.

-

North America is expected to experience substantial growth during the forecast period.

-

By type, the Proton Exchange Membrane Fuel Cell (PEMFC) segment held the highest market share in 2024.

-

The Phosphoric Acid Fuel Cell (PAFC) segment is projected to see notable growth during the forecast period.

-

By power rating, fuel cell systems below 100 kW captured the biggest market share in 2024.

-

The 100–200 kW power rating segment is anticipated to witness significant growth in the coming years.

-

Among vehicle types, passenger vehicles generated the major market share in 2024.

-

The buses segment is expected to experience significant growth during the forecast period.

Transformative Role of AI in Fuel Cell Ecosystem

AI’s influence extends across the entire fuel cell value chain—from development to deployment. Smart algorithms enable seamless integration of fuel cells with electric powertrains, supporting the transition to cleaner hybrid mobility solutions. In research and development, AI accelerates breakthroughs in core components like catalysts and membranes by analyzing massive datasets and predicting material behavior. It also enhances supply chain efficiency by optimizing logistics, reducing waste, and ensuring timely delivery of critical components. AI-powered analytics offer accurate market demand forecasting and strategic planning capabilities, helping companies stay competitive. Moreover, AI enables intelligent energy management in hybrid systems, effectively balancing battery and fuel cell output to maximize vehicle range and efficiency.

Growth Factors of the Automotive Fuel Cell Market

The automotive fuel cell market is experiencing robust growth due to the global push for zero-emission transportation and stringent environmental regulations. Governments across major economies are offering incentives, subsidies, and funding for fuel cell electric vehicles (FCEVs) and hydrogen infrastructure development. Growing awareness of climate change and the need to reduce greenhouse gas emissions are encouraging automakers to invest in hydrogen-powered vehicles as a sustainable alternative to internal combustion engines.

In addition, advancements in fuel cell technology such as improved power density, durability, and faster refueling capabilities are making FCEVs more competitive with battery electric vehicles (BEVs). Collaborations between automotive OEMs, energy companies, and research institutions are accelerating innovation and commercialization. The expanding hydrogen production and distribution network, particularly in Asia-Pacific and Europe, is also supporting market growth by addressing fuel availability concerns.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5591

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 234.04 Billion |

| Market Size in 2025 | USD 10.08 Billion |

| Market Size in 2024 | USD 7.11 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 41.82% |

| Leading Region/ Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Power Ratings, Vehicles and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

The automotive fuel cell market is primarily driven by the increasing demand for environmentally friendly and sustainable transportation solutions. Governments worldwide are enforcing stringent emission regulations, encouraging automakers to adopt zero-emission technologies like fuel cells. Additionally, rising concerns over air pollution and the depletion of fossil fuels are accelerating the shift towards hydrogen fuel cell vehicles. Technological advancements in fuel cell efficiency, durability, and cost reduction are further propelling market growth, making fuel cells a viable alternative to traditional internal combustion engines and battery electric vehicles for certain applications.

Opportunities

Opportunities in the market arise from expanding hydrogen infrastructure and growing collaborations between industry stakeholders, including vehicle manufacturers, technology providers, and governments. Investments in hydrogen production, storage, and refueling networks are addressing one of the key barriers to adoption, enhancing fuel cell vehicle accessibility. Moreover, the increasing focus on heavy-duty and commercial vehicles, which require longer range and faster refueling than battery electric vehicles can provide, presents significant growth potential for fuel cell technology. Emerging markets in Asia Pacific, where supportive policies and investments are rapidly developing, also offer promising opportunities for expansion.

Challenges

Despite its potential, the automotive fuel cell market faces several challenges. High production costs, particularly related to expensive materials like platinum used in fuel cell catalysts, continue to limit affordability. The lack of widespread hydrogen refueling infrastructure, especially outside major urban centers, restricts consumer adoption. Additionally, safety concerns related to hydrogen storage and transportation remain critical issues to be addressed. Competition from rapidly advancing battery electric vehicles also poses a challenge to fuel cell market growth, particularly in the passenger vehicle segment.

Regional Outlook

Regionally, Asia Pacific leads the global automotive fuel cell market, driven by strong government support, significant investments in hydrogen infrastructure, and the presence of major vehicle manufacturers adopting fuel cell technology. Countries like China, Japan, and South Korea are at the forefront of fuel cell vehicle deployment and infrastructure development. North America is expected to witness substantial market growth, supported by increasing investments and government initiatives promoting hydrogen fuel cell technology. Europe also shows promising growth potential due to stringent emission regulations and growing focus on clean transportation, with countries such as Germany and France actively developing hydrogen ecosystems.

Automotive Fuel Cell Market Compnies

- Ballard Power Systems

- Plug Power

- Hydrogenics

- Hyundai Motor Company

- Nuvera Fuel Cells, LLC

- PowerCell Sweden AB

- Horizon Fuel Cell Technologies

- Nedstack Fuel Cell Technology

- AVL

- ElringKlinger

- Intelligent Energy

- Pragma Industries

- Umicore

- Valmet Automotive

- Air Liquide

Latest Announcement by Industry Leaders

In October 2024, Hyundai Motor Company launched the INITIUM hydrogen fuel cell electric vehicle (FCEV) at the event at the Hyundai Motorstudio Goyang.

Recent Developments

- In September 2024, Toyota and BMW collaborated to develop the next generation of fuel cell technology, BMW for launching the first-ever series production fuel cell vehicle in 2028. The automobile giants are efficiently promoting hydrogen infrastructure development.

- In December 2024, KPIT’s Sentient Labs launched the hydrogen fuel cell bus, it is indigenously developed hydrogen mobility solution with the help of automotive-grade PEM (Proton Exchange Membrane) fuel cell technology.

Segments Covered in the Report

By Type

- PEMFC

- PAFC

- Others

By Power Rating

- Below 100 kW

- 100 – 200 kW

- Above 200 kW

By Vehicles

- Passenger Vehicles

- Light Commercial Vehicles (LCVs)

- Bus

- Trucks

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Source: https://www.precedenceresearch.com/automotive-fuel-cell-market