A robust CAGR and growing demand for targeted therapies set stage for transformative growth of bispecific antibody contract development and manufacturing across global markets

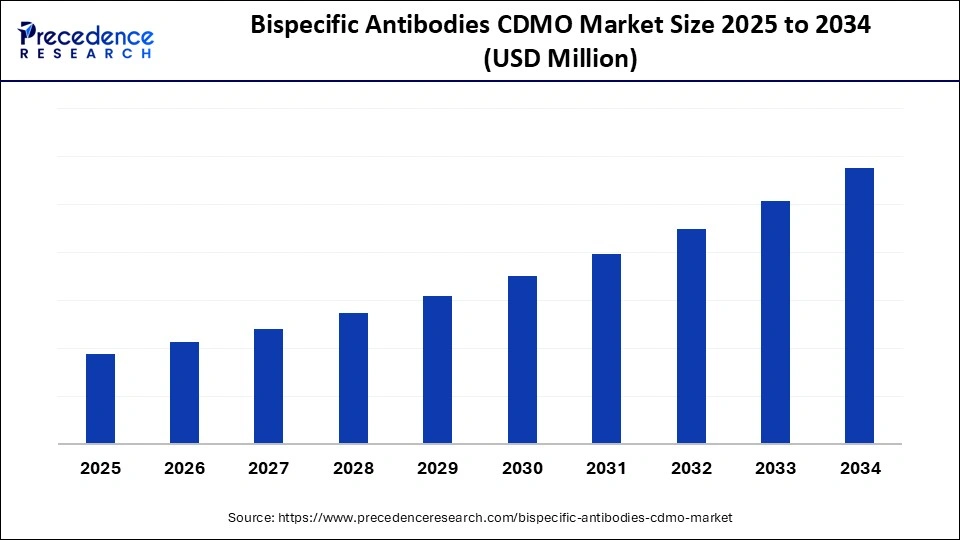

The global bispecific antibodies Contract Development and Manufacturing Organization (CDMO) market is projected to witness significant growth from 2025 to 2034, fueled by the rising demand for precision-targeted cancer and autoimmune therapies, increased biologics development, and accelerating outsourcing trends in complex antibody manufacturing.

The market benefits from a compound annual growth rate (CAGR) driven by advances in bioprocess technologies and AI integration that optimize production, improve scalability, and enhance therapeutic efficacy. Specifically, North America leads with a dominant 53% market share as a mature hub of biopharmaceutical innovation, while the Asia Pacific region is emerging as the fastest-growing market due to expanding biotech infrastructure and funding support.

Bispecific Antibodies CDMO Market Key Insights

-

The bispecific antibodies CDMO market’s base year is 2025, with forecast extending to 2034.

-

North America dominates the market, accounting for 53% share in 2024.

-

Asia Pacific is the fastest-growing region, supported by favorable policies and investments.

-

The oncology therapeutic segment represents the largest application area, holding 65% of the market in 2024.

-

Biopharmaceutical companies lead end-user adoption, capturing 60% share due to outsourcing needs.

-

The IgG-like bispecific antibodies format accounts for 50% market share, driven by structural versatility and efficacy.

-

Leading CDMOs include Lonza Group, Samsung Biologics, WuXi Biologics, and Roche (Genentech).

What is Driving the Bispecific Antibodies CDMO Market’s Growth?

The surge in bispecific antibody candidates targeting oncology, autoimmune disorders, and infectious diseases has dramatically increased demand for specialized manufacturing services. CDMOs provide essential end-to-end solutions including cell line development, process optimization, analytical characterization, and fill-finish capabilities, allowing biopharmaceutical companies to accelerate development timelines and reduce operational risks.

Technological advancements such as high-yield expression systems, single-use bioreactors, and AI-driven process automation underpin scalability, while regulatory bodies like the FDA and EMA facilitate faster approvals through streamlined pathways. The market is further bolstered by significant R&D investments and government incentives aimed at supporting biologics innovation worldwide.

How is AI Transforming Bispecific Antibody Development and Manufacturing?

Artificial Intelligence (AI) is revolutionizing the bispecific antibodies CDMO market by enhancing precision and efficiency across the drug development lifecycle. AI-driven protein design enables predictive modeling that optimizes binding specificity, therapeutic efficacy, and stability of bispecific molecules. In manufacturing, machine learning algorithms identify optimal culture conditions, maximizing yields while minimizing batch variability.

Furthermore, AI-powered analytics ensure real-time quality control, quickly detecting deviations to comply with stringent regulatory standards. This integration of AI accelerates process development, shortens scale-up timelines, and de-risks production, offering CDMOs a competitive edge in handling structurally complex bispecific antibodies.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Antibody Format, Service Type, Therapeutic Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Opportunities and Trends are Emerging in the Bispecific Antibodies CDMO Market?

Why is there a growing preference for outsourcing bispecific antibody production?

Outsourcing to CDMOs provides biopharmaceutical companies access to cutting-edge infrastructure and expertise without the capital burden of developing in-house manufacturing capabilities. This supports faster time-to-market and risk mitigation amid increasing pipeline complexity.

Which therapeutic areas promise the highest growth opportunities?

Oncology remains the largest segment, but autoimmune diseases are expected to register the fastest CAGR due to rising prevalence and demand for targeted immunotherapies using bispecific antibodies.

How are fragment-based bispecific antibodies impacting the market?

Fragment-based formats, such as single-chain variable fragments (scFvs), offer advantages in tissue penetration and modular design, gaining traction for applications requiring rapid systemic clearance and high specificity.

What role do emerging biotech startups play in the market?

Startups are rapidly expanding their bispecific antibody pipelines and increasingly rely on CDMOs to reduce capital expenses and access advanced production technologies, driving dynamic market growth supported by venture capital investments.

How Does the Market Break Down by Region, Application, and Segment?

The bispecific antibodies CDMO market is segmented into antibody format, service type, therapeutic application, end user, and region. Key highlights include:

Antibody Format: IgG-like bispecifics lead with 50% share in 2024, favored for combining structural stability with dual antigen targeting. Fragment-based bispecifics are the fastest growing due to modularity and improved tissue targeting.

Service Type: Upstream processing dominates with 32% market share, encompassing cell line development and bioreactor operations critical to yield and purity. Analytical and characterization services are growing rapidly given the complexity of bispecific antibody structures.

Therapeutic Application: Oncology commands the largest segment (65%), driven by bispecific antibodies’ ability to engage both tumor antigens and immune effector cells. Autoimmune diseases are emerging fast due to personalized medicine trends.

End User: Biopharmaceutical companies represent 60% market share, extensively outsourcing for expertise and efficiency. Biotechnology startups are the fastest-growing subgroup, capitalizing on flexible and scalable CDMO services.

Region: North America holds the largest share due to advanced infrastructure, robust funding, and regulatory support. Asia Pacific is the fastest-growing market, with China, Japan, South Korea, and India expanding biologics manufacturing capabilities.

Who Are the Leading Players Driving Market Innovation?

Top-tier CDMOs delivering comprehensive bispecific antibody services include:

| Company | Key Offerings |

|---|---|

| Lonza Group | End-to-end biologics CDMO with expertise in cell line development and commercial manufacturing |

| Samsung Biologics | Large-scale manufacturing with rapid platforms for complex bispecific antibodies |

| WuXi Biologics | Integrated drug development and flexible production of bispecific therapeutics |

| Roche (Genentech) | Oncology-focused biologics R&D and manufacturing |

| Amgen | Advanced bispecific antibody pipelines and production technologies |

What Challenges and Cost Pressures Impact the Market?

Manufacturing bispecific antibodies involves complex multi-stage processes with high costs related to purification, formulation, and validation. Stability issues and lot-to-lot variability pose quality challenges. Smaller biotech firms may face accessibility barriers due to capital intensity. Additionally, regulatory compliance imposes rigorous requirements, potentially delaying production and increasing operational expenses. Continuous investment in infrastructure, skilled workforce, and cutting-edge technology remains essential but expensive, limiting growth opportunities for less-capitalized CDMOs.

Are There Case Studies Highlighting Recent Breakthroughs?

In November 2024, BioNTech’s acquisition of Chinese biotech Biotheus, securing global rights to BNT327/PM8002, a late-stage bispecific antibody targeting PD-L1 and VEGF-A, exemplifies strategic expansion in bispecific antibody innovation. This acquisition, aimed at enhancing oncology combination therapies, reflects the growing importance of CDMO partnerships to accelerate clinical translation and commercialization in key markets like China.

Read Also: Exosome-based Cancer Therapy CDMO Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344