Market poised for robust 7.23% CAGR amid growing health and sustainability trends

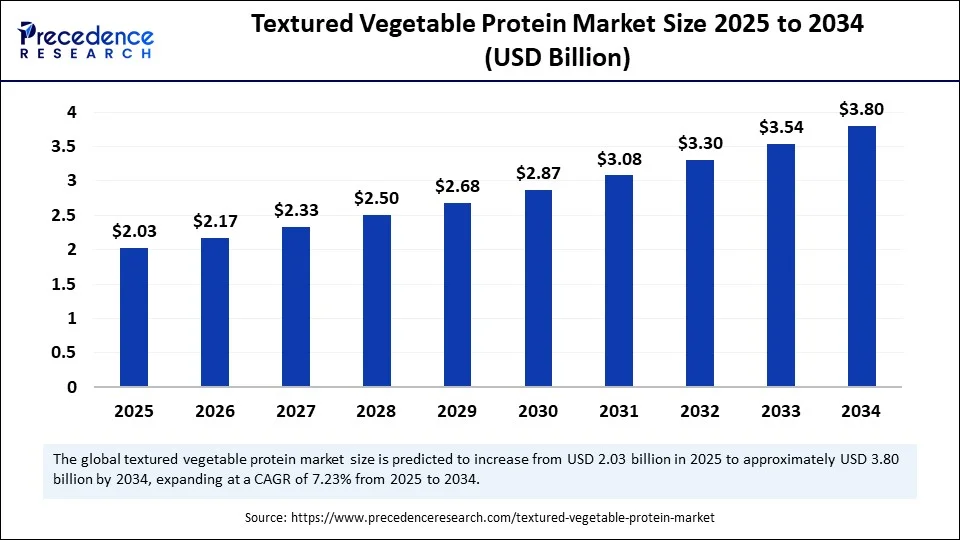

The global textured vegetable protein (TVP) market valuation is anticipated to expand from USD 2.03 billion in 2025 to approximately USD 3.80 billion by 2034, growing at a healthy compound annual growth rate (CAGR) of 7.23%.

This significant growth trajectory is driven by escalating consumer preferences for plant-based diets, increasing awareness of TVP’s health benefits, and a surge in vegan and flexitarian populations worldwide.

Textured Vegetable Protein Market Key Insights

-

The textured vegetable protein market revenue stood at USD 2.03 billion in 2025 and is forecasted to reach USD 3.80 billion by 2034.

-

Asia Pacific leads the production and consumption due to large-scale soy and pulse agriculture and a culturally embedded plant-based diet.

-

North America is recognized as the fastest-growing regional market owing to product innovation and strong retail foodservice ecosystems.

-

Major industry players include Archer Daniels Midland Company (ADM), Roquette Frères, Ingredion, Cargill, and DuPont.

-

Textured vegetable protein is primarily derived from soy, wheat, and pea proteins, used extensively in meat analogs, baked goods, and prepared meal products.

-

AI and big data analytics are increasingly utilized to optimize product formulations, enhance sensory qualities, and forecast consumer trends.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/6986

Market Growth Factors Fueling TVP Demand

The accelerating shift towards plant-based nutrition is the key driver underpinning the TVP market. Increasing awareness of the health advantages linked to plant proteins, concerns regarding animal welfare, and the environmental impact of animal farming significantly fuel demand.

Consumers increasingly seek meat alternatives that provide protein richness with sustainable sourcing and lower carbon footprints. Furthermore, food manufacturers invest heavily in new formulations to improve the texture, flavor, and nutritional profile of TVP, bolstering market expansion. The rise in vegan and flexitarian lifestyles globally supports sustained market growth.

How is Artificial Intelligence Revolutionizing the TVP Market?

Artificial intelligence (AI) and big data analytics are transforming the TVP landscape by enabling precise product customization and efficient supply chain management. AI helps companies analyze extensive consumer data—including taste preferences, dietary restrictions, and regional trends—to create personalized TVP offerings that better meet market demands.

AI-driven insights accelerate the identification of optimal ingredient ratios tailored to desired texture and flavor profiles, enhancing consumer acceptance. By integrating AI technologies, manufacturers can stay ahead of evolving food trends and deliver cleaner-label, high-protein, and non-GMO products that resonate with health-conscious consumers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.03 Billion |

| Market Size in 2026 | USD 2.17 Billion |

| Market Size by 2034 | USD 3.80 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.23% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Form, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Opportunities and Trends Define the Future of TVP?

What new market opportunities does the TVP industry present?

The TVP market opens new avenues in ready-to-eat meals, snacks, and bakery sectors by offering versatile, protein-rich ingredients adaptable to various cuisines and dietary needs. Partnerships between ingredient suppliers and food producers accelerate innovation aimed at improving product sensory attributes.

What industry trends are shaping product development?

Trends include the adoption of pea and other alternative plant proteins beyond soy to cater to allergen-sensitive consumers, advancement in extrusion technologies for replicating meat textures, and sustainability-focused sourcing. Continuous product innovation, including cleaner-label formulations and fortified nutrition, balances consumer demand and regulatory compliance.

Segmentation and Regional Analysis

Product Type Insights: Textured Soy Protein Leads

The textured soy protein segment dominated the textured vegetable protein (TVP) market in 2024 and is expected to maintain its growth. Its high protein content, cost-effectiveness, and excellent functional properties, such as texture and flavor absorption, drive its popularity. Soy protein is a complete protein containing all essential amino acids, making it ideal for nutritious meat alternatives. Textured soy protein is widely used in products like burgers, sausages, and nuggets.

Form Insights: Chunks Take the Lead

The chunks segment led the market in 2024 due to its meat-like texture and versatility. Chunks provide a familiar and satisfying experience for consumers, making them popular in meat substitutes and ready-to-eat meals. They are easy to prepare and serve as a cost-effective meat extender for households, restaurants, and food manufacturers.

Granules are also gaining traction, as they are versatile in applications like soups, sauces, snacks, and ready-to-eat meals. Their quick rehydration, flavor absorption, and ease of handling make them a convenient choice for manufacturers creating diverse plant-based products.

Distribution Channel Insights: B2C Dominates

The business-to-consumer (B2C) segment captured the largest share in 2024 by directly reaching health-conscious consumers through retail and online platforms. B2C channels effectively promote TVP’s nutritional benefits, low-fat, cholesterol-free, and sustainable qualities, tapping into trends like veganism and clean eating.

The business-to-business (B2B) segment is expected to grow rapidly, driven by demand for high-protein, plant-based ingredients. Advances in food processing and extrusion technology improve TVP’s taste, texture, and palatability, boosting its adoption in restaurants, food service, and manufacturing.

Regional Insights: Asia Pacific Leads

Asia Pacific dominated the TVP market in 2024, driven by environmental concerns, health awareness, and vegetarian dietary preferences. China and India are key soybean producers, providing a stable, cost-effective supply for manufacturers.

China contributes significantly due to its large population, government support for plant-based diets, and strong soybean supply chain. India’s vast vegetarian population, agricultural capacity, and government incentives for protein-rich crops make it a growing market for TVP.

North America Market Growth

North America is expected to grow steadily, fueled by a health-conscious population and rising demand for plant-based meat alternatives. Factors include investments by major food companies, advanced food processing infrastructure, wide retail availability, and government initiatives promoting sustainable food choices.

The U.S. plays a central role, leveraging advanced technologies and supply chains to create innovative TVP products with improved texture and flavor. TVP’s affordability and accessibility make it an attractive alternative to animal-based proteins for both consumers and institutional buyers.

Latest Breakthroughs from Industry Leaders

Recent advances include:

-

ADM’s acquisition of Sojaprotein (Serbia) to boost non-GMO vegetable protein capacity.

-

Roquette Frères’ launch of four new pea protein ingredients expanding its product portfolio.

-

Ingredion and DuPont focusing on sustainable sourcing and cleaner-label protein formulations.

Textured Vegetable Protein Market Companies

Tier I – Market Leaders

These companies are dominant players with extensive global reach, substantial production capacities, and significant brand recognition.

- Archer Daniels Midland Company (ADM): A leading global food processing and commodities trading corporation, ADM is a major supplier of soy-based TVP products.

- Cargill, Incorporated: A multinational corporation providing agricultural, food, and industrial products, Cargill is a significant producer of textured vegetable proteins.

- Roquette Frères: A global leader in plant-based ingredients, Roquette specializes in pea-based proteins and has a strong presence in the market.

- Ingredion Incorporated: A global ingredient solutions provider, Ingredion offers a range of plant-based proteins, including TVP products.

- Vippy Industries Ltd: An Indian company specializing in soy-based products, Vippy Industries is a significant player in the TVP market.

Tier II – Established Regional Players

These companies have a strong regional presence and contribute significantly to the market but on a smaller scale than Tier I.

- Axiom Foods, Inc.: A U.S.-based company specializing in plant-based protein ingredients, Axiom Foods offers a variety of TVP products.

- Sonic Biochem Extraction Pvt Ltd: An Indian company known for producing soy-based ingredients, including textured vegetable proteins.

- Bunge Limited: A global agribusiness and food company, Bunge produces a range of plant-based proteins, including TVP.

- MGP Ingredients, Inc.: A U.S.-based company that manufactures specialty proteins and starches, including textured vegetable proteins.

Tier III – Emerging and Niche Players

These companies are smaller or newer entrants with specialized offerings or regional focus.

- Bob’s Red Mill Natural Foods: A U.S.-based company known for natural and organic products, including textured vegetable proteins.

- Wilmar International Limited: A Singapore-based agribusiness group, Wilmar produces a variety of plant-based ingredients, including TVP.

- Sojaprotein: A Serbian company specializing in soy-based products, including textured vegetable proteins.

- Gushen Biological Technology Group Co., Ltd.: A Chinese company known for producing soy-based ingredients, including textured vegetable proteins.

Challenges and Cost Pressures in TVP Manufacturing

Despite rapid growth, challenges persist including consumer acceptance hurdles due to taste and texture preferences, allergenic concerns mainly linked to soy and wheat proteins, and supply chain constraints. Pricing pressures from rising raw material and energy costs may impact smaller manufacturers, especially in price-sensitive markets. Regulatory compliance and food safety standards further influence product development timelines.

Segment Covered in the Report

By Product Type

- Textured soy protein

- Others

By Form

- Granules

- Flakes

- Chunks

- Others

By End User

- Business to Business

- Business to Consumer

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Read Also: RNA Interference Drug Delivery Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344