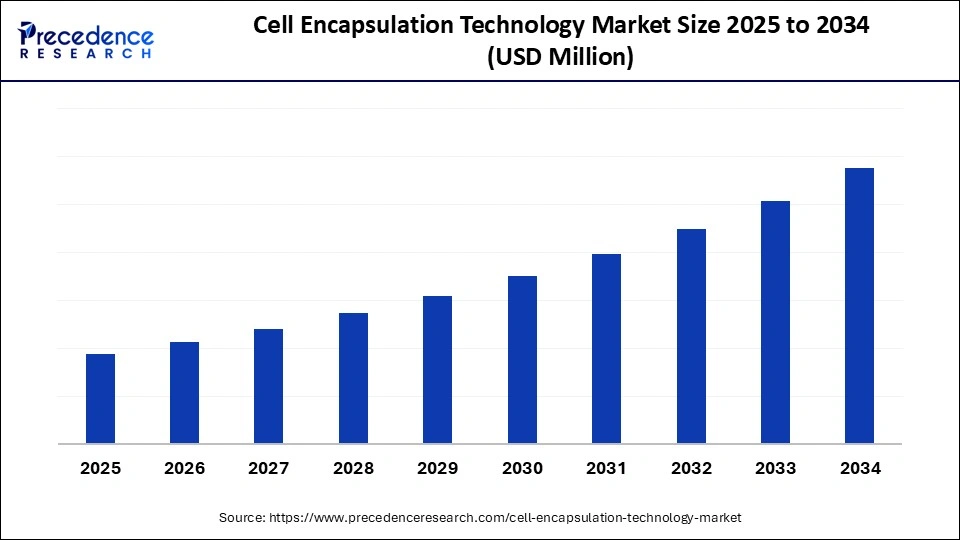

The global cell encapsulation technology market is projected to grow significantly, driven by advances in biocompatible materials, immunoprotective systems, and AI-enabled research. Valued strongly today, the market is forecasted to expand over the next decade, fueled by rising demand for immune-protected cell therapies in treating chronic diseases such as diabetes and neurodegenerative conditions.

Introduction: Accelerating Growth in Cell Encapsulation

The cell encapsulation technology market is experiencing rapid expansion with a projected Compound Annual Growth Rate (CAGR) highlighting strong growth opportunities through 2034. This growth is primarily propelled by the surge in precision medicine, the need for sustained and immune-protected therapeutic cell delivery, and breakthroughs in material sciences enabling better cell viability and immune system evasion .

Encapsulation protects living cells in semi-permeable membranes, allowing nutrient exchange while shielding from immune rejection, thereby enhancing therapeutic efficacy in chronic disease treatment.

Key Insights

-

The market is dominated by North America, which holds approximately 45% share as of 2024, with Asia Pacific expected to be the fastest-growing region at a 15% CAGR.

-

Microencapsulation led the encapsulation method segment with a 65% share in 2024 due to scalability and cost-efficiency.

-

Natural polymers, such as alginate and chitosan, command about 60% of the polymer segment share, favored for biocompatibility.

-

Drug delivery accounts for half of the market share, with regenerative medicine growing rapidly at around 10% CAGR.

-

Pharmaceutical and biotechnology firms dominate end-users with about 55% market share.

-

Key players include Sernova Corporation, PharmaCyte Biotech Inc., Beta O2 Technologies Ltd., and Living Cell Technologies Ltd., among others.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6972

Revenue and Market Breakdown

While specific revenue figures are proprietary, significant shares are segmented as follows:

| Segment | Market Share 2024 | Growth Outlook |

|---|---|---|

| Encapsulation Method – Microencapsulation | 65% | High due to ease of use and scale |

| Polymer Type – Natural Polymers | 60% | Biocompatibility driven |

| Application – Drug Delivery | 50% | Largest segment |

| End-User – Pharma & Biotech Companies | 55% | Leading adopters |

| Regional – North America | 45% | Innovation hub |

Artificial Intelligence’s Role in Advancing Cell Encapsulation

AI is playing a transformative role in optimizing cell encapsulation technology by enabling precise single-cell analysis and predictive design of biomaterials. AI-powered molecular simulations and machine learning models help refine hydrogel formulations to maximize cell viability and create immune-evading encapsulation membranes. These AI-driven tools shorten development cycles and enhance predictive accuracy for implantation success, accelerating transition from laboratory research to clinical applications.

Moreover, AI platforms are aiding targeted design of encapsulation polymers for disease-specific therapies such as type 1 diabetes. By integrating AI analytics with polymer science, researchers are advancing personalized encapsulated cell therapy solutions with improved safety, efficacy, and scalability.

What Factors Are Driving Market Growth?

The primary growth drivers include:

-

Rising demand for immune-protected cell therapies in chronic diseases like diabetes, cancer, and neurodegenerative disorders.

-

Progress in biomaterials, creating durable, biocompatible encapsulation membranes that improve cell survival and function.

-

Increasing investments in cell-based therapies and regenerative medicine research.

-

Expansion of clinical trials and regulatory frameworks facilitating faster approvals for advanced therapies.

-

Adoption of automated and scalable encapsulation technologies, such as extrusion and electrostatic dripping.

What New Opportunities and Trends Are Emerging in Cell Encapsulation?

How is immunomodulatory encapsulation reshaping future therapies?

Advances in embedding active immunomodulatory agents within encapsulation membranes are reducing the need for systemic immunosuppression, minimizing side effects and improving graft survival. For example, tacrolimus-loaded alginate beads are showing promise for Parkinson’s treatment by decreasing T-cell activation while preserving cell viability.

Why is nanoencapsulation attracting attention?

Nanoencapsulation enables targeted precision drug delivery with enhanced permeability and reduced immune rejection, positioning it as a key growth segment in personalized medicine.

How are regional markets evolving?

Asia Pacific is rapidly growing due to government-backed biotech initiatives and lower clinical trial costs. Countries like China, Japan, and South Korea are emerging as innovation hubs focusing on stem cell therapies and biomaterials.

Segmentation and Regional Overview

The market segments cover encapsulation methods (micro- and nanoencapsulation), polymer types (natural vs. synthetic), applications (drug delivery and regenerative medicine), technologies (extrusion, electrostatic dripping), end-users, and regions. North America leads, credited to its strong public-private funding, clinical trial ecosystem, and regulatory ecosystem. Asia Pacific shows the fastest growth potential, driven by investment and innovation efforts in biotechnology.

Top Companies Operating in the Cell Encapsulation Technology Market

Tier I – Major Players

These are the companies seen as market leaders, with major pipelines, significant R&D investment, or broad product/commercial scale in cell encapsulation.

- ViaCyte, Inc.: ViaCyte is a clinical-stage regenerative medicine company developing encapsulated cell therapies for type 1 diabetes, notably via its PEC Encap / PEC Encap tra device which protects implanted pancreatic progenitor cells using a semi-permeable membrane in collaboration with W.L. Gore & Associates. Their work has already progressed into Phase 2 clinical trials where the encapsulated cells are shown to engraft and secrete both insulin and glucagon, moving the field toward practical human application.

- Sigilon Therapeutics, Inc. (Now part of Lilly): Sigilon pioneered the Shielded Living Therapeutics platform using its proprietary Afibromer biomaterial, which encapsulates engineered cells (e.g. insulin producing β-cells) to sustain function while resisting immune/fibrotic reaction, aiming to treat diseases like type 1 diabetes without immunosuppression. The company has attracted substantial funding (Series B financing) and has been acquired by Lilly in 2023 to accelerate development of its lead encapsulated cell therapy candidate, SIG 002.

- ViLiving Cell Technologies Ltd.: ViLiving Cell Technologies Ltd. develops or advances encapsulation platforms aimed at regenerative medicine and therapeutic cell delivery, though publicly disclosed details of their offerings remain limited.

- Merck KGaA: Merck KGaA provides capabilities in encapsulation technologies, likely via materials, biotech platforms, or partnership/licensing in regenerative medicine.

Tier II – Mid Level Contributors

These firms are important players; they may have more narrow niches, smaller commercial scale, or earlier stage products, but contribute significantly to market growth.

Sernova Corporation

PharmaCyte Biotech Inc.

Beta O2 Technologies Ltd.

Living Cell Technologies Ltd

Tier III – Niche, Emerging, Regional Players

These are smaller biotechs or firms with more limited commercial presence, often focused on specific applications, earlier-stage products, or local/regional markets.

Neurotech Pharmaceuticals, Inc.

Encapsys, LLC

NovaMatri

Sigilon / Others of similar scale

Challenges and Cost Pressures

Despite promising advancements, the market faces challenges like immune response and fibrotic overgrowth caused by encapsulation materials, limiting long-term cell viability. Costs of development, regulatory hurdles, and manufacturing scalability also present barriers. Ongoing research seeks to mitigate these issues through improved biomaterials and integrated immunomodulatory strategies.

Case Study: Diabetes Management with Encapsulated β-Cells

Using microfluidic electrospray technology, hydrogels with porous alginate shells maintained above 90% viability of β-cells within 30 minutes. When transplanted into diabetic mice, encapsulated cells regulated blood glucose effectively, exemplifying the therapeutic potential of encapsulation in diabetes care .

Read Also: Engineered TCR (T-Cell Receptor) Therapy Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344