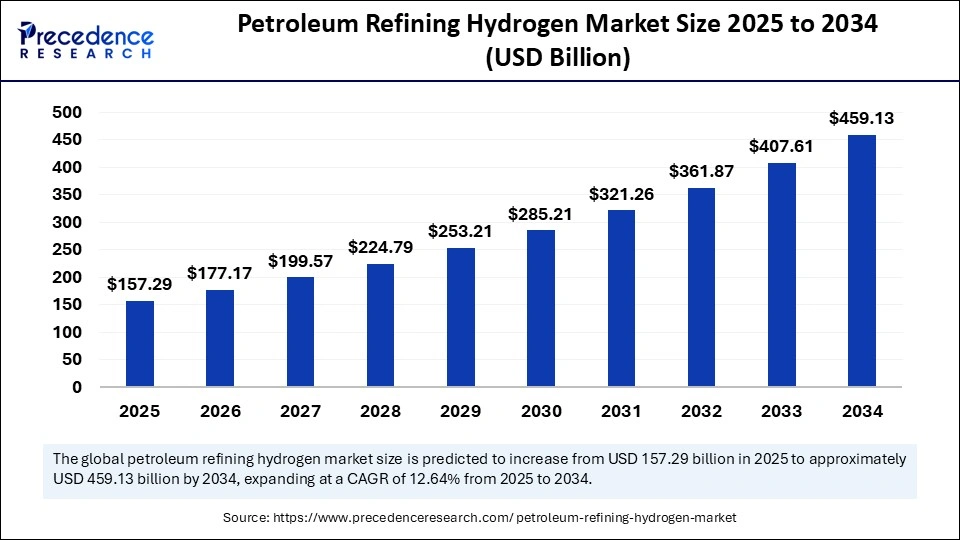

The global petroleum refining hydrogen market, valued at USD 139.64 billion in 2024, is set for robust growth, expected to expand to approximately USD 459.13 billion by 2034.

This growth, at a compound annual growth rate (CAGR) of 12.64% from 2025 to 2034, is primarily driven by stricter fuel regulations, refinery modernization efforts, and a rising focus on sustainable refining practices worldwide.

What are the immediate factors propelling hydrogen demand in petroleum refining?

The upward trajectory is fueled by global mandates for cleaner fuels, increased need for ultra-low sulfur fuel production, and evolving refining processes such as hydrocracking and desulfurization that rely heavily on hydrogen. These factors, underpinned by environmental policies and technological innovation, place hydrogen as a vital component for refining operations while presenting challenges related to cost and transition to low-emission hydrogen sources.

Petroleum Refining Hydrogen Market Key Highlights

-

The market size grew from USD 139.64 billion in 2024 to an estimated USD 157.29 billion in 2025.

-

Asia Pacific dominates the market with a 45% share, holding a valuation of USD 62.84 billion in 2024.

-

North America is the fastest-growing region, driven by stringent emission norms and hydrogen infrastructure advancements.

-

The steam methane reforming (SMR) method leads hydrogen production, contributing around 75% market share in 2024.

-

Hydrocracking processes dominate refining hydrogen use with a 35% segmentation share.

-

Grey hydrogen, derived predominantly from natural gas, accounts for 80% of hydrogen used in petroleum refining.

-

Top players include ExxonMobil, Shell, Chevron, BP, Air Liquide, Linde plc, and TotalEnergies.

How is AI transforming petroleum refining hydrogen operations?

Artificial Intelligence (AI) is playing an increasingly pivotal role in optimizing hydrogen production and refining efficiencies. Honeywell’s Protonium technology, launched in 2025, harnesses AI and machine learning to improve electrolyzer and plant design efficiency, exemplified by its implementation at the Mid-Atlantic Clean Hydrogen Hub in the U.S. Similarly, TotalEnergies leverages AI-driven digital twins in Europe to enhance operational accuracy and integrate green hydrogen into petrochemical workflows. AI frameworks such as AceWGS further accelerate catalyst innovation, contributing to cleaner and more effective refining processes.

What factors are driving the market’s impressive growth and what challenges does it face?

The market growth is stimulated by stringent regulations for fuel quality, refinery expansions, and increasing investments in cleaner hydrogen technologies such as electrolysis for green hydrogen. However, economic considerations present significant hurdles.

Transitioning from grey hydrogen to low-emission hydrogen sources like green or blue hydrogen is capital intensive and risky for refiners, slowing widespread adoption. European refiners face subsidy uncertainties, leading some to pause green hydrogen projects.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 139.64 Billion |

| Market Size in 2025 | USD 157.29 Billion |

| Market Size by 2034 | USD 459.13 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.64% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Hydrogen Production Method, Refining Process, Application in Petroleum Refining, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What are the emerging opportunities and trends within the petroleum refining hydrogen market?

-

Why is electrolysis gaining momentum in hydrogen production?

Driven by decarbonization efforts and regulatory emphasis on clean hydrogen, electrolysis is the fastest-growing production method segment, especially among small and medium-sized refineries. -

How are refining processes evolving with hydrogen usage?

While hydrocracking remains dominant, hydrotreating is witnessing rapid growth due to its effectiveness in removing impurities and meeting ultra-low sulfur fuel standards.

Regional and Segmentation Analysis

The Asia Pacific region leads the market, supported by refinery modernization and government backing for hydrogen projects, with China serving as a major growth engine. North America follows as the fastest-growing area due to its expansive refinery capacity, rigorous regulations, and substantial government support for low-carbon hydrogen initiatives.

Production Process Segmentation

-

Steam Methane Reforming (SMR): This process dominates the market, holding approximately 75% of the share in 2024, due to its proven effectiveness, cost-efficiency, and widespread use in large refineries. SMR primarily produces grey hydrogen, which accounts for the majority of hydrogen used in the industry.

-

Electrolysis: The fastest-growing segment, expected to witness significant expansion during the forecast period. Driven by decarbonization efforts and increasing investment in green hydrogen technologies, electrolysis offers environmentally friendly hydrogen production from renewable energy sources. Notable projects in Europe and North America exemplify this growth.

Application Segmentation

-

Hydrocracking: The hydrocracking segment led the market with a 35% share in 2024. This process converts heavy crude oil fractions into valuable, cleaner fuels such as diesel, jet fuel, and gasoline, making it essential for modern refineries.

-

Hydrotreating: A rapidly expanding application responsible for removing sulfur and other contaminants from fuels to meet stringent environmental standards like IMO 2020 and Euro 6.

-

Fluid Catalytic Cracking (FCC): Also significant, this process utilizes hydrogen to maximize the yield of lighter, high-value products from crude oil.

Type Segmentation

-

Merchant Hydrogen: Hydrogen supplied by third-party providers, used broadly across refineries, especially in small to medium-sized facilities.

-

Captive Hydrogen: Hydrogen produced and utilized within the same refinery or chemical plant, generally through onsite reforming units.

End-Use Industry Segmentation

-

Petroleum Refining: The primary end-user, accounting for about 60% of hydrogen consumption. Large, complex refineries require vast amounts of hydrogen for desulfurization, hydrocracking, and other processes.

-

Chemical & Petrochemical Production: Contributing approximately 20%, where hydrogen acts as a feedstock for ammonia, methanol, and other chemicals.

-

Energy Transition & Low-Emission Fuels: Growing segment with increasing focus on low-carbon hydrogen solutions for sustainable fuels and decarbonized processes.

Petroleum Refining Hydrogen Market Companies

- Shell Hydrogen

- BP

- ExxonMobil

- Chevron

- TotalEnergies

- Mitsubishi Heavy Industries

- Siemens

- Haldor Topsoe

- McDermott International

- Jacobs Engineering

- JGC Corporation

- WorleyParsons

- Doosan Heavy Industries & Construction

What challenges and cost pressures confront the market?

High costs associated with low-carbon hydrogen production and infrastructure investments are major restraints. Financial uncertainty over policy support can lead to project suspensions, as seen with some European refiners. Moreover, sustainability concerns over conventional hydrogen production via fossil fuels motivate ongoing research into cleaner alternatives, requiring significant capital and innovation.

Case Study Spotlight: Green Hydrogen Adoption in Colombia

Ecopetrol’s development of an 800-ton per year green hydrogen facility at its Cartagena refinery exemplifies integration of clean hydrogen into refining. This initiative aligns with broader decarbonization mandates and positions the refinery to cut emissions and improve fuel quality sustainably.

Read Also: 3D Protein Structures Analysis Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344