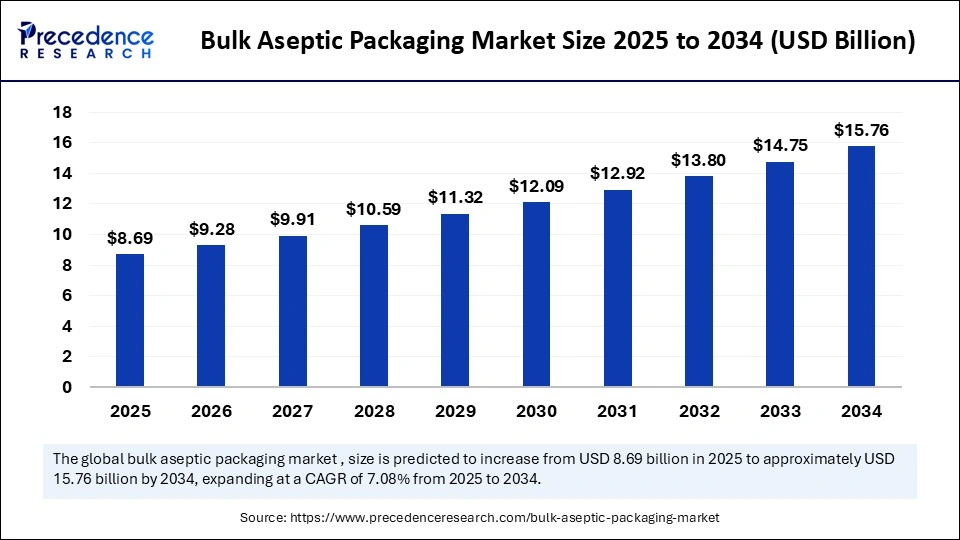

The global bulk aseptic packaging market, valued at USD 8.13 billion in 2024, is poised for significant expansion, projected to reach approximately USD 15.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.84% over the forecast period.

This robust growth is primarily fueled by the increasing consumer preference for preservative-free, minimally processed beverages and shelf-stable food products, alongside advancements in packaging technologies that ensure product safety and sustainability.

Bulk Aseptic Packaging Market Key Points

-

The market size stood at USD 8.13 billion in 2024 and is expected to hit USD 15.76 billion by 2034, expanding at a CAGR of 6.84%.

-

North America dominates the market with a 35% share in 2024, thanks to well-established supply chains and regulatory standards.

-

Asia Pacific emerges as the fastest-growing region due to rapid urbanization and rising demand for convenient, preservative-free products.

-

The aseptic cartons segment accounts for 50% market share, favored for dairy and fruit juice packaging.

-

Food & beverage is the leading end-user sector, capturing 60% of the market in 2024.

-

Paperboard materials hold a dominant 45% share, driven by sustainability trends.

-

Leading players include SIG, Coca-Cola, PepsiCo, and emerging regional innovators expanding capacity and sustainable offerings.

How Is Artificial Intelligence Shaping Bulk Aseptic Packaging?

Artificial intelligence (AI) is revolutionizing bulk aseptic packaging manufacturing by enhancing automation and precision. Vision-based inspections powered by AI help detect contamination risks early, while predictive maintenance minimizes unexpected downtimes. Furthermore, digital twin simulations enable manufacturers to optimize fill-finish line configurations, increasing efficiency and reducing human contact, which is critical for maintaining sterility.

Robots and vision-enabled cobots equipped with AI capabilities are increasingly used to manage SKU complexity and automate sterile filling processes. These technologies not only improve product safety but also accelerate production cycles, addressing supply chain challenges and increasing throughput to meet growing market demand.

What Factors Are Driving Market Growth?

The booming demand for preservative-free, shelf-stable beverages such as plant-based milks, fruit juices, and ready-to-drink products is a significant growth driver. Consumers are increasingly leaning toward clean-label, nutrient-rich options that retain flavor and nutritional value without refrigeration or chemical preservatives. Additionally, stringent food safety regulations and a focus on extended shelf life further fuel aseptic packaging adoption.

Sustainability drives are also critical; companies are investing in renewable and recyclable materials like paperboard and metallized PET to reduce environmental footprints. Significant capital investments in aseptic filling infrastructure, especially in North America and Asia Pacific, underscore the commitment to meeting rising consumer and regulatory expectations.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 8.13 Billion |

| Market Size in 2025 | USD 8.69 Billion |

| Market Size by 2034 | USD 15.76 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Material Type, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Are the Emerging Opportunities and Trends?

Why is demand for aseptic pouches increasing so rapidly?

Aseptic pouches offer convenience, flexibility, and portability, making them ideal for on-the-go consumers. Their lightweight nature and reduced shelf space requirements also cut logistics costs. Perfect for ready-to-drink beverages and medical liquids, they are gaining rapid market traction as an eco-friendly alternative to traditional packaging.

How are sustainability goals shaping product development?

Leading manufacturers like SIG are pioneering aseptic cartons that eliminate aluminum use, cutting carbon footprints by 61%. Increasing use of paper-based materials with enhanced barrier coatings meets rising consumer demand for eco-conscious packaging.

What role is Asia Pacific playing in the market’s future?

Rapid urbanization, rising incomes, and government support for sustainable packaging innovations are propelling Asia Pacific’s growth. India is emerging as a key hub, with investments targeting 85-90% paper-based aseptic cartons by 2030, facilitating broader distribution and market penetration.

How Is the Market Segmented?

By Product Type:

-

Aseptic Cartons: Dominated by dairy and juice packaging, they hold about 50% share.

-

Aseptic Pouches: Fastest-growing segment due to convenience and sustainability.

By Application:

-

Food & Beverage: 60% share in 2024, driven by dairy, soups, sauces.

-

Pharmaceuticals: Fastest CAGR with growing demand for sterile packaging.

By Material Type:

-

Paperboard: Holds 45% market share, valued for recyclability.

-

Plastic (Metallized PET): Fastest-growing, providing superior barrier protection.

By End-User Industry:

-

Food Processing: Largest segment with 55% share, driven by shelf life and food safety.

-

Beverage Manufacturing: Fastest growth owing to juice and dairy alternatives.

By Region:

-

North America: Market leader, supported by matured infrastructure.

-

Asia Pacific: Fastest growth, buoyed by urbanization and clean-label trends.

What Challenges and Cost Pressures Exist?

High capital investments pose significant barriers. Establishing sterile filling rooms, clean rooms, and handling specialized sterilization technologies can require expenditures exceeding $100 million. Supply chain delays and component shortages further extend project schedules.

Smaller companies often hesitate to undertake such risks without guaranteed demand. Additionally, ongoing cost pressures arise from the need to balance sustainability investments with cost-competitiveness.

Key Players in the Bulk Aseptic Packaging Market and Their Offering

- Tetra Pak International S.A.: Multinational food packaging and processing company that pioneered aseptic carton packaging. Tetra Brik Aseptic is its world’s best-selling carton package range for long-life liquid foods.

- SIG Combibloc Group Ltd.: A global leader in aseptic packaging systems and solutions for liquid food and beverages. Its aseptic packaging enables the highest food safety and quality, with a shelf life of up to 12 months, without the need for refrigeration or storage.

- Elopak AS: Global supplier of fiber-based packaging solutions, with a strong focus on aseptic carton packaging for ambient (long-life) liquid products.

- Greatview Aseptic Packaging Co., Ltd.: Multinational provider of aseptic carton packaging and filling machinery for the liquid food industry.

- UFlex Ltd.: First aseptic packaging materials manufacturer with an advanced facility in India, located in the industrial hub of Sanand in Gujarat, and emerged as a leading aseptic liquid packaging company in a short span of time with innovative liquid packaging solutions.

- Scholle IPN: A global leader in flexible aseptic packaging, specializing in bag-in-box and spouted pouch solutions.

- Sidel Group: A global leader in aseptic PET packaging solutions, offering integrated systems for sensitive beverages like juices, teas, and dairy products.

- Mondi Group: Mondi provides its customers with aseptic cartons that are cost-effective and safe and they emphasize both protective qualities and environmental benefits.

- Amcor Limited.: Amcor is a major provider of aseptic packaging solutions for food, beverages, and medical products.

Read Also: Green Mining Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344