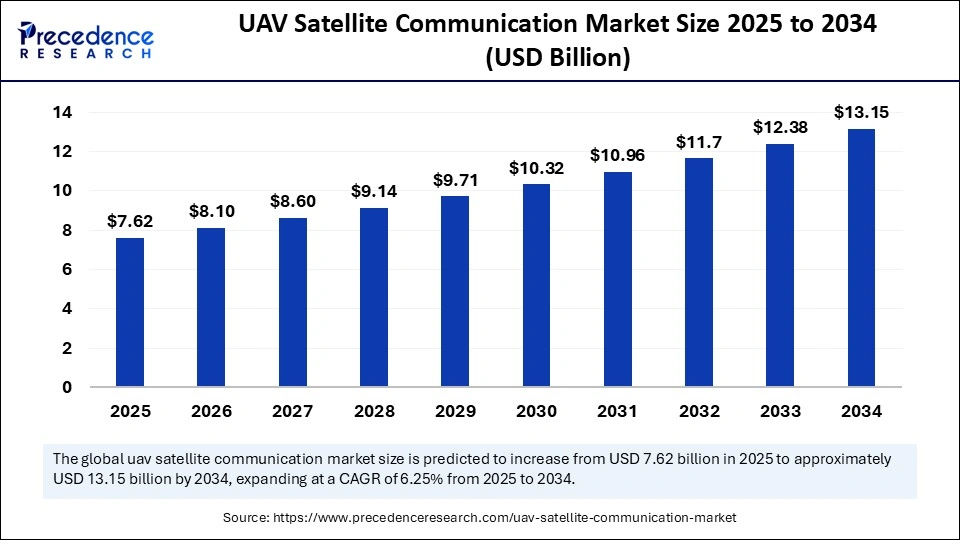

The global UAV satellite communication market is projected to grow from USD 7.62 billion in 2025 to approximately USD 13.15 billion by 2034, at a CAGR of 6.25%, driven by the rising demand for reliable, long-distance, and beyond-visual-line-of-sight (BVLOS) UAV operations. Growth is fueled by increasing UAV integration across defense, commercial, and civil sectors, as well as rapid advancements in LEO satellite constellations and miniaturized SATCOM technologies.

UAV Satellite Communication Market Key Highlights

-

Market value in 2024: USD 7.17 billion

-

Projected growth to 2034: USD 13.15 billion

-

Dominant region: North America (65% share in 2024)

-

Fastest-growing region: Asia Pacific

-

Leading component: SATCOM terminals (airborne) – 55% share in 2024

-

Fastest-growing component: Software-defined radios & communication systems

-

Top frequency band: Ku-band – 50% share in 2024

-

Fastest-growing frequency solution: Multi-band solutions

-

Dominant UAV platform: Medium-altitude long endurance (MALE) UAVs – 60% share in 2024

-

Fastest-growing platform: Small tactical UAVs

-

Leading end-user: Defense & security agencies – 70% share in 2024

-

Fastest-growing end-user: Commercial operators (logistics, energy, telecom)

Market Overview

UAV satellite communication solutions enable real-time data transfer, command & control, navigation, and surveillance even in areas beyond terrestrial connectivity. These solutions are crucial for defense operations, disaster management, precision agriculture, border monitoring, and logistics delivery. Adoption is further accelerated by regulatory streamlining, new business models, and integration with civil airspace.

Recent investments and collaborations highlight the market’s momentum:

-

Kraken Robotics invested USD 13 million to enhance UUV capabilities across the U.S., Turkey, and Norway.

-

DeltaQuad and Dutch Coalition partnered to advance autonomous drone technologies supporting NATO priorities.

-

Defense Acquisition Council (India) announced a Rs 30,000 crore deal for 87 MALE drones, fostering indigenous UAV manufacturing.

AI Driving Efficiency

Artificial intelligence plays a pivotal role in UAV satellite communication by optimizing bandwidth, network performance, and resource allocation. AI integration enhances autonomy, anomaly detection, and real-time decision-making, supporting both defense and commercial operations. Notable initiatives include TEKEVER’s AI-driven AR3 and AR5 drones showcased ahead of DSEI 2025, emphasizing autonomous capabilities for defense and border security.

Market Drivers

-

Expansion of satellite networks, especially LEO constellations and high-throughput satellites

-

Increasing demand for BVLOS UAV operations in defense and commercial sectors

-

Government initiatives and rising military spending supporting advanced UAV adoption

-

Technological advancements in miniaturized terminals, multi-band communication, and hybrid satellite-cellular networks

UAV Satellite Communication Market Segment Insights

-

Component: SATCOM terminals (airborne) dominate, while software-defined radios are growing fast

-

Frequency Band: Ku-band leads; multi-band solutions show the highest growth potential

-

Platform: MALE UAVs dominate; small tactical UAVs growing rapidly

-

End-User: Defense & security agencies lead; commercial operators fastest-growing

Regional Insights

-

North America: Largest market share, driven by advanced technological infrastructure, high UAV adoption, and defense investments

-

Asia Pacific: Fastest-growing region, supported by defense spending, UAV integration in agriculture, logistics, and government initiatives

-

Emerging Markets: China and India are significant growth regions due to strong defense, aerospace, and UAV adoption initiatives

Major Players

- Cobham Satcom

- Gilat Satellite Networks

- Inmarsat Global Limited

- Viasat Inc.

- Iridium Communications Inc.

- Hughes Network Systems LLC

- Intelsat S.A.

- SES S.A.

- Thuraya Telecommunications Company

- Eutelsat Communications

- L3Harris Technologies, Inc.

- Honeywell Aerospace

- General Atomics Aeronautical Systems, Inc.

- Northrop Grumman Corporation

- Boeing (Insitu)

- Lockheed Martin Corporation

- Blue Sky Network

- UAV Satcom Ltd.

- SkyPerfect JSAT Corporation

- Orbit Communication Systems

Recent Developments

-

September 2025: ARK Electronics launched ARK DIST SR and MR modules for precision UAV rangefinding

-

September 2025: Ascent AeroSystems introduced next-generation SPARTAN UAVs at Commercial UAV Expo 2025, enhancing defense, industrial, and agricultural applications

Read Also: Quantum Dot Materials and Technologies Market Size to Surge USD 46.41 Billion by 2034

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6791

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344