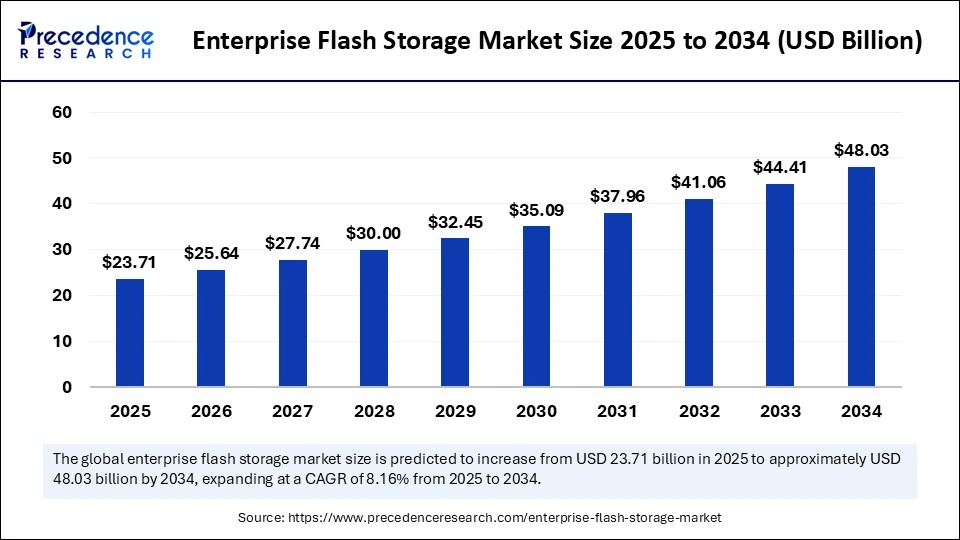

The enterprise flash storage market, valued at USD 23.71 billion in 2025, is forecast to nearly double by 2034, expanding at a CAGR of 8.16%. Engineered for speed and security, solutions such as all-flash arrays, NVMe storage, and persistent memory are fast becoming the backbone of data-driven enterprises. Key growth drivers include surging demand for real-time analytics, rapid adoption of cloud infrastructure, and the race for data compliance.

Enterprise Flash Storage Market Key Insights

-

The enterprise flash storage market will reach USD 48.03 billion by 2034, surging from USD 21.92 billion in 2024.

-

North America dominates in revenue, while Asia Pacific is the fastest-growing region.

-

The U.S. market alone will grow to USD 12.36 billion by 2034.

-

All-flash arrays (AFA) lead product segment for performance and low latency.

-

Samsung, Micron Technology, Kioxia, Western Digital, Dell, HPE, Pure Storage, and NetApp are cited as market leaders.

Enterprise Flash Storage Market Revenue Table

| Year | Global Market Value (USD Billion) |

|---|---|

| 2024 | 21.92 |

| 2025 | 23.71 |

| 2034 | 48.03 |

Recent advancements in Artificial Intelligence (AI) are reshaping flash storage architectures. Enterprises use flash systems for high-throughput AI/ML workloads, leveraging their low-latency, high-IOPS performance to accelerate training and inference cycles. NVMe-based storage platforms and next-generation persistent memory technologies enable seamless, real-time processing of complex datasets—not just for analytics, but for mission-critical functions in healthcare, finance, and hyperscale data centers.

AI’s growing footprint brings new data security and compliance challenges, compelling vendors to offer advanced encryption, snapshotting, and integrated governance as part of storage software stacks. As more organizations use flash memory for AI workloads, demand for scalable, software-defined flash solutions is set to soar.

What Drives Growth in Enterprise Flash Storage?

-

Cloud Computing & Virtualization: The surge in cloud-native applications and virtualization increases demand for robust, flash-based solutions.

-

Data Security & Compliance: Regulatory pressures fuel investment in secure storage solutions with sophisticated encryption and protection.

-

Digital Transformation: Global demand for real-time analytics, IoT, and big data is creating exponential data growth—outpacing traditional HDD infrastructure.

-

High Performance/Low Latency Needs: Enterprise-class flash storage enables organizations to deliver mission-critical workloads with minimal delay and maximum scalability.

What Opportunities and Trends Define the Market?

Which Region Represents the Real Growth Frontier?

Asia Pacific is the fastest-growing region, propelled by rapid digitalization in countries like China and India. Strategic government investments, technology upgrades, and strong cloud vendor expansion—especially in 3D NAND and software-defined flash—are driving regional opportunity.

How Are Leading Companies Innovating?

Firms like Yangtze Memory Technologies Co (YMTC) in China are investing heavily in next-gen NAND chip production and ramping up indigenous SSD manufacturing, while global giants Samsung and Micron continue to push performance and endurance benchmarks. Strategic partnerships, cloud integrations, and AI-optimized storage architectures are central to these innovations.

What’s Powering the Shift Toward NVMe?

Modern enterprise workloads require parallelism, speed, and ultra-low latency—qualities delivered by NVMe-over-Fabrics (NVMe-oF) and disaggregated storage nodes. This shift supports high-throughput analytics, AI/ML training, and scalable cloud deployments.

Enterprise Flash Storage Market Regional and Segmentation Analysis

North America: Remains the largest market, driven by advanced IT infrastructure and aggressive adoption of data-centric strategies among Fortune 500s.

Asia Pacific: Fastest growth, with China and India investing in indigenous technologies, supply chain resilience, and government-supported initiatives in AI and storage modernization.

Europe/Latin America/Middle East & Africa: Experiencing steady expansion as digital transformation accelerates among midsize enterprises.

Segmentation Insights

-

By Product Type: All-flash arrays and NVMe appliances lead in performance.

-

By Component: Storage media (SSD, SCM) dominates, but storage software’s rapid growth is catalyzed by AI, virtualization, and data management needs.

-

By Deployment Model: On-premises preferred for compliance; public cloud gaining share with scalable, cost-effective flash-as-a-service.

-

By Application: Databases and AI/ML training on flash arrays; real-time analytics, ERP, and backup/disaster recovery round out core use cases.

-

By End-User: IT/telecom, hyperscalers, CSPs lead; healthcare/life sciences will see fastest adoption through 2034.

-

By Enterprise Size: Large enterprises/hyperscalers drive innovation; mid-market increasingly attracted to affordable, cloud-centric flash solutions.

-

Top Companies (mentioned): Samsung Electronics, Micron Technology, Kioxia, Western Digital, Dell, HPE, Pure Storage, NetApp; China’s YMTC highlighted as home-grown leader.

Breakthroughs and Company News

-

Yangtze Memory Technologies Co (YMTC): Launched a $3 billion flash memory venture, focused on next-gen NAND chips in Wuhan, driving indigenous leadership in China.

-

Samsung, Micron, Kioxia, Western Digital: Ongoing advances in SSD endurance, NVMe interfaces, and energy efficiency.

-

Dell, HPE, NetApp, Pure Storage: Deploying software-defined and flash-optimized arrays for hybrid and cloud environments.

Enterprise Flash Storage Market Companies

- Dell Technologies

- Pure Storage

- NetApp

- Hewlett Packard Enterprise (HPE)

- IBM

- Samsung Electronics

- Western Digital

- Kioxia

- Micron Technology

- Intel

- Hitachi Vantara

- Inspur

- Lenovo

- Huawei

- Inspur

Challenges and Cost Pressures

The high initial investment for enterprise-class flash storage—especially all-flash arrays and storage-class memory—is a key market barrier. Mid-market firms face cost, compatibility, and lifecycle management hurdles while striving to keep pace with data growth. Flash solutions also contend with security, lifespan, and scalability concerns that require innovative approaches for resilience.

Case Study: China’s YMTC Drives Indigenous Storage Innovation

In September, China’s YMTC launched a landmark $3 billion venture to boost domestic NAND chip capability. The company’s focus on indigenous production helped reduce reliance on imported HDDs and SSDs, providing new supply chain security and fueling rapid market growth.

Read Also: Data Center Monitoring Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344