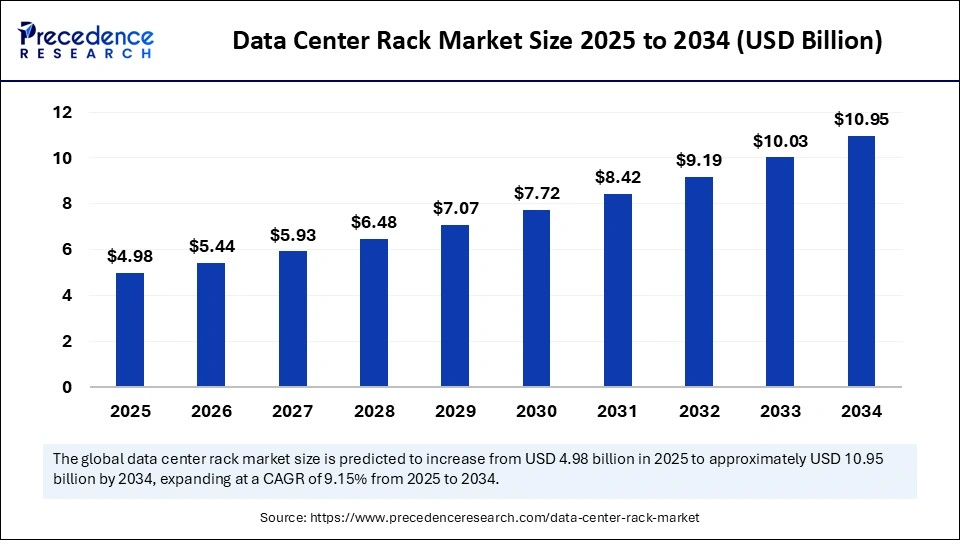

According to Precedence Research, the global data center rack market is projected to reach USD 10.95 billion by 2034, expanding at a robust CAGR of 9.15% from 2025 to 2034, powered by hyperscale expansion, cloud adoption, and surging AI workloads.

The data center rack market size accounted for USD 4.56 billion in 2024 and is set to increase to USD 4.98 billion in 2025. With hyperscale data centers and colocation facilities multiplying globally, and cloud plus edge computing transforming digital infrastructure, the market will more than double by 2034. Key growth prospects are anchored in the escalating demand for efficient, high-density server environments and advanced rack solutions supporting high-performance computing.

Data Center Rack Market Key Insights: What’s Driving Market Momentum?

- The market is valued at USD 4.98 billion in 2025, projected to reach USD 10.95 billion by 2034.

- CAGR for 2025-2034: 9.15%, a pace outstripping most IT infrastructure segments.

- North America leads globally, reflecting strong AI and hyperscale drivers; Asia Pacific is the fastest-growing region.

- Top players: Eaton, Schneider Electric, Rittal, Delta Electronics, Panduit, Belden, Uptime Institute (testing/certification), HPE, Siemens Digital Industries, TUV SUD/NORD.

- The U.S. market alone forecasts a rise from USD 1.47 billion (2024) to USD 3.60 billion (2034), CAGR 9.37%.

- Enclosed racks/cabinets dominate, prized for security, airflow management, and capacity.

- Segmentation covers rack type, height, width, depth, mounting, application, end user, and region.

Data Center Rack Market Revenue Breakdown (2024–2034)

| Year | Global Market Value (USD Billion) | U.S. Market Value (USD Billion) |

| 2024 | 4.56 | 1.47 |

| 2025 | 4.98 | 1.61 |

| 2034 | 10.95 | 3.60 |

How is AI Reshaping Data Center Rack Architecture?

Artificial intelligence is transforming the very backbone of data center rack systems. Rising AI workloads require racks equipped to support high-performance GPUs and specialized AI accelerators, resulting in increased electrical load and power density. Modern racks must handle dense server deployments, maximize cooling efficiency, and ensure adaptable scaling for fluctuating AI processing needs. This evolution leads to greater energy efficiency and utilization of advanced cooling and cable management paradigms.

Additionally, AI-driven machine learning accelerates the adoption of high-density IT hardware, pressing racks to deliver improved airflow, structured cabling, and modular capability all crucial for supporting intense workloads and reducing power consumption. Data centers are adapting by rolling out high-density racks, which optimize space and operational costs while bolstering advanced, AI-ready computing environments.

Data Center Rack Market Growth Factors: Why Is Expansion So Rapid?

Multiple forces fuel the market trajectory:

- Cloud computing and hyperscale data centers: These are standardizing the deployment of performance-optimized racks across regions.

- Digital transformation: From e-commerce to government initiatives, organizations are investing in scalable, reliable infrastructure to support massive growth in data and technology services.

- Sustainability: New rack designs prioritize energy efficiency and modularity—a necessity for both environmental objectives and operational savings.

What Opportunities and Trends Are Shaping the Future?

Will Modular and High-Density Rack Designs Continue to Lead?

Yes. The industry is advancing rapidly towards modular, easily scalable, and high-density rack solutions because they enable better resource utilization, enhanced cooling, and simplified infrastructure upgrades.

With data localization rules and government policy shifts, especially in India, China, and Australia, local manufacturing is set for explosive growth. As more workloads migrate to the cloud, demand for robust, standards-compliant racks will surge, driving innovation in rack construction, integration, and lifecycle management.

Is Asia Pacific Set to Overtake Other Regions in Market Growth?

Asia Pacific is the global pace-setter, thanks to unprecedented digital transformation in countries like India, China, Japan, and Malaysia. Accelerated adoption of AI, cloud computing, and digital infrastructure investments place APAC at the forefront, particularly as governments pour billions into IT growth. China’s leadership is consolidated through expansive data center rollouts and adoption of cutting-edge rack technologies, with Australia and India following suit in optimizing resources and localizing data.

What Segmentation Developments Will Define Investment Priorities?

Segmental innovation is ongoing:

Rack type: Enclosed racks/cabinets lead, ideal for high density and security. Open frame racks offer cost-effective, airflow-optimized solutions for critical environments.

Height/depth/width: 37U–48U vertical racks and 1001–1200 mm deep racks dominate, supporting denser server configurations for AI and big data.

Mounting: Floor-mounted racks, especially for high segregation and liquid cooling, are now key for SMEs and edge data centers.

Application: Server racks lead due to robust IT workload needs; networking racks are the fastest-growing, supporting cloud and AI demands.

End User: Colocation data centers hold the largest market share, while cloud service providers are expanding fastest.

Regional Analysis

North America: Dominates, driven by hyperscale data center growth and generative AI adoption, with the U.S. leading via robust digital infrastructure and supportive public policy.

Asia Pacific: Fastest-growing; countries like China and India are investing in large-scale data center rack deployment to meet digital transformation and localization objectives.

Europe: Steady adoption rate, led by emphasis on sustainability and cutting-edge technology upgrades.

Latin America, MEA: Emerging adoption with investments in trade infrastructure and increased cloud/AI penetration.

Data Center Rack Market Companies

- Eaton

- Schneider Electric

- Rittal

- Delta Electronics

- Panduit

- Belden

- HPE

- Siemens Digital Industries

- Uptime Institute

- TUV SUD

- TUV NORD

Challenges and Cost Pressures

High initial investments for installation and upgrading rack infrastructure—especially high-density racks with integrated cooling present significant financial hurdles. Concerns around budget strains, floor reinforcement, airflow management, and cabling must be managed. For new entrants and smaller data centers, these costs can slow adoption of next-generation rack solutions and increase risk.

Case Study: Hyperscale Data Center in the U.S.

A leading U.S. data center operator recently invested in modular, high-density racks from Eaton and Rittal to handle rapid growth in AI and cloud deployments. By transitioning to new racks, the provider boosted energy efficiency by 18%, increased server capacity per square foot, and achieved superior thermal management, reducing cooling costs showcasing the ROI offered by market-leading high-density solutions.

Read Also: Data Center Rack Market Companies

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344