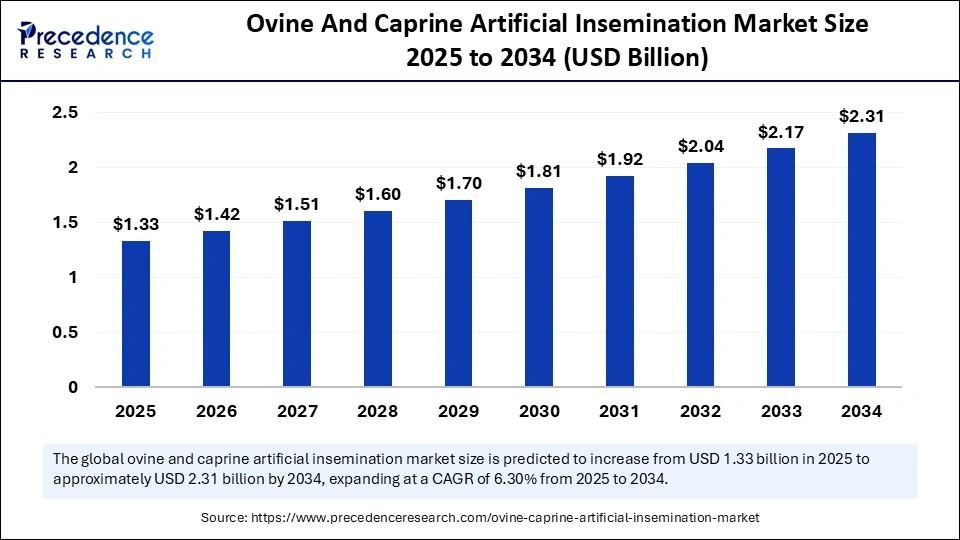

The ovine and caprine artificial insemination market reached USD 1.25 billion in 2024 and will increase to USD 1.33 billion in 2025, eventually hitting USD 2.31 billion by 2034. Expansion is fueled by rising demand for genetic improvement, sustainable livestock management, dairy innovation, and the growing influence of artificial intelligence in precision breeding.

Ovine And Caprine Artificial Insemination Market Key Insights

-

The market size is projected to expand from USD 1.33 billion in 2025 to USD 2.31 billion by 2034.

-

Europe remains the leading regional market, supported by structured breeding programs and advanced infrastructure.

-

Asia Pacific will be the fastest-growing region, driven by population growth and increased protein demand.

-

Top companies include IMV Technologies and Minitüb GmbH, which lead in veterinary insemination equipment and services.

-

Dairy production represents the largest application segment, with meat production growing fastest.

-

The frozen semen segment leads due to flexibility in storage and distribution.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6748

Ovine And Caprine Artificial Insemination Market Revenue Tables and Regional Breakdown

| Attribute | Data / Region | Value |

|---|---|---|

| Global Market Size (2025) | Worldwide | USD 1.33 Billion |

| Global Market Size (2034) | Worldwide | USD 2.31 Billion |

| CAGR (2025–2034) | Worldwide | 6.30% |

| Europe Market Size (2025) | Europe | USD 465.50 Million |

| Europe Market Size (2034) | Europe | USD 820.05 Million |

| Asia Pacific (Fastest-Growing) | Asia Pacific | Highest CAGR |

AI is rapidly transforming ovine and caprine insemination by leveraging machine learning and sensor analytics to optimize genetic selection and breeding schedules. Algorithms parse animal health, reproductive performance, and genetic data, enabling selection of top traits for disease resistance and yield. Further, AI-controlled estrus synchronization and robotic insemination increase conception rates and efficiency, making advanced genetics more accessible and scalable for breeders globally.

AI also helps disseminate superior semen across borders—from living, deceased, or distant sires—broadening the gene pool and accelerating the adoption of elite traits. The integration of predictive breeding models streamlines flock improvement, enhancing productivity in regions with high demand for animal protein.

What Drives Market Growth?

Growth is fueled by surging global demand for premium meat, milk, and wool products, pushing breeders to adopt selective genetics. Government support in Europe and Asia, coupled with tech advances in semen preservation and reproductive management software, further anchors market momentum. The proliferation of advanced synchronization and estrus protocols also improves herd quality and productivity.

What Opportunities and Trends Shape the Future?

How can technology deepen market penetration?

Breakthroughs in sexed semen, genomic selection, and improved cryopreservation enable smallholders and large farms alike to access top genetics, driving quality and profitability.

What makes Asia Pacific a hotbed for growth?

Rapid urbanization, rising incomes, and increased awareness of nutrition in countries like India and China spur demand for processed meat and dairy, fostering regional investment in breeding innovation.

What is the role of equipment in boosting reliability?

Cryogenic storage, double-lumen needles, and advanced insemination devices are increasing conception rates and making AI adoption more practical for smaller operations.

Ovine And Caprine Artificial Insemination Market Regional and Segmentation Analysis

Europe dominates with intensive breeding programs and public support. The UK excels in genetic diversity and disease-resilient breeds; Germany’s tech leadership drives better reproductive outcomes. Asia Pacific outpaces others in growth due to population pressure and invention adoption, while livestock farms remain the largest consumer of AI technologies for breeding.

Ovine And Caprine Artificial Insemination Market Segment Highlights

-

Cervical insemination is preferred for goats due to simplicity and effectiveness; sheep require costlier laparoscopic methods for best results.

-

Frozen semen ensures genetic reach and flexibility but faces anatomical challenges in application.

-

Hormone-assisted insemination boosts conception and synchronizes breeding cycles for large-scale herd management.

-

Semen equipment and cryogenic tanks are essential to distributing top genetics globally and ensuring superior livestock productivity.

Ovine And Caprine Artificial Insemination Market Companies

- Zoetis Inc.

- Neogen Corporation

- STgenetics

- Ceva Sante Animale

- Minitube International

- URUS Group LP

- CRV

- Viking Genetics

- IMV Technologies

- Genus plc (ABS Global)

- Select Sires Inc.

Pressures and Challenges

Achieving effective semen application—especially with frozen semen—is constrained by complex ovine cervical anatomy, leading to inconsistent conception rates and higher costs for surgical insemination. Small farms in developing countries face affordability issues and limited access to advanced AI services, even as equipment and synchronization protocols evolve.

Case Study Highlight: UK Breed Improvement

The UK leverages advanced genomics and synchronized artificial insemination to preserve native sheep breeds, accelerating productivity and global export potential while maintaining disease resistance and market certifications.

Read Also: Tocotrienol Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 934