Water Recycle and Reuse Market Key Points

-

Asia Pacific led the global market in 2024, accounting for the largest share of 37%.

-

North America is anticipated to register the fastest CAGR during the forecast period.

-

By equipment, the filtration segment held the largest market share of 37% in 2024.

-

The tanks segment, by equipment, is expected to experience significant growth during the forecast period.

-

By end user, the industrial segment dominated the market with a 49% share in 2024.

-

The commercial segment, by end user, is projected to expand at the fastest CAGR in the coming years.

Market Overview

The water recycle and reuse market has emerged as a critical segment within the global environmental and infrastructure sectors, addressing the urgent need for sustainable water management in the face of escalating water scarcity. This market encompasses technologies, services, and systems designed to treat wastewater—industrial, municipal, or agricultural—for reuse in applications ranging from landscape irrigation and industrial cooling to potable water supply. With population growth, rapid urbanization, and increasing demand for water-intensive industrial processes, the strain on freshwater resources has intensified.

As a result, water recycling and reuse are no longer optional but essential for water-stressed regions, cities, and industries aiming to achieve water security and environmental compliance. Governments, private enterprises, and municipal utilities are now making significant investments in advanced water treatment infrastructure, including membrane filtration, UV disinfection, reverse osmosis, and decentralized treatment systems. In 2024, the market is valued in the tens of billions and is poised for robust growth throughout the next decade as circular water economy practices become central to climate resilience strategies.

Growth Factors

Several macroeconomic and environmental trends are driving the growth of the water recycle and reuse market. Chief among them is global water scarcity, exacerbated by climate change, over-extraction of groundwater, and pollution of freshwater sources. According to the UN, by 2030, global water demand is expected to outstrip supply by 40%, making efficient water reuse strategies critical. Another important factor is tightening environmental regulations. Governments across the world, especially in regions like Europe, the U.S., and Asia Pacific, are implementing stricter discharge norms and incentivizing industries to adopt water recycling technologies to reduce freshwater consumption and lower pollution levels.

Technological advancements have also made water reuse more cost-effective and scalable. Innovations in membrane bioreactors, advanced oxidation, and AI-driven monitoring have significantly improved the efficiency and quality of recycled water. Additionally, the growth of industrialization and urbanization, particularly in emerging economies, has increased the demand for sustainable water management systems in both municipal and industrial settings.

Impact of AI on the Market

Artificial intelligence (AI) is playing an increasingly transformative role in the water recycle and reuse market, enabling smarter, faster, and more reliable water treatment systems. AI-powered algorithms are being used to optimize treatment processes by continuously monitoring water quality parameters and adjusting operations in real time to improve output and energy efficiency. For example, AI can predict the optimal dosage of chemicals in a membrane bioreactor or anticipate filter fouling before it affects plant performance. This reduces downtime, maintenance costs, and energy usage, making the entire treatment process more sustainable and economical.

In addition, AI-driven predictive analytics are being used in demand forecasting, helping municipalities and industries plan water reuse capacities based on consumption patterns and environmental data. Machine learning models also enhance leak detection and pipeline maintenance in reclaimed water distribution systems, reducing non-revenue water losses. Furthermore, AI-integrated digital twins of water treatment plants are being deployed to simulate different scenarios, train operators, and improve decision-making. As smart cities and Industry 4.0 initiatives continue to expand, AI will become a cornerstone of next-generation, autonomous water recycling infrastructure.

Market Scope

| Report Coverage | Details |

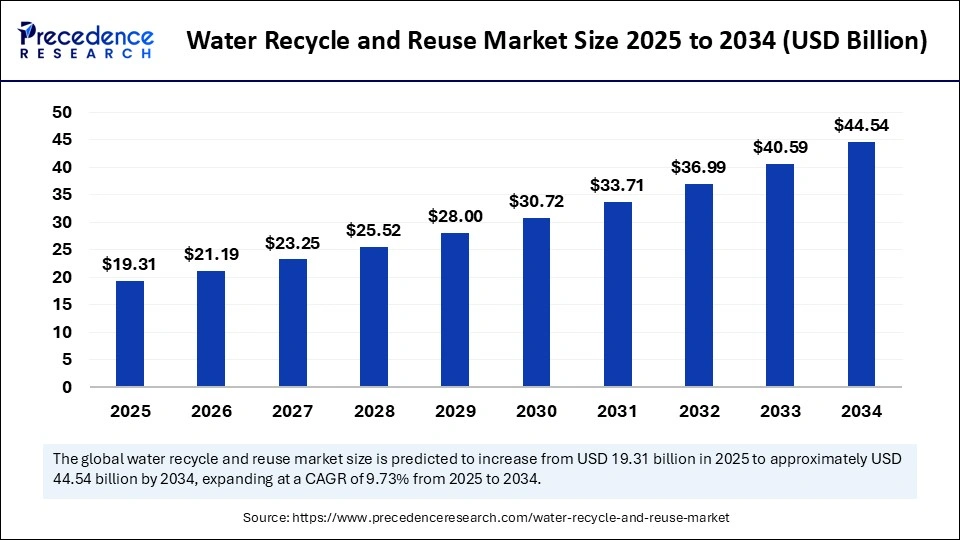

| Market Size by 2034 | USD 44.54 Billion |

| Market Size in 2025 | USD 19.31 Billion |

| Market Size in 2024 | USD 17.6 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.73% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Equipment, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

Key market drivers include regulatory mandates, environmental sustainability goals, and rising water demand. The implementation of water reuse policies by global institutions such as the UN and World Bank has catalyzed public and private sector action. In regions like the Middle East, where freshwater is scarce, recycled water is being prioritized for agricultural and urban use. Additionally, corporate sustainability programs—especially in water-intensive sectors like food and beverage, pharmaceuticals, chemicals, and textiles—are pushing companies to adopt closed-loop water systems to reduce operational risks and meet ESG targets.

Another strong driver is the emergence of decentralized water treatment systems, which allow remote communities, construction sites, and individual buildings to treat and reuse water independently. This is especially important in regions where centralized infrastructure is lacking. Lastly, public awareness of climate change and water conservation is increasing support for recycled water use, even for potable applications—evident in projects like potable reuse in California and Singapore’s NEWater.

Opportunities

The water recycle and reuse market offers a broad spectrum of opportunities across both public and private sectors. One major opportunity lies in the expansion of potable reuse programs, where treated wastewater is purified to drinking water standards. Advances in ultrafiltration, UV disinfection, and multi-barrier processes are making this a viable solution in water-stressed cities. Another opportunity exists in the industrial reuse sector, where zero-liquid discharge (ZLD) systems are being adopted to minimize waste and reclaim every drop of water in production processes.

There is also significant potential in smart water management systems that integrate IoT, AI, and data analytics to improve operational efficiency and transparency. Emerging economies offer untapped potential for water recycling infrastructure, especially in rapidly urbanizing countries like India, Indonesia, and Nigeria. Moreover, public-private partnerships (PPPs) and innovative financing models—such as performance-based contracts and water-as-a-service (WaaS)—are gaining traction and enabling large-scale infrastructure development.

Challenges

Despite strong momentum, the water recycle and reuse market faces several challenges. A key barrier is the high initial investment cost associated with advanced treatment technologies and distribution systems. Many municipal bodies and small industries struggle to fund large-scale installations without government support or private investment. Public perception and acceptance of recycled water—especially for potable use—remain hurdles in many regions, driven by lack of education and cultural stigmas.

Technical challenges also persist, such as membrane fouling, energy consumption, and sludge disposal, which can impact long-term system efficiency and cost. Additionally, regulatory fragmentation—with inconsistent standards and approval processes—can slow down the implementation of water reuse projects. In rural or underserved areas, lack of skilled manpower and maintenance capabilities also hinder adoption. Finally, the sector is exposed to climate risks and supply chain vulnerabilities, such as the availability of treatment chemicals, components, and membranes, especially in times of global disruption like pandemics or geopolitical conflict.

Regional Outlook

The Asia Pacific region is expected to witness the fastest growth in the water recycle and reuse market, driven by rapid urbanization, industrial growth, and water scarcity in countries like China, India, and Southeast Asia. Government initiatives such as India’s Jal Shakti Abhiyan and China’s sponge city programs are promoting large-scale water recycling infrastructure. North America remains a mature market, with high adoption in the U.S. driven by EPA guidelines, state mandates, and successful potable reuse projects in California, Texas, and Arizona.

Europe is also a prominent market, fueled by the EU’s circular economy action plan and the Water Reuse Regulation adopted in 2020. Countries like Spain, Italy, and the Netherlands lead in agricultural water reuse. The Middle East and Africa represent a region of critical importance, with countries like the UAE, Saudi Arabia, and Israel heavily investing in water reuse to combat extreme aridity. These nations are pioneers in municipal and industrial-scale water recycling projects. Latin America is gradually expanding its market footprint, with Brazil, Chile, and Mexico investing in wastewater treatment and reuse to support agriculture and mining operations. However, infrastructure gaps and funding limitations still constrain broader adoption in some areas.

Water Recycle and Reuse Market Companies

- Veolia

- Evoqua Technologies & Solutions

- Fluence Corporation Limited

- Dow Corporate

- Hitachi Ltd.

- Kubota Corporation

- Siemens

- Alfa Laval

- Hydraloop

- Membracon

- Toshiba Infrastructure Systems & Solutions Corporation

- Genesis Water Technologies Inc.

- NEWater China

Segments Covered in the Report

By Equipment

- Filtration

- Machinery

- Tanks

- Pipes & Drains

- Others

By End User

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Read Also: Special Mission Aircraft Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6126

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344